Barchart Morning Call

OVERNIGHT MARKETS AND NEWS

Sep E-mini S&Ps (ESU14 +0.18%) this morning are trading slightly higher by +0.18% on support from today's +0.63% rally in the Euro Stoxx 50 index and a further +0.2% upward rebound in Russian stocks. Asian stocks today closed mostly higher: Japan -0.10%, Hong Kong +0.80%, China +0.23%, Australia +0.60%, Singapore +0.72%, South Korea -0.11, India +0.47%, Turkey +0.38%. The dollar index (DXY00 -0.03%) is slightly lower by -0.03% this morning, while EUR/USD (^EURUSD) is up +0.03% and USD/JPY (^USDJPY) is down -0.05%. Sep T-note prices (ZNU14 +0.05%) are up 1 tick.

Commodity prices are little changed on net this morning. Sep WTI crude oil (CLU14 +0.14%) is up +0.02% and Sep gasoline (RBU14 -0.05%) is down -0.09%. Aug gold (GCQ14 +0.11%) is up +0.16%, Sep silver (SIU14 -0.01%) is up +0.10%, and Sep copper (HGU14 +0.05%) is down -0.31%. Grain prices are steady to slightly higher this morning. Livestock and softs are mixed.

The Russian Micex stock index today is up +0.2%, adding to Tuesday's gain of +1.55% for the second day of recovery after 6 straight losses totaling -7.7%. The EU is now waiting to see if Russia assists in an international investigation into last week's downing of the Malaysia Air passenger plane in deciding whether to launch sanctions that could include more limited access to the EU capital markets and restrictions on access to sensitive energy and defense technology. The markets were pleased with the EU's limited sanctions threat.

The Bank of England at its July 9-10 policy meeting voted 9-0 to leave its base rate unchanged at 0.50%, according to the minutes released today. The minutes also said that some Monetary Policy Committee members have started to argue that there are reduced risks from a rate hike due to strengthening economic growth. However, other members said that "although the domestic economy was growing at or above longer-term average rates, there was little indication of inflation pressures building." The minutes added, "A premature tightening in monetary policy might leave the economy vulnerable to shocks." The MPC is waiting for the BOE's release next month of the quarterly Inflation Report, which will provide more data on the amount of slack in the UK economy.

Spain's Q2 GDP improved slightly to +0.5% q/q from +0.4% q/q in Q1, which was slightly above market expectations of +0.4%. Spain's Q2 GDP on a year-on-year basis was up +1.0% y/y. Spain's GDP has now risen for four straight quarters, indicating that it was clearly emerged from the recession sparked by the global financial crisis and the Eurozone debt crisis. The Bank of Spain is forecasting that Spain's GDP growth rate will improve to +2.0% in 2015 from +1.3% in 2014, indicating expectations for lackluster economic growth in Spain.

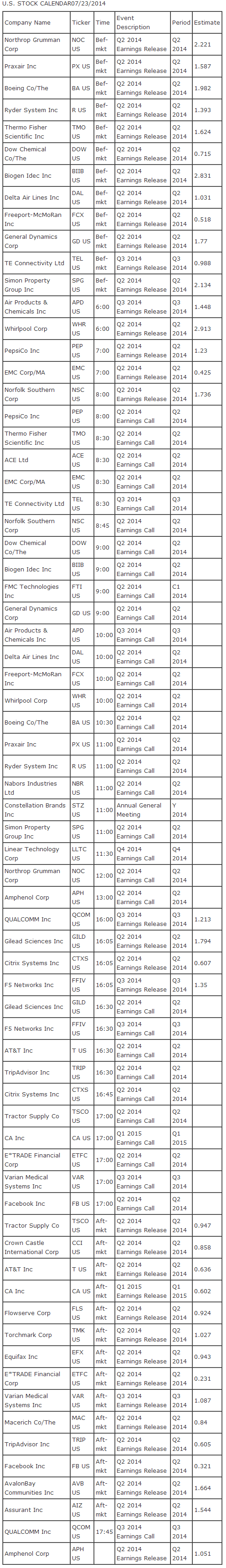

U.S. STOCK PREVIEW

There are 37 of the S&P 500 companies that report earnings today with notable reports including: AT&T (consensus $0.63), Facebook (0.32), E-Trade (0.23), Boeing (1.98), Northrop Grumman (2.22), Dow Chemical (0.72), Delta Airlines (1.03), PepsiCo (1.23), Norfolk Southern (1.74), and Gilead Sciences (1.79). Equity conferences during the remainder of this week include: Wells Fargo Small Cell Symposium on Thu.

Sep E-mini S&Ps this morning are up +0.18% on support from today's +0.63% rally in the Europe Stoxx 50 index. The U.S. stock market on Tuesday rallied moderately with a new record high in the S&P 500 index: S&P 500 +0.50%, Dow Jones +0.36%, Nasdaq +0.71%. Bullish factors included (1) reduced concerns about the Russian-Ukraine situation after Russian separatists handed over the black boxes to Malaysian authorities and released the train with bodies of the victims, (2) the stronger than expected June existing home sales report of +2.6% to a new 8-month high, and (3) the stabilization of the June CPI report that took some tightening pressure off the Fed.

OVERNIGHT U.S. STOCK MOVERS

- Of the 13 of the S&P 500 companies that have reported earnings this morning, only two reported below-consensus EPS, i.e., Whirlpool (WHR +2.03%) (2.62 vs consensus of 2.91) and Praxair (PX +0.16%) (1.58 vs 1.59). Notable companies that have reported above-consensus earnings this morning include Dow Chemical (DOW +0.85%) (0.74 vs 0.72), PepsiCo (PEP -0.82%) (1.32 vs 1.23), Delta Airlines (DAL +1.43%) (1.04 vs 1.033), and General Dynamics (GD +0.17%) (1.88 vs 1.77).

- Apple (AAPL +0.83%) fell late yesterday after after reporting third quarter results and fourth quarter guidance.

- Microsoft (MSFT unch) recovered and rose more than 1% late yesterday after an initial dip on its earnings report. Microsoft's Q2 EPS of 55 cents was below the consensus of 60 cents due to expenses related to Microsoft's purchase of Nokia's mobile business in April.

- Broadcom (BRCM +0.31%) (+3%) and Robert Half (RHI +0.73%) (+4%) rallied in after-hours trading yesterday after positive earnings results.

- Ballard Power Systems (BLDP +0.24%) rallied near 3% late yesterday after news its received a purchase order from New Flyer Industries.

- Xilinx (XLNX -0.37%) fell sharply by nearly 9% late yesterday after reporting earnings.

- Deutsche Bank is down more than -2% today after news that the New York Fed in December sent a letter to the bank saying that regulators found that the bank's U.S. operations suffered from inadequate oversight.

MARKET COMMENTS

Sep 10-year T-notes this morning are up 1 tick. Sep 10-year T-note futures prices on Tuesday closed mildly higher due to ongoing safe-haven demand and technical buying. Closes: TYU4 +3.5, FVU4 +4.25.

The dollar index this morning is slightly lower by -0.03 points (-0.03%) while EUR/USD is up +0.0004 (+0.03%) and USD/JPY is down -0.05 (-0.05%). The dollar index on Tuesday closed moderately higher as EUR saw weakness as the markets wait for the shoe to drop on the extent of new sanctions on Russia. The dollar index was also supported by the stronger-than-expected U.S. existing home sales report. Closes: Dollar index +0.22 (+0.27%), EUR/USD -0.0058 (-0.43), USD/JPY +0.06 (+0.06%).

Sep WTI crude oil this morning is up +0.02 (+0.02%) and Sep gasoline is down -0.0027 (-0.09%). Aug crude and gasoline prices on Tuesday closed lower: CLU4 -0.47 (-0.46%), RBU4 -0.0107 (-0.37%). Bearish factors included expectations for a continued rise in gasoline inventories, bearish API figures, the rally in the dollar index, and long liquidation pressure after Monday's rally.

Disclosure: None