Dollar Rallies To Its Highest Point Since June 2017

Dollar Rallies - Stocks Rebound On Tuesday

The dollar is set against the world stage. The word contagion was used constantly in the media on Monday. Anything is possible, but it was always extremely unlikely that a Turkish collapse would hurt the stability of the EU. And certainly not the stability of the dollar.

It looks more like that was an excuse to sell off now that the S&P 500 recovered a lot of the losses. It was up 0.64% and the Russell 2000 was up 1.03% on Tuesday. The VIX returned to the summer doldrums as it was down 9.95% to 13.31. With the S&P 500 about 1% from its record high.

The CNN Fear and Greed index is at 58 out of 100 which signals greed. It signals a strong dollar also.

It’s possible that the S&P 500 gets back to near extreme greed again when it takes out the record high. That’s because the market didn’t correct fully. I expected it to fall 3%.

The best sector on Tuesday was consumer discretionary as Amazon was up 1.24% to an all-time high. The worst performing sector was utilities which was up 0.17%.

Dollar and Recovery For Turkey Not For China

The Turkish collapse was overdone so there was a snapback rally. The Vanguard emerging markets index was up 0.6%. While Turkey recovered, China is still in a downturn. The Shanghai Composite fell 1.31% on Wednesday. It’s only 1.5% above its 52 week low it made on August 6th.

The chart below shows a ‘tale of two cities’ as American tech stocks such as Apple and Amazon have rallied to all-time highs while the Chinese technology sector is at its 52 week low.

Baidu stock is down 20.35% since July 12th and is also at its 52 week low. Tencent Holdings is down 26.5% since January 23rd. The Chinese economy was already weakening regardless of the trade war. It’s safe to say America is winning the battle since the S&P 500 and dollar is near its record high.

(Click on image to enlarge)

The Turkish lira was up 8% to 6.36 versus the dollar and the Turkish stock market ETF was up 11.3% which was its biggest once-day increase since 2008. The country’s currency and stock market increased because the finance minister will speak with investors about Erdogan’s policies.

However, America and Turkey are still at odds over their interests in Syria, so it’s possible this recovery is short lived. If Turkey starts to fall again, I don’t expect American stocks or the dollar to fall with it.

Dollar, Oil, And Treasuries

Oil fell again as WTI was down 34 cents to $66.70. Oil is on pace to extend its streak of losses to 7. The API said inventories increased 3.7 million barrels. Furthermore, oil is falling on worries about the global economic outlook as emerging markets are in a tailspin, led by China.

World trade growth peaked at 5.7% in January 2017 and was below 3% as of May. Slowing growth means less demand for commodities. The other major factor which is driving down all commodity prices is the rising dollar. The Bloomberg commodities index is down 1.77% year to date.

The dollar index has been on a rampage lately as the index is now at $96.85. It is up 5.11% year to date as the Fed’s rate hikes and the outperformance of the U.S. economy has caused it to explode higher.

The next technical resistance level is $103.82. If it hits that, every international firm will mention it on their conference calls.

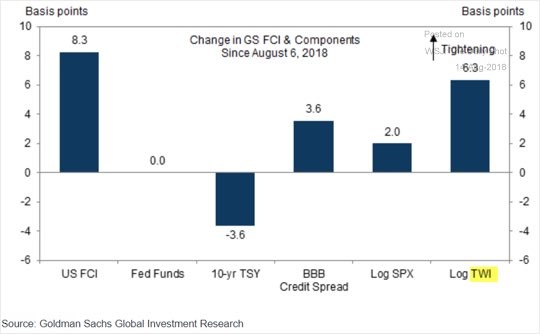

As you can see from the chart below, the trade-weighted dollar has caused the Goldman Sachs financial conditions index to become more stressed.

The odds of the Fed hiking rates 2 more times this year is back above 70% as it is at 70.2%. Headline year over year inflation will decelerate as the dollar gains strength and oil falls.

The Fed sees no reason to halt rate hikes. There are discussions to end the balance sheet reduction prematurely at $3.5 trillion. I don’t think that will have much of an effect on markets.

(Click on image to enlarge)

The 10-year yield was flat at 2.90% and the 2-year yield rose 3 basis points to 2.64%. This means the latest difference in yields is only 26 basis points.

As the December rate hike becomes further priced in, I expect the difference between the 2 yields to fall below 20 basis points.

I expect an inversion sometime in late 2018 or early 2019. The longer it takes for an inversion, the less likely there will be a recession in 2019. Not that it’s very likely, to begin with.

Dollar and Weak Import & Exports Prices

July import prices were flat month over month which missed the consensus by one-tenth. Import prices would have been down 0.1% if it wasn’t for the 0.9% increase in petroleum import prices.

Export prices were down 0.5% which missed the consensus for 0.2% growth. Import prices were up 4.8% year over year which is one-tenth higher than June. This is the highest increased since February 2012. Export prices were up 4.3% which is one percent below June.

Agricultural prices were down 0.5% month over month and 2% year over year. Import iron and steel prices were up 0.3% in July and 19.2% year over year. Imported aluminum prices fell 1.8% month over month and were up 9.7% year over year.

The positive effect on prices from tariffs are waning. The recent increase in the dollar means there will be a limit to the increase in import prices.

The dollar is up in August which means prices could fall month over month. In July, month over month Chinese import prices were down 0.2%. They were up 0.2% year over year. Prices for EU imports were down 0.1% month over month and up 3.5% year over year.

The Dollar - Conclusion

It will be interesting to see how long it takes for the dollar to prevent stocks from rallying.

It’s possible that the market is already lower than it would have been without the dollar rally.

However, the positive economic growth which is boosting the dollar is also helping stocks. The more the dollar goes up, the more it becomes too much of a good thing.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial ...

more