Dividend Portfolio Sector Allocation May 2015

Every few months I like to take a look at my portfolio holdings and examine my overall sector allocations to see if they meet my comfort level as to how my capital is distributed. As we all know, market forces affect certain sectors at different times throughout business cycles which can often throw many portfolio balances out of sync. Most recently, the halving of crude oil prices knocked down all energy related companies as it seemed every dividend income investor was buying an oil major, oil driller or oil services company. With attractive valuations and higher yields being offered many dividend growth portfolios began to skew heavily to energy related stocks. This is why it’s vital to assess your holdings from time to time, if nothing else, to simply decide if your allocations are meeting your needs and comfort level. After all I’m a big proponent of ‘sleeping well at night’ which is why I perform these informal audits of my portfolio holdings.

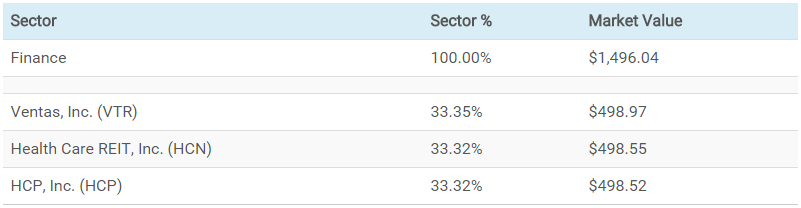

In general, without seeking to achieve a specific percentage goal in mind, consumer staples will be my largest sector overall among my three portfolios as a whole. Industrial and health stocks should follow with finance next. I don’t plan to ever hold any tech names in my portfolio and energy, if I ever pull the trigger, will be a small portion as are other sectors currently such as retail, utilities, materials and now REITs as I initiated, for the first time, three positions in the health REITs, HCP, VTR and HCN in my IRA.

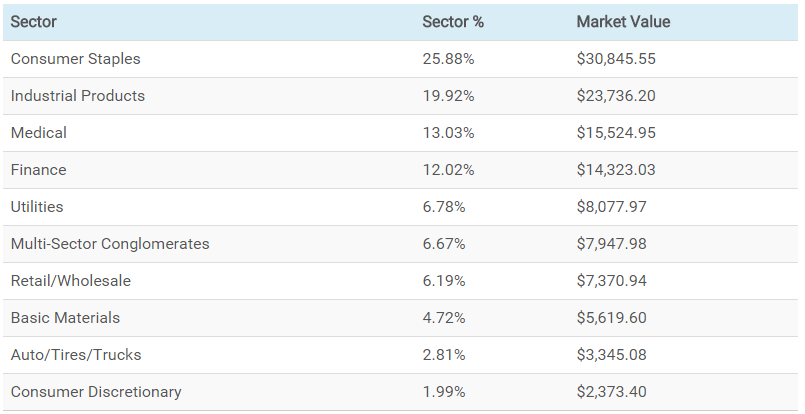

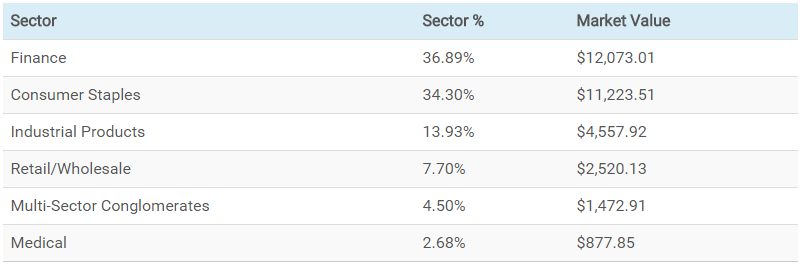

Below you will find my asset allocation for my dividend stocks. The biggest change can be seen in my financial allocation in my ROTH account jumping from 10.68% in September, 2014 to 36.89% today. Of course, it’s no secret that this jump occurred as a result of my monthly buying, since last summer, of three large Canadian banks, TD, BNS and RY. At the time I was looking for additional financial exposure as my only holding was WFC. Mission accomplished. I still may be adding to my Canadian banks going forward but not as aggressively as in months past. I still am looking to increase my health exposure via my REIT holdings in my IRA as well as other names already in my portfolio such as JNJ, ABT, BDX, BCR among others.

Brokerage Account

ROTH Account

IRA Account

How are your stocks allocated? What is your largest sector holding(s) and how do you feel about having a relatively high overweight sector in your portfolio? Please let me know below.

Disclosure: Long HCP, VTR, HCN, TD, BNS, RY, JNJ, ABT, BDX, BCR