Coffee-Testing 11-Year Support With Bulls Hard To Find

(Click on image to enlarge)

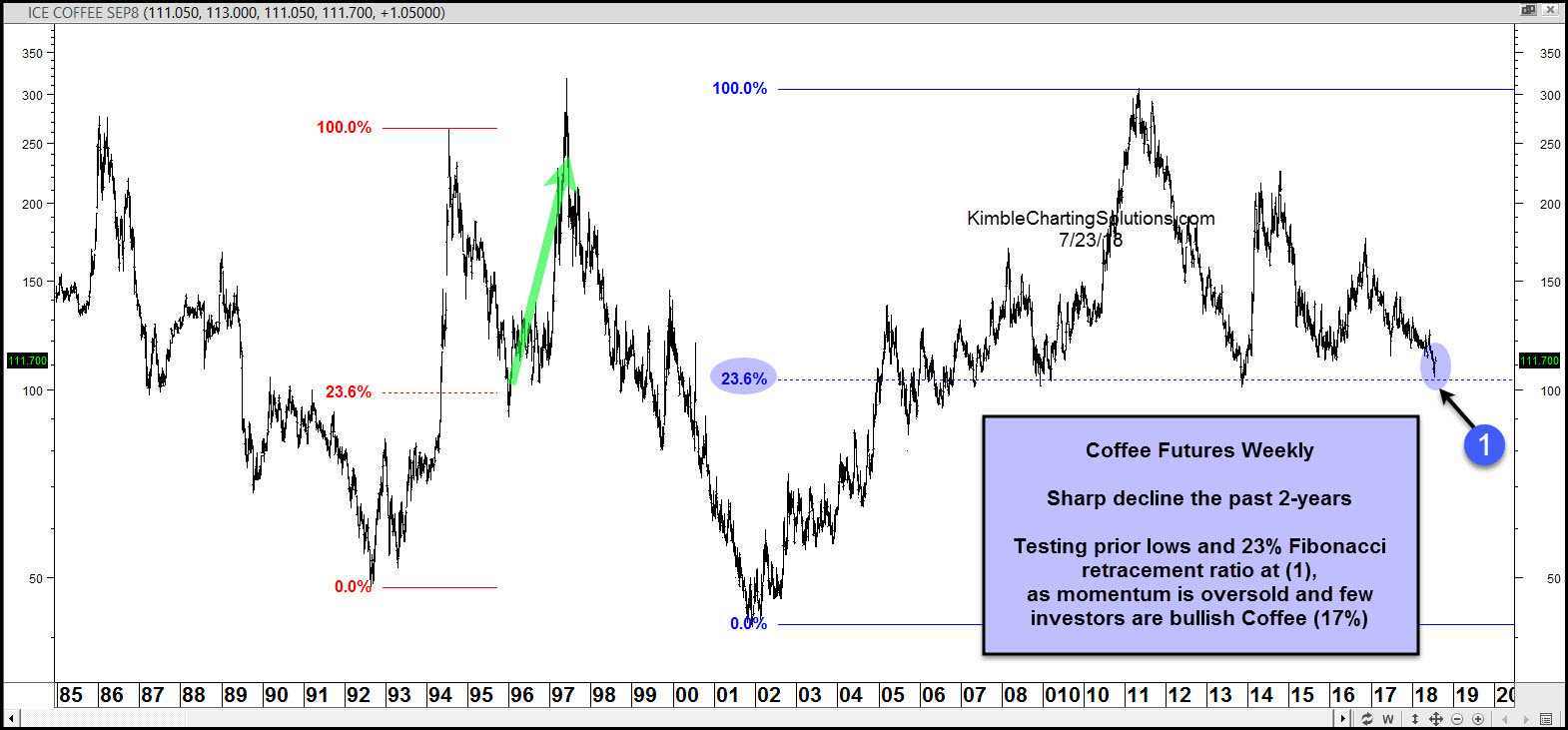

Coffee hasn’t been perking well over the past 2-years, as it has declined nearly 40%.

This sizeable decline has it testing the 2007, 2008 and 2013 lows, where rallies happened to get started. The current price is also testing the 23% Fibonacci retracement level at (1).

In the mid-1990’s when Coffee fell sharply and hit its 23% retracement level, a strong rally took place. Coffee is now testing the 1995 support/23% level currently as well at (1). Understandably the decline has bullish sentiment towards Coffee very low. (17% Bulls).

The trend remains down for Coffee. It finds itself at a price point where a short-term counter-trend rally could take place. If Coffee continues weak and breaks support at (1), aggressive traders would want to use the support break as a new price point to short it.

Sign up for Chris's Kimble Charting Solutions' email alerts--click here.