Brent Crude In Its Second Leg Up Off The Bottom, Targets Higher Prices

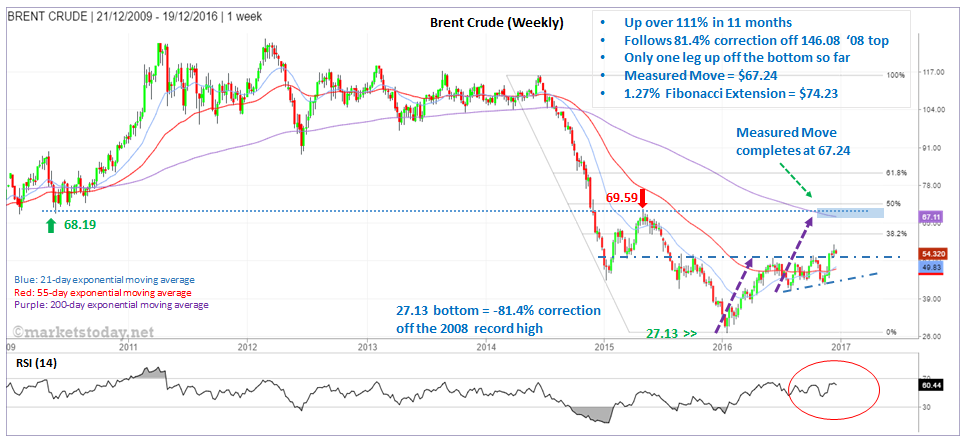

Last January Brent Crude completed an 81.4% correction off the record high of $146.08 reached in 2008 when it found a low at $27.13. Since then Brent has advanced as much as 111.9% as of the $57.50 high hit last week. It looks like there’s a good chance that Brent can continue to strengthen and is not yet done with its initial recovery.

Three weeks ago Brent broke out of a five-month sideways consolidation channel with a strong wide range candle that closed above the consolidation and near the high for the week. It is now well above the 55-week exponential moving average (ema), and the 21-week ema has crossed above the 55-week ema, for the first time since August 2014.

The next primary intermediate target is the completion of a measured move around $67.24, which is close to the 200-week ema, now at $67.11. That’s where the second leg up in the uptrend off the January low matches the advance in the first leg up. The next higher target zone would be from approximately $69.59 (prior peak) to $71.40 (50% retracement of the downtrend starting from the 2014 peak).

Retracements back towards support of the recent consolidation zone will likely see strength as buyers step up in anticipation of a continuation of the uptrend.

Disclaimer: The views and opinions expressed here are solely those of the authors / contributors and do not necessarily reflect the views ...

more