Best Seasonal Stock Picks For Q1

This seasonality report provides insight into historical seasonal trends that can be exploited for determining appropriate over- and under-weights on a sector, industry, and individual stock basis. Many of our clients use it as an additional idea generation tool. As a refresher, seasonality is calculated over rolling 10 year periods.

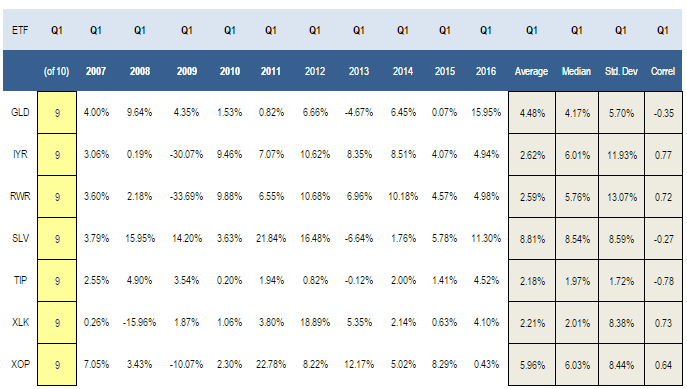

In the first quarter, gold, REIT, silver, technology, and oil & gas productions ETFs offer the strongest seasonal tailwinds. Silver offers the highest average and median return in the period.

The following table highlights those ETFs within our coverage that have posted gains in at least 9 of the past 10 Q1s.

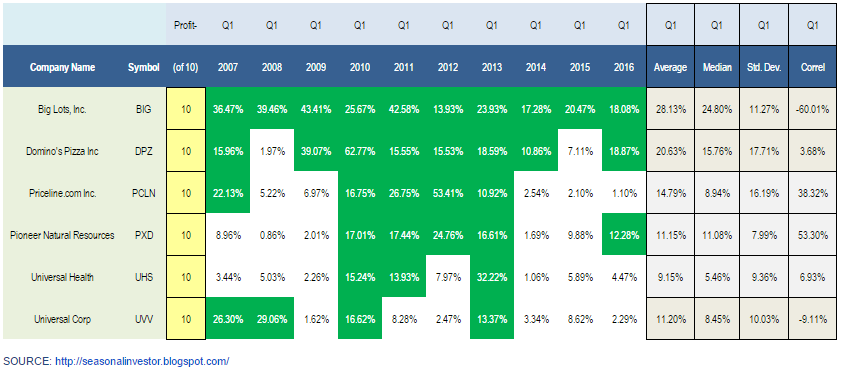

These stocks have posted gains in all 10 of the past 10 Q1s:

Note: all 3 of the picks we highlighted in the Q4 report (TRV, ALK, AIR) gained again this year, returning an average 16.5%, versus a 4.3% gain in the SP500.

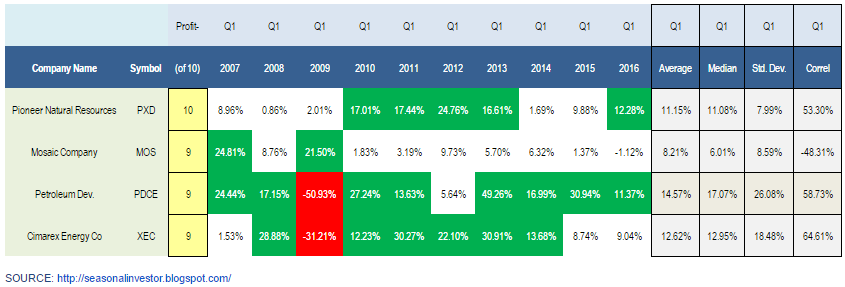

These are the best seasonal performers in basics:

Note: Q4 basic materials picks returned an average 10.02%.

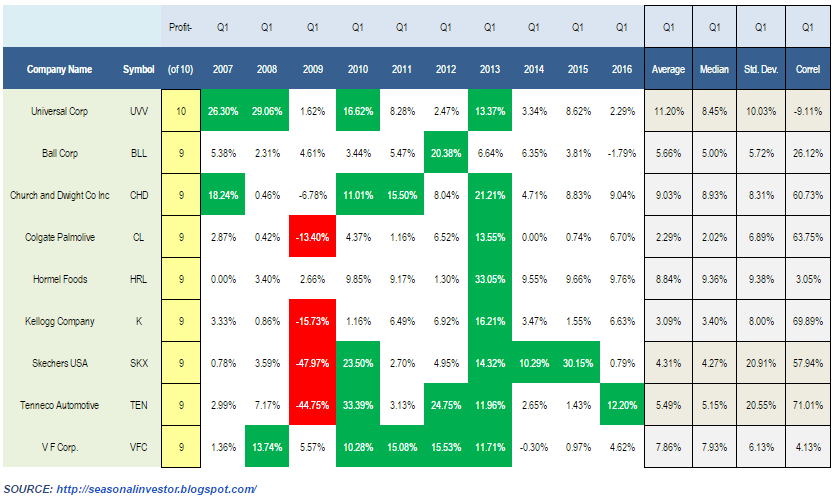

These are the best seasonal performers in consumer goods.

Note: We didn't highlight any consumer goods in the Q4 report. The XLP fell 1.5% in Q4.

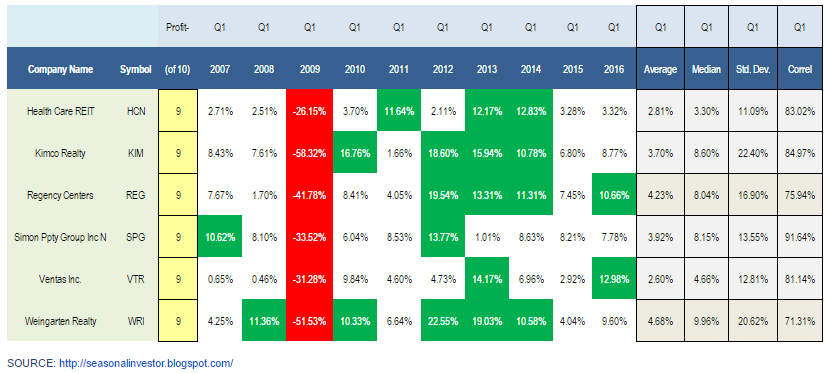

These are the best seasonal performers in financials:

Note: Q4 financials picks returned an average 7.9%.

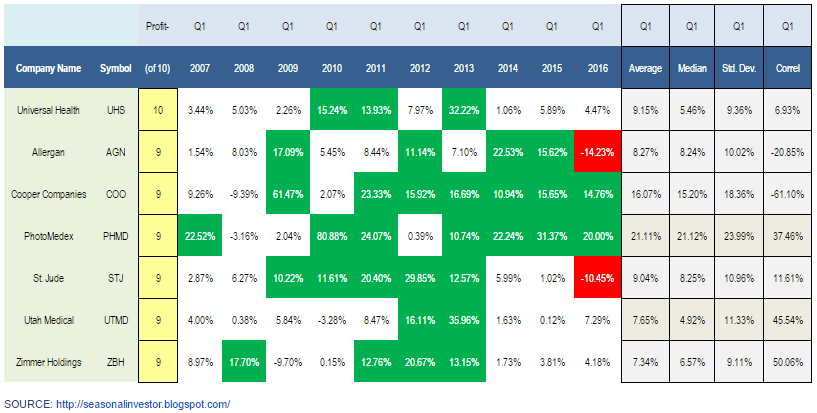

These are the best seasonal performers in healthcare:

Note: Q4 healthcare picks returned an average 7.2%.

These are the best seasonal performers in industrial goods:

Note: No industrial goods stocks were highlighted in Q4. The XLI was up 7.6%.

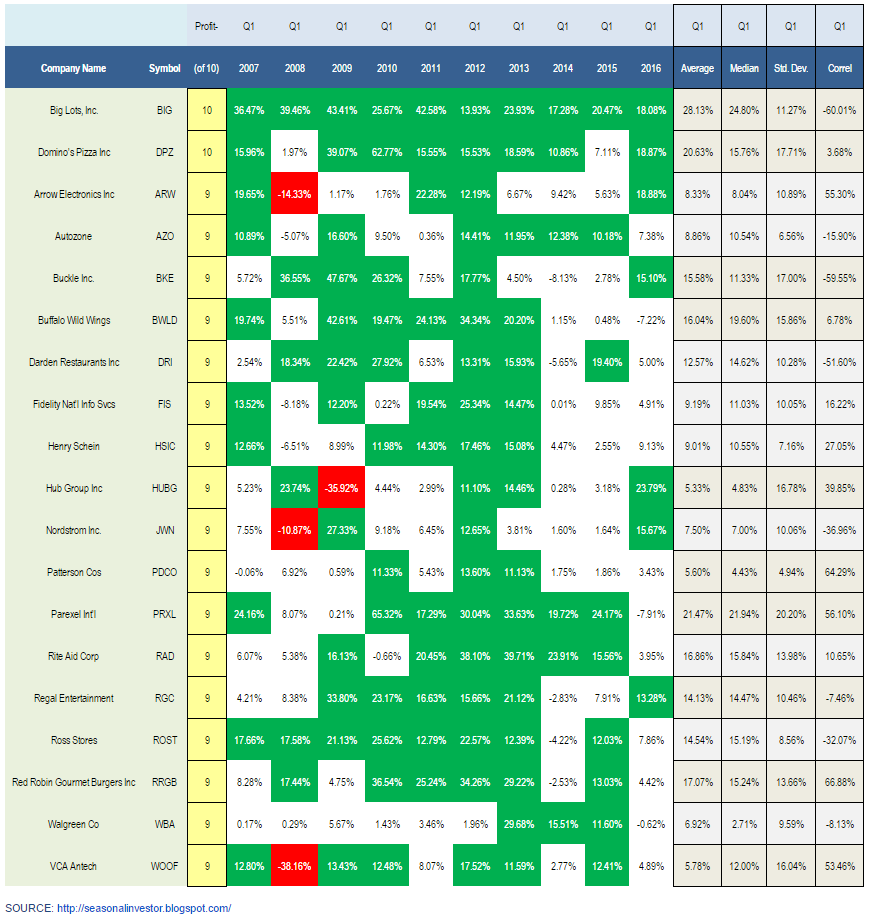

These are the top services stocks:

Note: Q4 services picks returned an average 11.05%.

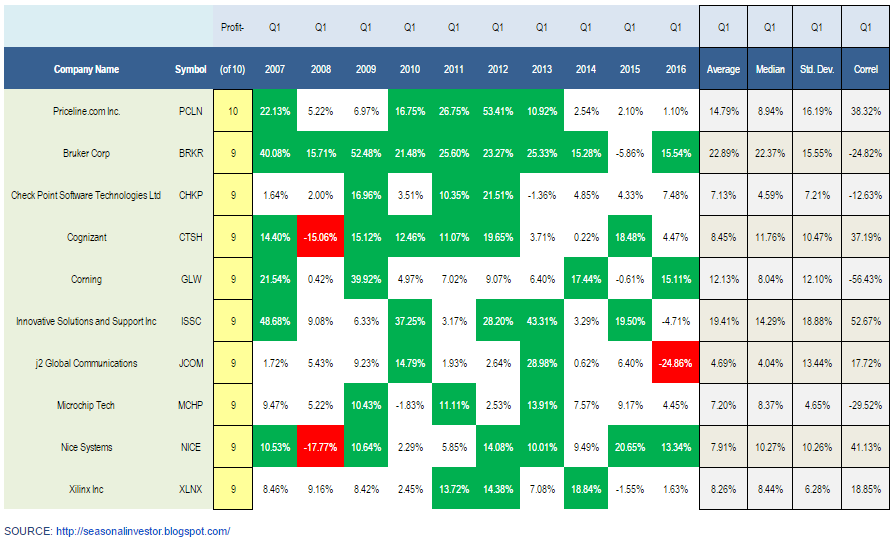

These are the best seasonal performers in technology:

Note: Q4 technology picks returned 2.5%, with 5 of 6 gaining.ground.

Disclosure: None.