Crude Oil Prices Eye OPEC Meeting After Soaring To 3-Year High

Crude oil prices rose as Iraq delayed an auction of oil field development rights while officials from OPEC-led producers (notably including Russia) prepared for a meeting that may bring an extension of coordinated production cuts into 2019.

EIA inventory flow statistics amplified gains, showing stockpiles shed 1.07 million barrels last week. Economists were expecting a shallow build of 393.6k barrels, though a closely followed private-sector estimate from API published Tuesday foreshadowed the large outflow.

Gold prices probed higher as the crude oil surge echoed as strength across the raw-materials space. Indeed, the benchmark Bloomberg Commodity Index posted its largest one-day gain in eight months. A second day of US Dollar gains undercut momentum however, leaving the metal little-changed for the day.

OPEC MEETING, MONTHLY API REPORT AHEAD

From here, traders are eyeing a meeting of OPEC’s Joint Technical Committee. Soundbites from the gathering will parsed for clues about a possible extension of output curbs that may emerge from the follow-on ministers’ meeting on Friday.

The APImonthly statistical report is also due. That may help inform speculation about the extent to which swelling US supply will swamp cartel-led efforts. Output hit a record 10.5 million barrels per day last week and data from Baker Hughes put the number of active rigs at the highest in three years.

On the sentiment front, S&P 500 futures are pointing cautiously higher ahead of the opening bell on Wall Street. If momentum carries through, the risk-on mood may translate into higher bond yields and weigh on non-interest-bearing gold prices.

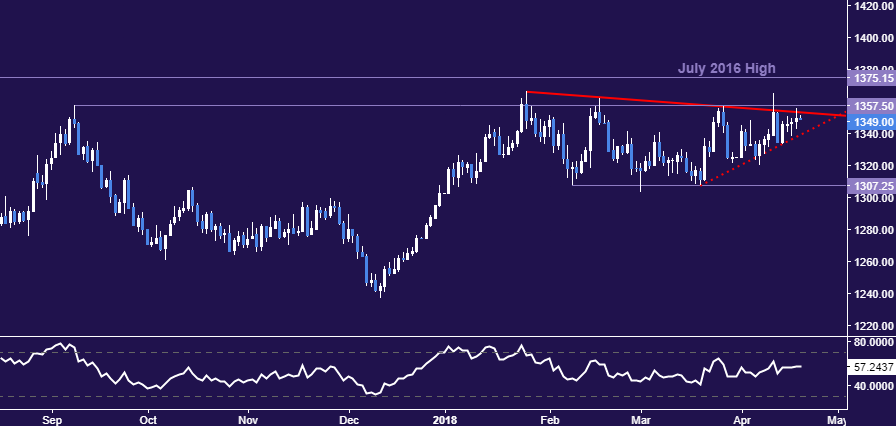

GOLD TECHNICAL ANALYSIS

Gold prices are still struggling to find direction below resistance in the 1353.87-57.50 area (double top, falling trend line). A break above this barrier confirmed on a daily closing basis exposes July 2016 high at 1375.15. Alternatively, a reversal below near-term rising trend support – now at 1339.64 – opens the door for a challenge of range support at 1307.25.

(Click on image to enlarge)

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices launched sharply higher, hitting the highest level since December 2014. From here, a daily close above the 38.2% Fibonacci expansion at 69.25 targets the 50% level at 70.39 next. Alternatively, a move back below the 23.6% Fib at 67.85 paves the way for a retest of former resistance at 66.22.

(Click on image to enlarge)