Chin Ready

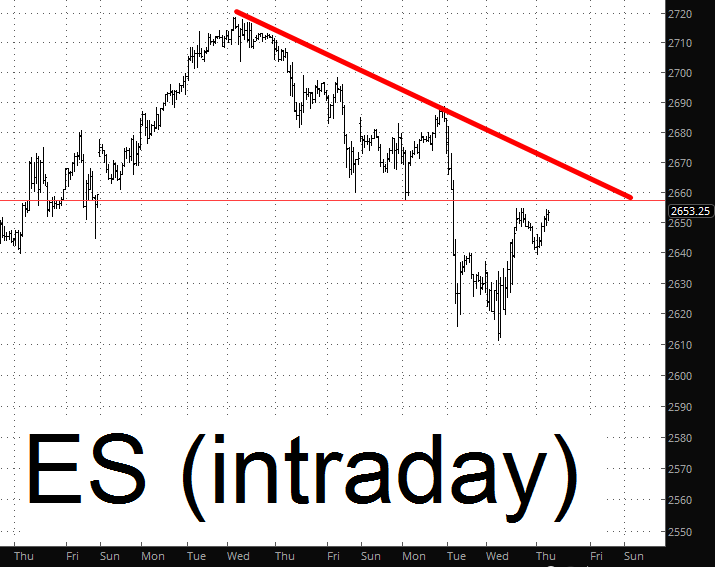

This is one of those mornings where I’ve mentally prepared myself to take it on the chin. It’s not that the market is up huge – – as of this moment, the S&P futures are up one-third of a single percentage point. It’s just that a few of my shorts – AMD, FB, AAP – have some big post-earnings risings, so I’ll almost certainly see those stopped out. Strong as the NQ rally is (up almost a percentage point), the trend (so far) remains down.

The same is true for the ES. You can see how it is relatively weaker than the chart above, since it isn’t nearly as close to its descending trendline.

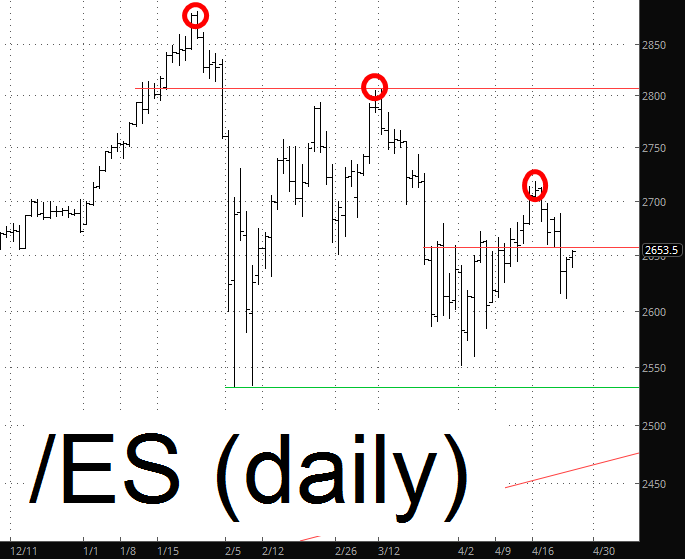

Taking a big step back, on a daily basis, you can also see how the trend for 2018 has been – – in fits and lurches – – lower.

My biggest worry point is the bonds, which have had some really good weakness for a couple of weeks (red arrow) but look prone to a bounce. I’m probably going to remain less aggressive in position entries for a little while, until the coast is more clear.

Disclaimer: This is not meant to be a recommendation to buy or to sell securities nor an offer to buy or sell securities. Before selling or buying any stock or other investment you should consult ...

more