Dollar-Yen Looks To The Long Side

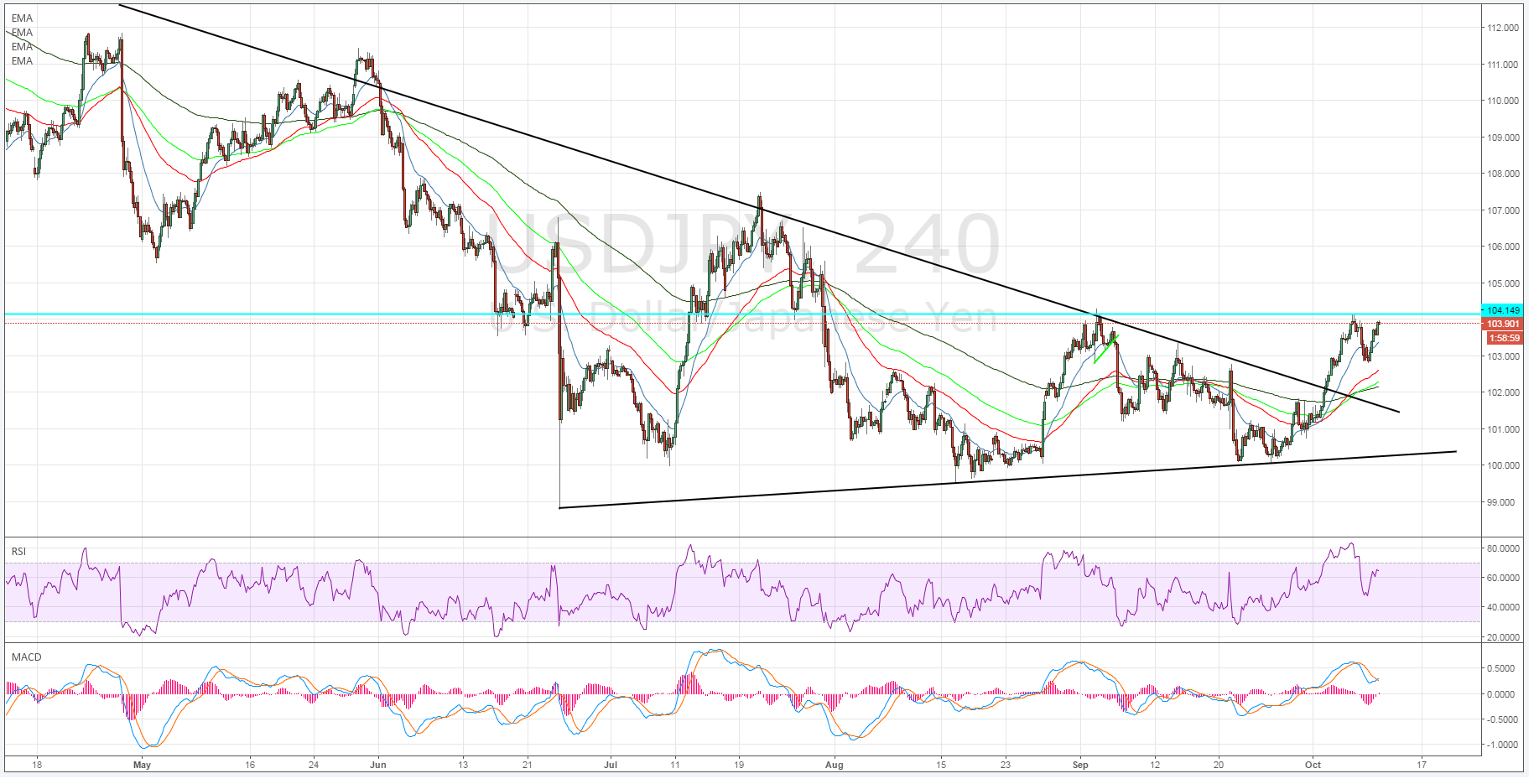

The USDJPY has been rampantly bullish over the past few weeks as the pair has benefited from the growing economic divide between the US and Japanese economies. Subsequently, the currency has convincingly broken through the bearish trend line and is now flirting with a key resistance level. However, it remains to be seen if the pair has the constitution to move beyond the next resistance point.

A cursory review of the charts demonstrates the cross roads that is currently facing the pair. In particular, price action has recently experienced a pullback after a failure near the key resistance point of 104.15. However, this correction wasn’t totally unexpected given the fact that the RSI Oscillator was deep within overbought territory. Consequently, the pullback has largely relieved much of the pressure upon the RSI Oscillator giving the pair plenty of room to move on the upside. In addition, price action has maintained its bullish position above the 50 and 100 MA’s suggesting that it hasn’t lost much of its upside momentum.

Subsequently, the USDJPY is now ticking steadily higher and is likely to challenge the key upside resistance point, around the 104.15 mark, in the coming days. Now where the pair moves to from this level is likely to remain in question as there is some relatively strong resistance around the 106.60 point. The upside is therefore relatively limited and, at least on a short term basis, we are likely to only see a move above the 105.00 handle.

However, be aware that there is plenty of economic divergence that can be seen between the two economies. In particular, US labour markets continue to firm and this pressure must eventually flow through to inflation figures which will likely spur the Fed into action on rates. In contrast, Japan is remains within a contractionary phase that is likely to see further reductions within inflationary data and a worsening labour market until their economy turns the corner. Subsequently, there is likely to be further upward pressure on fundamentals in the medium term as the US economy continues to move towards tightening their monetary policy.

Ultimately, the USDJPY was always going to recover from the 100.00 handle given the aforementioned economic divergences. Subsequently, keep a close watch on the charts over the next few sessions as a breach of the 104.15 support zone could signal game on for the bulls.

Disclosure: Forex and CFDs are leveraged products and you may lose your initial deposit as well as substantial amounts of your investment. Trading leveraged products carries a high level of risk and ...

more