Bond Yields Are Pushing Higher Which Pushes Down High-Yielding Stocks

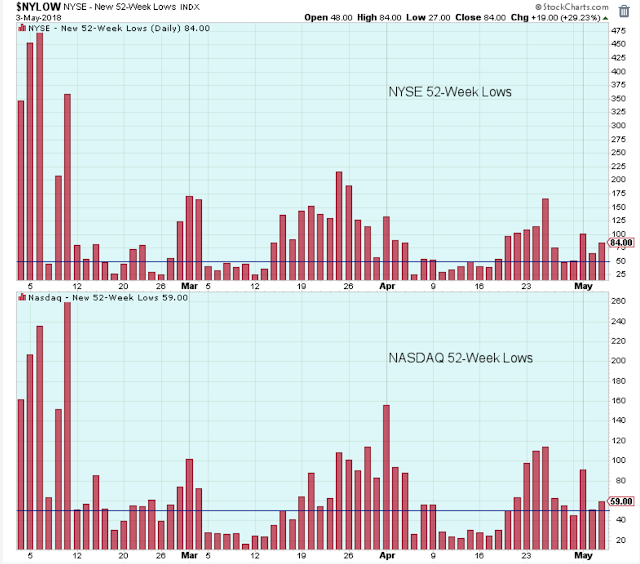

There are still too many new 52-week lows to get bullish, but not enough to get too bearish either. It seems like confirmation of more sideways action.

(Click on image to enlarge)

The market really isn't doing much that is interesting to blog about. So the following is miscellaneous.

This Cybersecurity ETF represents one of the few areas of the market that is pushing up against a new high. I like this group.

(Click on image to enlarge)

(Click on image to enlarge)

This bond fund looks to me like it wants to hit new highs.

New 52-week high for this high-yield Muni ETF. Why? Is it because this government high-yield is considered safer than corporate high-yield?

(Click on image to enlarge)

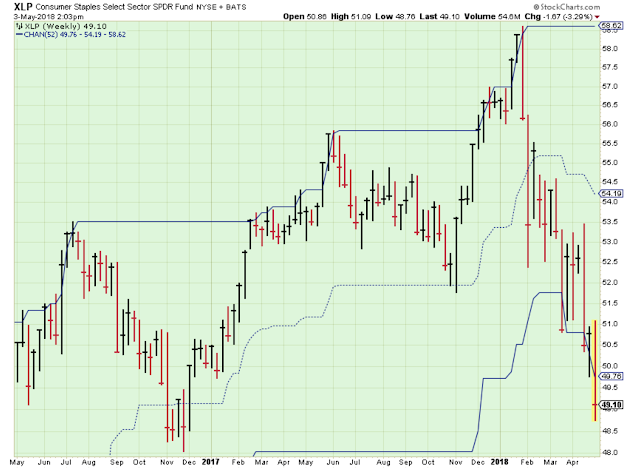

New 52-week low for this Consumer Staples ETF. This I get. Bond yields are pushing higher which pushes down high-yielding stocks.

(Click on image to enlarge)

Outlook Summary:

The long-term outlook is cautious.

The medium-term trend is down.

The short-term trend is down.

The medium-term trend for bond prices is down.

Disclaimer: I am not a registered investment advisor. My comments above reflect my view of the market, and what I am doing with my accounts. The analysis is not a recommendation to buy, ...

more