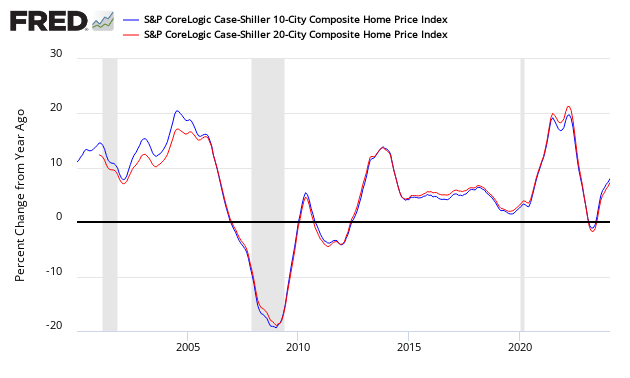

Case-Shiller 20 City Home Price Index February 2018 Now Rises To 6.8 % Year-Over-Year Growth

The non-seasonally adjusted Case-Shiller home price index (20 cities) year-over-year rate of home price growth rose from 6.4 % to 6.8 %. The index authors stated, "With expectations for continued economic growth and further employment gains, the current run of rising prices is likely to continue."

Analyst Opinion of Case-Shiller HPI

Many pundits believe home prices are back in a bubble. Maybe, but the falling inventory of homes for sale keeps home prices relatively high. I continue to see this a situation of supply and demand. It is the affordability of the homes which is becoming an issue for the lower segments of consumers.

- 20 city unadjusted home price rate of growth grew 0.4 % month-over-month. [Econintersect uses the change in year-over-year growth from month-to-month to calculate the change in rate of growth]

- Note that Case-Shiller index is an average of the last three months of data.

- The market expected:

| Consensus Range | Consensus | Actual | |

| 20-city, SA - M/M | 0.5 % to 0.7 % | 0.7 % | +0.8 % |

| 20-city, NSA - M/M | 0.1 % to 0.3 % | 0.2 % | +0.7 % |

| 20-city, NSA - Yr/Yr | 6.1 % to 6.6 % | 6.2 % | +6.8 % |

S&P/Case-Shiller Home Price Indices Year-over-Year Change

Comparing all the home price indices, it needs to be understood each of the indices uses a unique methodology in compiling their index - and no index is perfect.

The way to understand the dynamics of home prices is to watch the direction of the rate of change. Here home price growth generally appears to stabilize (rate of growth not rising or falling).

There are some differences between the indices on the rate of "recovery" of home prices.

A synopsis of Authors of the Leading Indices:

Case Shiller's David M. Blitzer, Chairman of the Index Committee at S&P Indices:

"Home prices continue to rise across the country. The S&P CoreLogic Case-Shiller National Index is up 6.3% in the 12 months through February 2018. Year-over-year prices measured by the National index have increased continuously for the past 70 months, since May 2012. Over that time, the price increases averaged 6% per year. This run, which is still ongoing, compares to the previous long run from January 1992 to February 2007, 182 months, when prices averaged 6.1% annually. With expectations for continued economic growth and further employment gains, the current run of rising prices is likely to continue.

Increasing employment supports rising home prices both nationally and locally. Among the 20 cities covered by the S&P CoreLogic Case-Shiller Indices, Seattle enjoyed both the largest gain in employment and in home prices over the 12 months ended in February 2018. At the other end of the scale, Chicago was ranked 19th in both home price and employment gains; Cleveland ranked 18th in home prices and 20th in employment increases. In San Francisco and Los Angeles, home price gains ranked much higher than would be expected from their employment increases, indicating that California home prices continue to rise faster than might be expected. In contrast, Miami home prices experienced some of the smaller increases despite better than average employment gains.

CoreLogic believes low inventories are spurring rising home prices (January 2018 Data). Per Dr. Frank Nothaft, chief economist for CoreLogic and Frank Martell, president and CEO of CoreLogic stated:

A number of western states have had hot housing markets. Idaho Nevada, Utah and Washington all had home prices up more than 11 percent over the last year. With the recent rise in mortgage rates, affordability has fallen sharply in these states.

Family income is rising more slowly than home prices and mortgage rates, meaning that the mortgage payment takes a bigger bite out of income for new homebuyers.

The National Association of Realtors says home sales prices continue to increase (February 2018 data):

Lawrence Yun, NAR chief economist, says sales were uneven across the country in February but did increase nicely overall. "A big jump in existing sales in the South and West last month helped the housing market recover from a two-month sales slump," he said. "The very healthy U.S. economy and labor market are creating a sizeable interest in buying a home in early 2018. However, even as seasonal inventory gains helped boost sales last month, home prices - especially in the West - shot up considerably. Affordability continues to be a pressing issue because new and existing housing supply is still severely subpar."

Added Yun, "The unseasonably cold weather to start the year muted pending sales in the Northeast and Midwest in January and ultimately led to their sales retreat last month. Looking ahead, several markets in the Northeast will likely see even more temporary disruptions from the large winter storms that have occurred in March."

"Mortgage rates are at their highest level in nearly four years, at a time when home prices are still climbing at double the pace of wage growth," said Yun. "Homes for sale are going under contract a week faster than a year ago, which is quite remarkable given weakening affordability conditions and extremely tight supply. To fully satisfy demand, most markets right now need a substantial increase in new listings."

NAR President Elizabeth Mendenhall, a sixth-generation Realtor® from Columbia, Missouri and CEO of RE/MAX Boone Realty, says first-time buyers are seeing stiff competition for the available listings in their price range. "Realtors® in several markets note that entry-level homes for first-timers are hard to come by, which is contributing to their underperforming share of overall sales to start the year." she said. "Prospective buyers should start conversations with a Realtor® now on what they want in a new home. Even with the expected uptick in new listings in coming months, buyers in most markets will likely have to act fast on any available listing that checks all their boxes."

Black Knight Financial Services (formerly known as Lender Processing Services) December 2017 home price index Up 0.1 Percent for the Month; Up 6.6 Percent Year-Over-Year. Note that Black Knight uses the current month closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

Econintersect publishes knowledgeable views of the housing market.

Caveats on the Use of Home Price Indices

The housing price decline seen since 2005 varies by zip code - and seems to have ended somewhere around the beginning of the 2Q2012. Every area of the country has differing characteristics. Since January 2006, the housing declines in Charlotte and Denver are well less than 10%, while Las Vegas home prices had declined almost 60%.

Each home price index uses a different methodology - and this creates slightly different answers.

The most broadly based index is the US Federal Housing Finance Agency's House Price Index (HPI) - a quarterly broad measure of the movement of single-family house prices. This index is a weighted, repeat-sales index on the same properties in 363 metro centers, compared to the 20 cities Case-Shiller.

The US Federal Housing Finance Agency also has an index (HPIPONM226S) based on 6,000,000 same home sales - a much broader index than Case-Shiller. Also, there is a big difference between home prices and owner's equity (OEHRENWBSHNO) which has been included on the graph below.

Comparing Various Home Price Indices to Owner's Equity (blue line)

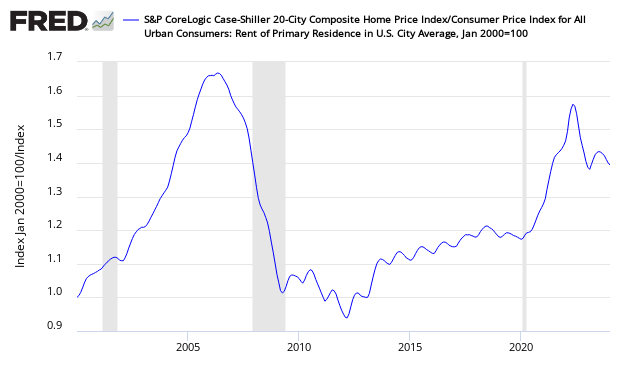

The affordability factor favors rental vs owning.

Price to Rent Ratio - Indexed on January 2000 - Based on Case-Shiller 20 cities index ratio to CPI Rent Index

Disclosure: None.