Chinese Stocks Plummet Despite Government Threats To Shorts, Europe Lower, US Closed

The Greece impasse set to culminate on Sunday continues to have a massive impact on at least one stock market, unfortunately it is the wrong one, located on a continent which is mostly irrelevant to the future of the Greek people (unless that whole AIIB bailout does take place of course). We are, of course, talking about China which as noted earlier, started off horribly, plunging over 7% with over 1000 stocks hitting 10% limit down, then in the afternoon session mysteriously recovering all losses and even trading slightly higher on the day, before the late selling returned once more, and the Shanghai Composite plunged to close down 5.8%: a ridiculous 20% total roundtrip move!

This brings the total drop since the highs less then three weeks ago to just over 28% (and 33% for the Nasdaq-equivalent Shenzhen) the biggest 3-week plunge in 23 years.

What is most troubling is that, as we noted last night, this clear bubble bursting is not done with the government's blessings - as should have been the case since a crash was clear to anyone - but despite the government constant attempts to intervene and prop up the bubble.

It all started with appeals to buy and hold because, well, it's patriotic: "Fan Shaoxuan, a senior executive at Weibo TV who has more than 12,000 followers on Sina Weibo, posted a photograph showing the slogans: “Hold stocks with confidence. Win glory for the country even if you lose the last penny."

Then overnight Bloomberg reported that in one sign of utter desperation, China is telling underwater investors to literally "bet the house on stocks" because under new rules announced Wednesday real estate is now an acceptable form of collateral for Chinese margin traders, who borrow money from securities firms to amplify their wagers on equities. Clearly this also means if share prices fall enough, individual investors who pledge their homes could be at risk of losing them to a broker.

While the rule change was intended to help revive confidence in China’s $7.3 trillion stock market, down almost 30 percent in less than three weeks, analysts say securities firms may be reluctant to follow through. Accepting real estate as collateral would tether brokerages to another troubled sector of the economy, adding to risk-management challenges as they try to navigate the world’s most-volatile stock market.

“It does come across as relatively desperate,” said Wei Hou, an analyst at Sanford C. Bernstein & Co. in Hong Kong. “Globally, illiquid assets such as real estate are not accepted as collateral as they are very hard to liquidate.”

“Brokers are not stupid,” said Hao Hong, a China strategist at Bocom International Holdings Co. in Hong Kong. “I don’t think they would be willing to take this kind of collateral.”

For more on China's margin debt and Umbrella Trust problem read our article from earlier in the week:

But the real desperation was revealed overnight when China effectively hinted anyone caught shorting would be put in front of a firing squad (metaphorically, we hope).

BREAKING: China suspended 22 short-selling accounts of stock index futures amid stock market crash - @Reuters 路透社消息:股市暴跌,中国政府出手暫停22个卖空股指的帳戶

— George Chen (@george_chen) July 3, 2015

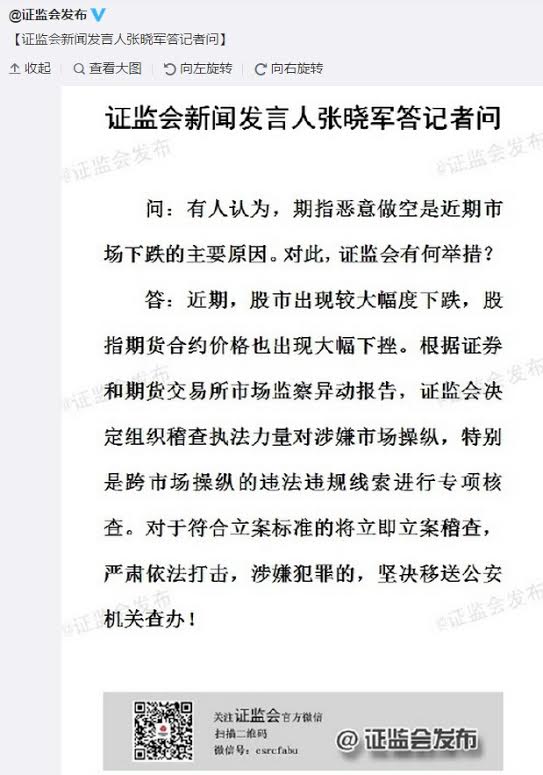

It wasn't just the shorts: a crackdown on "manipulators", which really means sellers, has also been launched:

China's securities watchdog announced Thursday it will investigate suspected manipulation of the stock market following weeks of plummeting stocks and future markets. Zhang Xiaojun, spokesman of the China Securities Regulatory Commission (CSRC), said they will investigate possible illegal activities occurring in multiple markets. He said they have tracked irregularities between securities and futures trading.

Even Morgan Stanley was mysteriously dragged into the blame game:

State newspaper backed by PBOC named Morgan Stanley a foreign bank with "suspicious purposes" in Chinese stock market pic.twitter.com/PEF0ZHYifH

— George Chen (@george_chen) July 3, 2015

And if indeed the Chinese government is now helpless to halt the all out rout which, as we have warned countless times over the past 6 months, will leave millions of Chinese "traders" with nothing and thus desperate and angry, then the next step is also very clear and was laid out last week in a note by Nomura which warned that "A Market Crash "Poses Great Danger To Social Stability."

Because a civil war over a market crash is all this worlds needs right now.

Hopefully there will be no civil war in Greece after this weekend's referendum which those who are not watching their paper "profits" vaporize in China, will be watching closely as tthe fate of the Eurozone may well depend on the outcome of the vote.

For now, however, unlike in China European trading is muted perhaps because unlike in China, the European Central Bank long ago became the primary marginal source of risk demand.

In what will most likely be a front-loaded session with the US away from market today, price action has been relatively subdued. In terms of the current state of play, the latest Ethnos poll shows there is not much between the 'yes' and the `no' vote, while Varoufakis remains optimistic that a deal can be done in the event of a `no' victory, although his European counterparts fail to share his optimism. Therefore, given the uncertainty surrounding the event, markets started off on a relatively tentative footing with equities drifting lower with selling pressure relatively broad-based while fixed income products have been provided a bid tone.

Elsewhere, in FX markets EUR/USD has been relatively resilient to the otherwise dampened sentiment for Europe. This is likely a continuation of the recent trend which has seen prices largely swayed by carry trade flow which sees purchases of EUR when the market is presented with bad news. AUD/USD has continued to extend on losses after stops were tripped on the break of June low of 0.7587. Of note, AUD underperformed overnight following lower than expected Australian retail sales data (0.3% vs. Exp. 0.5%), while soft Chinese HSBC PMI readings further weighed on the currency. Finally, GBP was lent some support by the latest services PMI data (58.5 vs. Exp. 57.5).

In the commodity complex, WTI and Brent crude futures trade with minor losses in the wake of yesterday's Baker Hughes data. In terms of commodity specific newsflow, participants continue to keep an eye on negotiations between Iran and their counterparts with the latest reports suggesting Iran are finally paving the way to allow inspectors access to some of their nuclear facilities. With this in mind, some have suggested that sanctions could be lifted by as soon as December.

According to Genscape, flows from the Marathon to Catlettsburg pipeline have increased to 210k bpd from 141k bpd. (RTRS)

In metals markets, spot gold and silver trade relatively unchanged while Nickel extended on recent losses overnight in the wake of disappointing Chinese PMI data. Iron ore prices continue to be weighed on by increasing supply levels with reports suggesting that China will allow Vale's 400,000 tonne mega-ship access to its ports

In summary: European shares remain lower, though are off intraday lows, with the basic resources and banks sectors underperforming and real estate, tech outperforming. Euro-area services PMI rises in line with estimate, U.K. services PMI above. Greeks split evenly on Sunday’s referendum, poll shows, more than 4 in 5 want to keep euro. ECB said to extend backstop to Bulgaria. Shanghai Composite drops 5.8%. U.S. markets closed for holiday. The Spanish and Swiss markets are the worst-performing larger bourses, the Dutch the best. The euro is stronger against the dollar. Japanese 10yr bond yields fall; Spanish yields decline. Brent crude, WTI crude fall.

Market Wrap

- S&P 500 futures little changed at 2068.5

- Stoxx 600 down 0.2% to 384.8

- German 10Yr yield down 1bps to 0.84%

- MSCI Asia Pacific down 0.4% to 146.4

- Gold spot up 0.2% to $1168.9/oz

- Eurostoxx 50 -0.3%, FTSE 100 -0.2%, CAC 40 -0.3%, DAX -0%, IBEX -0.4%, FTSEMIB -0.3%, SMI -0.3%

- Asian stocks fall with the Sensex outperforming and the Shanghai Composite underperforming; MSCI Asia Pacific down 0.4% to 146.4

- Nikkei 225 up 0.1%, Hang Seng down 0.8%, Kospi down 0.1%, Shanghai Composite down 5.8%, ASX down 1.1%, Sensex up 0.5%

- Euro up 0.26% to $1.1113

- Dollar Index down 0.21% to 95.91

- Italian 10Yr yield down 3bps to 2.29%

- Spanish 10Yr yield down 5bps to 2.26%

- French 10Yr yield down 1bps to 1.29%

- Brent Futures down 0.7% to $61.6/bbl, WTI Futures down 0.7% to $56.6/bbl

- LME 3m Copper up 0.1% to $5799/MT

- LME 3m Nickel down 0.2% to $12170/MT

In conclusion, here is the traditional overnight market recap courtesy of DB's Jim Reid

I'm sure this comment will come back to haunt me but it looks set to be a quiet day given that the US will be celebrating Independence Day and the rest of the market will be in a holding pattern ahead of Sunday's Greek referendum. Given I've just said this, cue mayhem to break out somewhere today. I'll just be glad to be in the office away from the adoring crowds at home as on primetime TV in the UK last night my wife, bump and Bronte were on a small section of "Dogs. Their secret lives". In the unlikely event you're interested let me know and I'll send you a short clip.

The Greek go to the polls on Sunday with voting taking place between 7am to 7pm local time which is 2 hours ahead of London time. As yet there is no confirmation that an exit poll will be conducted but if there is this will clearly be the starting point for Sunday night/Monday morning's fun and games. We expect results to start filtering through after around an hour with the closeness of the result dictating whether we'll know the outcome before Asia opens.

DB will be hosting a conference call on Sunday night 9pm London time to discuss where we are at that point. The dial-in details are at the end. We recommend that you dial-in 15 minutes ahead of the start of the call as we'd expect high demand.

Yesterday markets briefly put Greece to one side to focus on a slightly below market US payrolls print (223k vs. 233k expected). A cumulative 60k of downward revisions to the previous two months was also announced and having peaked at 2.462% in the moments before the reading, 10y yields tumbled about 10bps following the print before closing at 2.382% and 4.0bps lower in yield on the day. The Dollar index also pared some early gains before eventually closing -0.20% down on the day. US equities were more muted meanwhile with the S&P 500 (-0.03%) and Dow (-0.16%) broadly unchanged on the day. Following the report, we also saw a decent re-pricing across Fed Funds contracts. The Dec15 (-2.5bps), Dec16 (-5bps) and Dec17 (-5bps) contracts all declined to 0.290%, 1.030% and 1.740% respectively and in terms of what’s priced in now, Bloomberg are reporting that based on futures contracts, the probability of a September hike fell from 35% (on Wednesday) to 29% yesterday, while the probability of a December move fell from 72% to 67%. The moves were seemingly sharper in the moments immediately following the report before markets settled down, but still a reasonable re-pricing.

An interesting story also came out of the ECB yesterday after we heard that the Bank widened the eligible assets under its purchasing program to include 13 state-backed (or part state-backed) companies. The new additions appear to

have been identified as ‘agency issuers’, although interestingly some of the names are also members of some European corporate bond indices raising the questions of why other companies with government ownership haven’t been included. One to keep an eye on.

Ahead of Sunday it was actually a fairly quiet day for headlines out of Greece yesterday (relative to the last week or so). Finance Minister Varoufakis said that he ‘will not’ continue in his post in the event of a yes vote while Tspiras rather vaguely said that in that event he would ‘put in motion procedures foreseen by the Constitution’. The IMF also suggested that the cost of a third program for Greece through 2018 would be around €52bn. In a report, the Fund also argued that Greece would need debt sustainability measures including a doubling of maturities on existing loans. In anticipation of Sunday, DB’s George Saravelos noted in his latest outlook published yesterday that the referendum appears to be too close to call. He says that irrespective of the outcome, there is unlikely to be an immediate resolution of the crisis the next day. A yes vote still carries risks while a no vote opens a wide range of possibilities. Interestingly, George notes the domestic political situation is becoming a lot more tense. Yesterday four coalition government Independent Greek MP’s were said to have voiced their disagreement with the referendum and called for its withdrawal, stating that they would vote yes. This should be seen in the context of a government majority of 11. As we go to print, the results of the latest poll (run by the University of Macedonia) have in fact just hit the wires which show an even split of votes at 43% each for yes and no. The remainder were said to have been undecided or declined to answer.

Staying in Europe, equity markets were fairly subdued in the region for the most part yesterday, declining once the US session kicked in. The Stoxx 600 (- 0.91%), DAX (-0.73%) and CAC (-0.98%) all fell, while steeper declines were felt in the FTSE MIB (-1.43%). Sovereign bond yields moved wider generally. 10y Bunds moved 3.3bps wider to 0.844%, while in the periphery Italy (+3.0bps), Spain (+3.4bps) and Portugal (+7.7bps) also moved wider. Interestingly, Greek 10y (-25bps) yields moved lower for the second consecutive day. 10y yields in Sweden were sharply tighter (-8.8bps) meanwhile after the Riksbank cut the repo rate by another 10bps to -0.35% and surprising the market. The Riksbank also announced that it is to expand the bond purchasing program by an additional 45bn kronor, adding to the already 80-90bn kronor program.

Recapping the rest of yesterday’s data, in conjunction with the payrolls report we also saw the unemployment rate tick down two-tenths of a percent to 5.3% (vs. 5.4% expected) and to the lowest level now since April 2008. DB’s Joe Lavorgna noted the fall was supported by a plunge in the labour force participation rate, which fell to 62.6% from 62.9%. This is in fact the lowest reading since October 1977. Average hourly earnings disappointed (0.0% mom vs. +0.2% expected) having stayed unchanged during June and resulting in the annualized rate dropping down to +2.0% yoy (from +2.3%). The household survey also reported a 56k decline in employment during the month. Meanwhile, initial jobless claims rose 10k last week to 281k (vs. 270k expected) while factory orders for the month of May fell by more than expected (-1.0% mom vs. -0.5% expected). Finally the ISM NY rose 7.1pts to 63.1, the joint highest reading this year. Euro area PPI was the only notable highlight of a quiet European data calendar yesterday, with the 0.0% mom reading for May below expectations of +0.1%.

Refreshing our screens this morning, it’s all about China once again where the Shanghai Comp (-3.25%) and Shenzhen (-3.14%) have taken yet another steep leg lower this morning. The Shanghai Comp in fact traded as much as 7% down at one point with the index now nearly 12% lower this week alone (including a high-to-low range of nearly 16%). This index is now on track for its steepest three-week decline since 1992. There are reports (Bloomberg) that the China Securities & Regulatory Commission is investigating recent short selling activity and is set to ‘strictly’ punish any signs of manipulation found. Elsewhere, it’s fairly weaker across the board. The Nikkei (-0.22%), Hang Seng (-0.23%), Kospi (-0.25%) and ASX (-1.17%) have all tracked the move lower. Meanwhile data in China has done little to help lift sentiment. The compositeJune PMI reading has fallen 0.6pts to 50.6, dragged down by a 1.7pt fall in the services reading to 51.8. In Japan the composite reading declined 0.1pts to 51.5, while the services reading rose to 51.8 (+0.3pts).

Moving on, as discussed at the top, this morning our Euro HY monthly reviews H1 and updates our outlook for H2. At the start of the year we felt it would be a positive year for HY credit with our firm bias for single-Bs (on a cheap relative value basis) and for a better H2 than H1. The better H2 was due to concerns that Greece and the Fed would cause volatility and periods of weakness in H1 before a resolution in the former and a turn more dovish for the latter in H2 as growth struggled to meet the consensus and the Fed's forecasts. This theory is going to be tested in the days, weeks and the months ahead but we stick broadly to the same script even if the Greece saga looks set to continue longer than we could have imagined at the start of the year. This week's price action has given us some comfort that Greece can be contained even if an accident would lead to a period of risk-off. Expect the ECB to provide more stimulus and the Fed to err on the side of caution in this scenario.

Single-Bs are no longer the stand-out relative value they were at the start of the year and all four rating main corporate rating bands (As through to Bs) are now back grouped broadly together again from a relval perspective for the first time in 18 months. In this time single Bs have gone from being very expensive a year ago to very cheap 6 months ago. Because we think credit will have a better H2 than H1 we still would have a preference for single-Bs and HY in general over IG but it’s more because of a desire to be exposed to high beta and the higher carry now rather than an obvious relative value play.

Our central case scenario is that European HY spreads will be 90bps tighter by YE 2015 with no Grexit and no Fed hike. However with scenario analysis assessing various Greek and Fed risks the weighted average tightening by year-end is around 40bps. Please see the link in your mailbox from Nick Burns in the last hour or so for the full report.

Wrapping up, with a US holiday today it’s a fairly quiet data day ahead. News flow in Europe will be centered on the final composite and services PMI readings for the Euro area, Germany and France as well as readings for the UK, Italy and Spain. Euro area retail sales are also due while it goes without saying that Greece headlines will be closely watched ahead of Sunday’s main event.

Copyright ©2009-2015 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time you engage ...

more