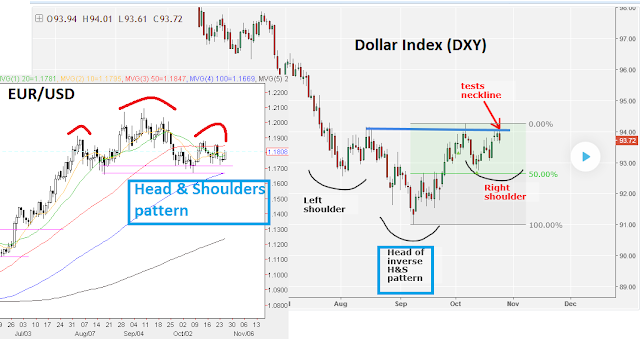

Dollar Index Tests Neckline Of Inverse Head & Shoulders Pattern

The US Dollar Index ( DXY) has been able to trace-out a big inverted H&S pattern, but just hours ago, failed at the pattern's neckline. While this could set-up a more precise breakout, it could also set the stage for a dip back towards the right shoulder's potential base in the 92.5/75 region. The same pattern ( H&S ) is also visible on daily charts for the EUR/USD, the largest component of the DXY. This is relevant, because both of these patterns are setting up ahead of a key news event, namely the ECB announcement tomorrow. Either way, price-action in both the DXY & euro should provide clarity to whether these patterns will be confirmed or not.

(Click on image to enlarge)

Disclosure: None.

Comments

Please wait...

Comment posted successfully.

No Thumbs up yet!