Buy These 2 Safe Blue Chip Growth Stocks For A Volatile Market

Many smart investors fear that the growth experienced over the past six years is coming to an end. Weekly mood swings in the market are the new norm and if you’re worried about your portfolio you are not alone. Bret Jensen is worried too, and here are his top two safest no-brainers in this difficult market.

The market has opened 2015 with quite a bit more volatility than investors have become accustom to over the past few years. The market heading down to start January and continue to go down for most of the opening stanza of the year. February saw equities post their best performance in a month since 2011. Markets turned downward to March only to reverse when the Federal Reserve finally lost the word “patient” in their comments on March 18th only to bend over backward to assure the markets that interest rate hikes would be slower and more incremental than the consensus. Global equities posted their best weekly performance in two years on those soothing words.

The next week markets turned down again as the durable goods report came in weak and as Saudi Arabia started bombing selected targets in Yemen which looks like an escalation of a proxy war for influence in the Middle East between the Sunni House of Saudi and Shiite Iran.

Some of the high beta stocks that led the market higher in February such as chip stocks, the biotech sector and high flyers like Tesla Motors (NASDAQ: TSLA) have broken down recently. I have become somewhat more apprehensive recently given the major currency swings of late, flat earnings growth projected for the S&P 500 in the first half of year and because of the significant and multiple geopolitical hotspots in the world right now.

This recent bout of volatility could be with investors for a while. I believe the prudent course of action is to tilt toward large cap growth plays with reasonable valuations that should be able to grow revenues and earnings at a good clip regardless of what the current global environment brings in coming weeks.

Here are two of those “Blue Chip Gems” I am adding to on any dips in the overall market. Both have solid revenue and earnings growth, fortress balance sheets, attractive valuations and even small but growing dividend yields.

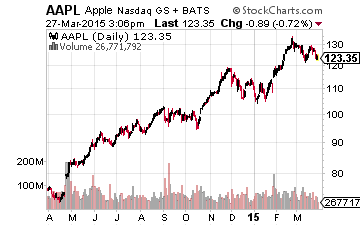

Let’s start with the juggernaut Apple (NASDAQ: AAPL) which recently sported the largest market capitalization of any equity in history. The tech giant is probably the easiest one stock decision in the market at the current moment and the shares have dropped over five percent recently in the general market weakness and is offering a better entry point for long term growth and value investors.

The company continues to dominate the smartphone market and this dominance has accelerated with the runaway success of the new larger screen version of its iconic iPhone franchise. The traction that Apple Pay has been able to achieve gives consumers just one more reason to upgrade to the latest iPhone or iPad.

The company will continue to garner the majority of the profits in the smartphone space as competitors have a hard time competing against Apple’s design prowess or the growing stickiness of its expanding ecosystem. The penetration of the company’s product line into consumers’ lives should continue to expand with the roll out of Apple’s first foray into wearable technology with the launch of the much awaited Apple Watch. The company also announced it will launch a web streaming TV service which also could prove to be a market disruptor.

From an investment standpoint, the stock still offers myriad attractive traits despite the stock’s big rally of the last 18 months. Apple is a free cash flow machine. Last year the company returned an astounding $65 billion to shareholders via stock buybacks and dividend payouts. A similar amount should find its way to holders of Apple stock this year.

Despite its largesse, the company still has over $125 billion in net cash and marketable securities on its balance sheet – more than some countries. Earnings are tracking to be up more than 30% year-over-year in FY2015 and in the teens in FY2016. Equating for cash, the shares sell at under 12 times this year’s profit projections; a significant discount to the overall market multiple.

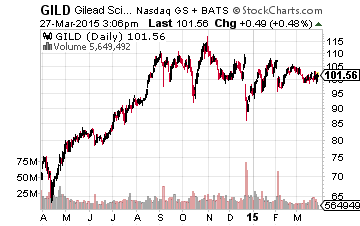

Next up is Gilead Sciences (NASDAQ: GILD). This biotech juggernaut’s stock has been stuck in a relatively narrow range for almost nine months now and the shares have not participated in the huge biotech rally of the past half-year. This should make the shares much less susceptible if a swoon settles over the biotech sector much like the pullback that hit the space last March.

Gilead dominates the lucrative hepatitis C and HIV spaces. Its hepatitis C drug Sovaldi racked up over $10 billion in sales in its first year on the market in 2014, which stands as an all-time record for a new drug. The company recently received approval to distribute Sovaldi in Japan for certain types of hepatitis C. Japan has over one million citizens with some form of hepatitis C.

The company has a deep pipeline of upcoming drugs including improvements to its core HIV franchise and potentially other lucrative sectors of the pharmaceutical market. The stock is cheap at under 11 times forward earnings, the company should produce some $60 billion in free cash flow over the next five years, will soon start to pay a dividend and has already accelerated a rather large stock repurchase program which should remove some 10% of the outstanding float in the next couple of years.

Although the company will not achieve the blockbuster growth in earnings and revenues that it did in 2014 Gilead should be able to produce 15% growth in earnings on a six to 10% increase in sales annually over the next couple of years.

Both of these Blue Chip Gems belong in every growth investor’s portfolio. If they are not in yours, consider picking up a few shares up on the next pullback in the overall market.