BEA Estimates 1st Quarter 2018 GDP Growth At 2.32%

In their first (preliminary) estimate of the US GDP for the first quarter of 2018, the Bureau of Economic Analysis (BEA) reported that the US economy was growing at a +2.32% annual rate, down -0.56% from the prior quarter.

The line item details were much weaker than the headline number might suggest. The most stunning news in the report was that consumer spending for consumer goods actually contracted during the quarter at a -0.24% annualized rate (down -1.91% from the prior quarter). Spending on consumer services also softened to a +0.97% annualized growth rate, down -0.11% from the prior quarter. The overall growth rate for consumer spending dropped over 2% from 4Q-2017 -- despite the roll-out of lower tax withholding rates during the quarter.

Weakening growth was also seen in the commercial and governmental sectors. Relative to the prior quarter the annualized growth rate for fixed commercial investment dropped -0.55%, governmental spending dropped -0.31%, and exports were -0.24% lower.

The only line items that recorded improving growth were inventories (up +0.96% from the prior quarter) and imports (up +1.60% from the prior quarter). In the BEA's formula, growth in these two line items is generally indicative of weakening domestic demand; and unfortunately, the quarter-to-quarter swing in those two line items provided the headline number's entire positive spin.

Real annualized household disposable income increased a material $270 per year from the prior quarter to $39,493 (in 2009 dollars) -- a reflection of improved "take-home" pay from the revised withholding tables. All of that improved "take-home" pay seems to have gone into savings since the household savings rate improved to 3.1%. While this level is still below recent norms, it is +0.5% better than the prior quarter -- which was the lowest level seen since the third quarter of 2007.

For this revision, the BEA assumed an effective annualized deflator of 1.98%. During the same quarter (January 2018 through March 2018) the inflation recorded by the Bureau of Labor Statistics (BLS) in their CPI-U index was materially higher at 2.53%. Underestimating inflation results in optimistic growth rates, and if the BEA's "nominal" data was deflated using CPI-U inflation information the headline growth number would have been significantly lower at a +1.82% annualized growth rate.

Among the notable items in the report :

-- Consumer expenditures for goods contracted at a -0.24% annualized rate (down -1.91% from the prior quarter).

-- The contribution to the headline from consumer spending on services dropped -0.11% to +0.97%. The combined consumer contribution to the headline number was +0.73%, down -2.02% from 4Q-2017.

-- The headline contribution from commercial private fixed investments was +0.76%, down -0.55% from the prior quarter.

-- Inventories added +0.43% to the headline number -- after removing -0.53% in the prior quarter (a quarter-to-quarter swing of +0.96%). It is important to remember that the BEA's inventory numbers are exceptionally noisy (and susceptible to significant distortions/anomalies caused by commodity price or currency swings) while ultimately representing a zero reverting (and long-term essentially zero-sum) series.

-- Governmental spending added +0.20% to the headline number, down -0.31% from the prior quarter. Most of that softening came from weakening infrastructure spending at a local level.

-- Exports contributed +0.59% to the headline number, down -0.24% from the prior quarter.

-- Imports subtracted only -0.39% from the headline number, up +1.60% from the prior quarter. In aggregate, foreign trade boosted the headline number by +0.20%.

-- The "real final sales of domestic product" growth was reported to be +1.89%, down a substantial -1.52% from the prior quarter. This is the BEA's "bottom line" measurement of the economy and it excludes the inventory data.

-- As mentioned above, real per-capita annual disposable was reported to have grown $270 per annum from the prior quarter. The household savings rate was reported to be 3.1% (up +0.5% from the prior quarter, but only half of the rate recorded for second quarter of 2015). As always, it is important to keep this line item in perspective: real per-capita annual disposable income is up only +7.68% in aggregate since the second quarter of 2008 -- a meager annualized +0.76% growth rate over the past 39 quarters.

The Numbers

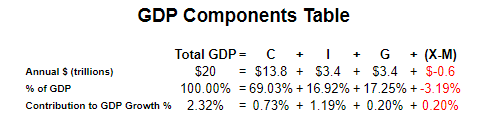

As a quick reminder, the classic definition of the GDP can be summarized with the following equation :

GDP = private consumption + gross private investment + government spending + (exports - imports)

or, as it is commonly expressed in algebraic shorthand :

GDP = C + I + G + (X-M)

In the new report the values for that equation (total dollars, percentage of the total GDP, and contribution to the final percentage growth number) are as follows :

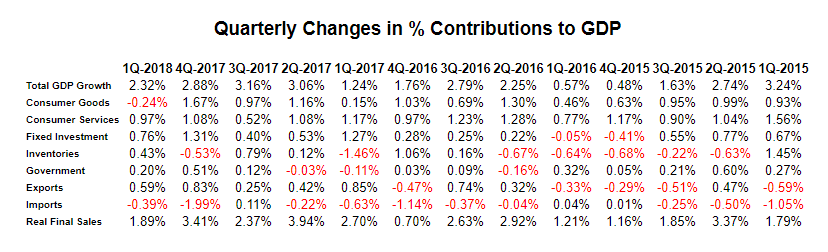

The quarter-to-quarter changes in the contributions that various components make to the overall GDP can be best understood from the table below, which breaks out the component contributions in more detail and over time. In the table below we have split the "C" component into goods and services, split the "I" component into fixed investment and inventories, separated exports from imports, added a line for the BEA's "Real Final Sales of Domestic Product" and listed the quarters in columns with the most current to the left :

Summary and Commentary

It can be argued that the headline number materially overstates the actual growth rate of the US economy. All of the BEA's three major "smoke and mirrors" components seem to be in play for the first quarter of 2018: inventories, imports, and deflators. At key economic inflection points those three components can become closely coupled, with lagging price discovery compounding reported inventory and import swings.

The major takeaways from this report are :

-- Consumer spending for goods contracted during the quarter.

-- The annualized growth rate for overall consumer spending dropped over -2%.

-- The growth rates for everything not inventories or imports weakened materially.

-- Although household disposable income improved (because of reduced withholding rates in the "Tax Cuts and Jobs Act of 2017"), most of that improvement went into increased savings. During the first quarter of 2018 households were showing signs of budgetary stress.

-- The BEA's deflators may once again be boosting the headline number, in this case by +0.50%.

The US economy is not quite as robust as the BEA's headline number might suggest. A +2.32% headline would generally be a good thing. But unfortunately, weakening domestic demand is causing inventories to soar and imports to crash -- which in the BEA's calculus are boosting what would otherwise be a much weaker headline number.

Although upcoming revisions might tell a different story, this report painted a picture of an economy in transition to materially lower growth.

Disclosure: None