Best Positive Guidance Since At Least 1996

EPS Guidance Looks Spectacular

Q4 2017 earnings are shaping up to be great. These results support this bull market. There are many investors who argue that earnings don’t matter. There is always going to be short term action which doesn’t work in concert with earnings growth, but that’s not a sufficient argument to say earnings don’t matter. There could always be a recession which knocks down stocks before earnings growth shows the weakness, but recessions don’t occur often and earnings growth isn’t the only aspect we look at when investing. To further the first point, if a recession lasts for 1 year every 8 years, there are about 2 years (25%) of earnings results which aren’t useful. The earnings growth in the year before the recession is too optimistic and the earnings declines during the recession are too pessimistic. If you understand this, you can better grasp how to utilize this metric.

Anyone can look at a metric wrongly, which is often at face value, and say it has no value. Investing takes analysis which is often not straight forward, since every economy and company has a unique wrinkle. To further the second point, future earnings justify stock values, but they don’t always predict prices because guidance often misses recessions until they are so close that stocks have already fallen in sympathy of the economic weakness. This is why I look at all economic stats and a few key indicators with a good forecasting record.

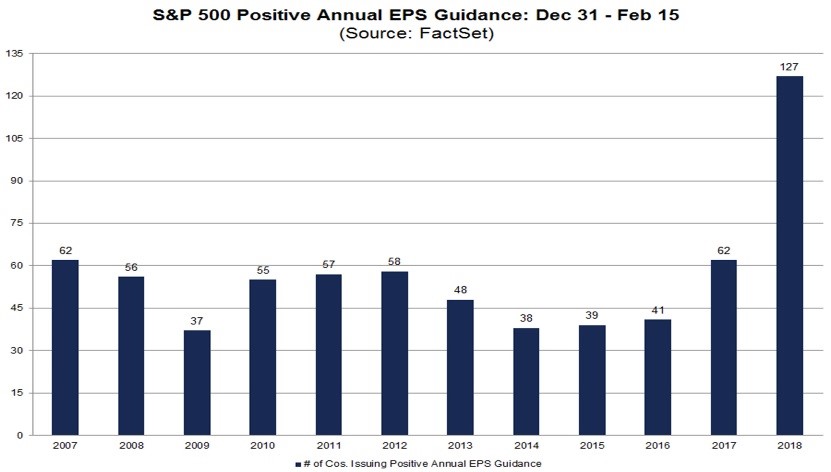

With that understanding of the importance of earnings, you know how to interpret the latest data on Q4. As you can see from the chart below, 127 firms had positive annual EPS guidance from December 31st to February 15th. This is the largest annual increase since at least 1996, which is when FactSet started this calculation. The 2017 S&P 500 bottom up EPS estimates have increased 7% since December 31st. The estimates went from $147.22 to $157.57. The expected earnings growth coming into Q4 was 11%; now the blended estimate is 15.2%.

This great news supports my opinion that the recent market decline was a correction and not the start of a bear market. While the earnings guidance could be completely wrong, you need to prove why the optimism is misguided. You need to come up with a negative catalyst. This is an important framing mindset. Since the economy is solid and earnings are very strong, it’s wrong to start with a negative mindset and look for a positive catalyst to change your mind. It’s asking ‘what could go wrong’ instead of ‘what could go right?’

(Click on image to enlarge)

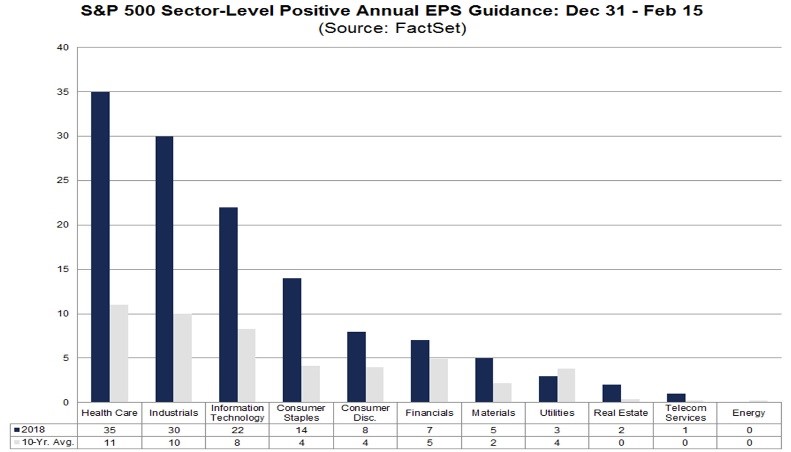

The chart below shows the breakdown by sector of the positive guidance issued. It’s interesting to see that even though the telecom sector and the energy sector are supposed to be helped by the tax cut the most, they only had one firm produce positive guidance combined. The reason for this is these firms don’t usually issue positive guidance. Since the energy market is so volatile, it doesn’t make much sense to issue guidance for the full year. The sector also hasn’t had a great quarter as the sector level earnings surprise percentage is -6.1% so far which is the worst performance out of any sector.

Even though tech was expected to be the least helped by the tax cut, 22 firms issued positive guidance. This is likely because of the strong economy and the repatriation tax holiday. 14 consumer staples firms have issued positive guidance this year, but the sector still crashed on Tuesday as it was down 2.25%. It was the worst performing sector because Wal-Mart stock was down over 10%. It’s unusual to see a staples stock down because of weakness in online sales, but that’s considered to be the future for the company. The industrials sector had 30 firms issue positive guidance which makes sense because emerging markets and commodities look strong. The economy is in a cyclical upturn in manufacturing.

(Click on image to enlarge)

S&P Dow Jones Earnings Results

I like to look at the S&P Dow Jones metrics because the spreadsheet includes the actual and operating results broken down. The difference between actual GAAP results and pro-forma results is an indicator of earnings strength in itself. I discussed this in 2016 when the gap between GAAP and non-GAAP results increased. Usually when the gap increases, it’s a sign of a bear market, but the stock market was able to avoid one in 2016.

So far, 78.61% of earnings reports have come in. 75.06% of firms beat estimates. The best sector was healthcare as 86.27% of these firms beat estimates. This is consistent with the high positive guidance rate seen in the chart above.

The full year operating earnings for 2017 were expected to be $135.95 on March 31st 2016. The blended estimate is now $125.07. The beats didn’t get us close to the original estimates. This is why I usually take estimates from 2 years in advance with a grain of salt. Furthermore, I expect that when all the assumptions include the affect of the tax cut, that will the peak of expectations. After that, estimates will fall like they usually do. The big difference is that the estimates usually don’t rise significantly. The estimate for 2018 earnings started at $146.48 and is now at $156.25. In almost the same period (5 weeks less), 2017 estimates fell from $135.95 to $129.78.

One final point is that actual results differed widely from operating results in Q4 2017 because of the write downs caused by the tax cut. The blended actual results for the quarter were $23.92. The operating results were $34.41.

Conclusion

Earnings are the backbone of this market; the tax cut boosted 2018 estimates. I’m not expecting the estimates to be hit, but even if results are slightly below them, it will still be a great year. With economic indicators looking decent and the yield curve still normal, I see no evidence of a recession coming in the next 12 months which would break up this great run of earnings since last year. That means the bull market should continue.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial ...

more