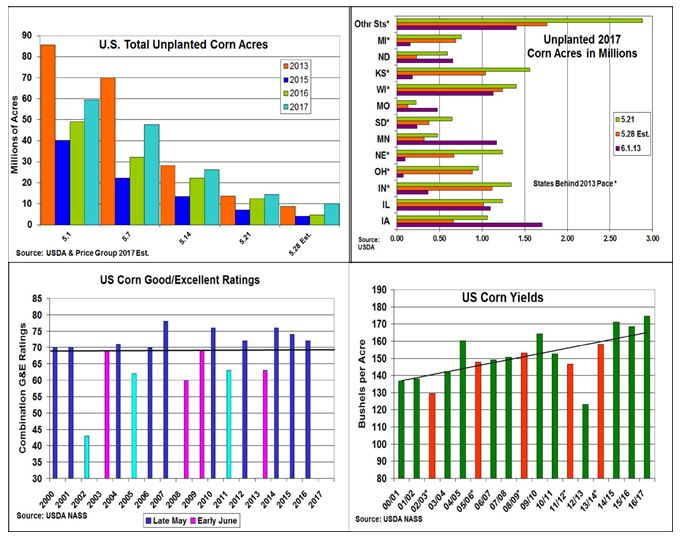

Despite Normal Pace, US Unplanted Corn Maybe Highest Since 2013 Now

Market Analysis

Despite a national corn planting pace which has progressed near the 5-year average pace, the 2017 planting season wouldn’t be considered anything near normal by most US producers. Heavy rains across the southern US this spring got planting off to slow start. Cold and rainy conditions in April and into early May in the western and northern areas of the Midwest delayed seedings. A window opened in IL, IN and OH for planting during the same time period, but heavy flooding rains and cold temperatures after seeding has prompted higher than normal replanting in IL & IN this year. The Western Corn Belt’s seedings have surged recently leaving the US total at 84% last week. Rains circulating around the Central US have left many planters in the shed this week.

Overall, 2017’s unplanted acres have remained lower than the extremely late 2013 spring. However, they have been tracking higher than the past two years when conditions were much better for planting. There seem to be two distinct areas of seeding delays, the ECB and Central Plains (KS, NE & SD) where this coming week’s unplanted corn area might be higher than 2013. If our state seeding forecasts are on target, 2017’s unplanted corn area could total 10.2 million vs. 2013’s 8.8 million acres.

This spring’s cold, wet and windy weather has hurt corn stands because of soil crusting and flooding, slowed growth and snapped seedlings from flying debris. After three strong recent national crop rating along with 2 other years (2004 and 2009) when the late May or first of June ratings were 69% good/excellent, the US corn crop produced an above trend yield. 2012’s 70 plus rating was hit by a drought, but a low initial rating has produced only trend or below yields five times, too. Tuesday’s corn planting/rating update could prompt a volatile reaction if 2017’s planting progress is below 90% and the US G/E total is also below 69%.

What’s Ahead

Along with next week’s post-holiday crop progress report, the current heavy short corn positions from investor funds could also add to the volatility. However, this year’s sizable old-crop supplies will likely limit any major rally until corn’s pollination period later this summer. Utilize any 10-20 cent short covering rally to advance old-crop sales to 80-90% & new-crop to 40-45% of a conservative yield.

Disclaimer – The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of The PRICE Futures Group, any of ...

more