Despite Ideas Of Big Bean & Wheat Area Changes, Ag Forum Isn’t As Bold

Market Analysis

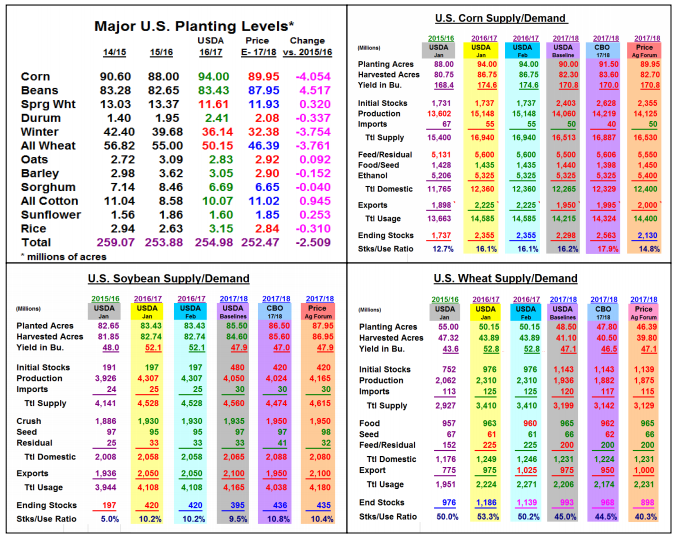

Each year, the USDA calculates economic derived supply-demand forecasts for the major U.S. crops at its annual Agricultural Outlook Forum being held on February 23 and 24 in Washington, DC. The USDA’s Chief Economist Johansson will provide some basic 2017 details during his AM remarks on the 23rd, while the complete balance sheets will be released on Friday AM.

Given 2016’s hefty corn plantings and strong soybean prices so far 2017, smaller US corn seeding and larger soybean plantings are expected. Last fall’s lower-than expected WW seedings and this year’s strong cotton prices are unknowns on the US Plains seedings mix.

Each fall, the USDA works up 10 year crop balance sheets called Baseline Projections as part of their annual Farm Bill update for Congress. Recently, these numbers have been released in November. Because of last fall’s extremely low W. Corn Belt and Plains corn prices, where 75% of 2016’s 6 million area rise occurred, the USDA forecast a 90 million 2017 planting, off 4 million. This area along with their weather derived 170.8 yield from last fall will be used to project a 14.1 billion bu. crop. The USDA isn’t likely to change its demand levels, except maybe ethanol because of strong exports. The USDA’s stocks will likely be in 2.15-2.3 billion range.

Rotational recovery in the WCB, lower winter wheat seedings in the Plains & Delta than expected and this winter’s stronger soybean prices will likely increase the USDA’s Ag Forum bean planting from last fall’s 2 million Baseline forecast. Our 4.5 million rise maybe this spring’s planting intentions level, but the USDA usually stays with its yield 47.9 yield level until the growing season. Overall, a crop size around 4.1 billion bu. and demand levels to create a 420-435 million stocks range seems likely.

Given US WW plantings & spring/durum area near last year, stocks may tighten to 900 million, best in 3 years.

What’s Ahead

The trade will be looking forward to this week’s Ag Forum projections, but the USDA has had a tendency for just modest changes in their major Baseline plantings and no change in their yield levels vs. their November levels. Despite these track records, whisper changes of 5-6 million higher beans and 1.0-1.5 million lower spring seedings continue, which could provide selling opportunities in both markets.

Disclaimer – The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of The PRICE Futures Group, any of ...

more