Despite Low Crop Ratings, Large Corn & Bean Crops Stun Market

Market Analysis

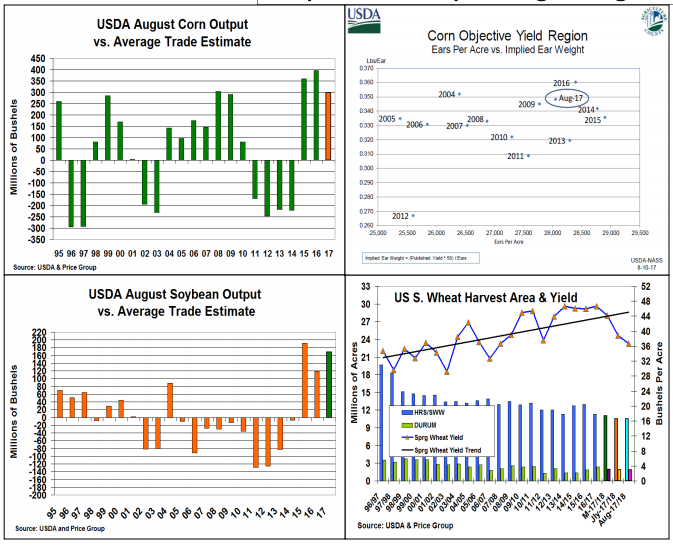

The USDA’s August corn & soybean forecasts revealed surprisingly high yields vs. trade’s averages, prompting a sharp price break across the markets. Given this year’s lowest ratings for both crop in 4 years, some initial skepticism surfaced. However, investor selling kept values on the defensive as memories of 2016’s large final crops overtook country reports of reduced output this week.

With the trade’s average corn yield slipping to 166.2 bu because of 2017’s good/excellent rating being 14-15% lower than last year, the USDA’s 3.3 bu. jump to 169.5 bu. and 298 million rise to a 14.15 billion bu. crop was a stunner. IA (-278 mil bu.) & IL (-197 mill bu.) didn’t participate in the increase, but IN, OH, NE, the Delta and the SE US had higher yields than 2016 this month. The USDA’s 2017 planting/ear levels forecast is 300-400 ears per acre lower than 2016 and the lowest in 5 years because of spring weather. However, their derived ear weight at .349 lbs, the 3rd highest ever, is a shocker. Since the USDA doesn’t select ears from the plots until September for weighting, this suggests the USDA’s is very cautious about cutting yields given record levels the last 3 years. Surprisingly, the World Board also sliced 25 million off of both corn’s 2017/18 feed and export demand leaving the coming year’s stocks art 2.27 billion bu. The USDA also advanced its soybean yield (1.9 bu.) & crop size (169 million bu.) vs. the trade’s average estimate. The Midwest yields are lower than 2016 while the Delta and SE are higher resulting in 4.38 billion bu. crop.

The USDA upped both its old (+50 mil) and new (+75 mil) crop export forecasts, but shaved the US crush by 10 million each year leaving a 475 million 2017/18 stocks.

The USDA did shave its spring wheat yield by 2 bu to 38.3 bu. However, no change in this variety’s harvested area despite a record low crop conditions left this total crop size at 402 million, off just 21.5 million from July.

What’s Ahead

After this month’s sharp price break, grain values are near 2017 lows. Given 2017’s weather trend of dryness in many parts of the Central US and major US crop tour stepping off in 10 days, some modest price recoveries could occur. Utilize 10-15 cent corn and 15-20 cent bean rallies to clean up old-crop supplies, but hold new-crop sales at current levels.

Disclaimer – The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of The PRICE Futures Group, any of ...

more