Austerity Vs. Deficit Spending - Is There No Science In Economics?

I am appalled what passes for economic "fact" or "proven" economic theory. Scientific methods require:

- changing only one factor (variable) and keep all other conditions the same (carefully controlled conditions);

- gathering detailed empirical data; and,

- being able to replicate.

It seems unlikely that economics will ever rise to be a science. If it ever does it will be because the structures of both data and analysis reach entirely different points than they have to date.

- It is hard, if not impossible to allow one economic variable to change while holding the rest frozen. What would be possible is for one area in a country to do one thing, and another area in a country to do another - but there would still be no control of the variables.

- A majority of economic data in the USA is extrapolated, lacks detail, and is far from real time. Every economic dynamic must be identified, managed and recorded.

- Being a sailor, you begin to understand the concept of multiple dynamics. The swell one encounters at sea come from many directions - sometimes reinforcing each other, sometimes cancelling each other - but never constant or consistent. With over 7 billion people, nearly 200 countries, and 100s of thousands of business globally each producing various sizes of economic swell - it is impossible to replicate ANY economic situation. Every situation will be different.

For any economist to believe deeply in a single economic theory is not logical. Recently Nobel Laureate Paul Krugman, the mouthpiece for neo-Keynesians, stated:

America has yet to achieve a full recovery from the effects of the 2008 financial crisis. Still, it seems fair to say that we’ve made up much, though by no means all, of the lost ground. But you can’t say the same about the eurozone, where real G.D.P. per capita is still lower than it was in 2007 ....

Why has Europe done so badly? In the past few weeks, I’ve seen a number of speeches and articles suggesting that the problem lies in the inadequacy of our economic models — that we need to rethink macroeconomic theory, which has failed to offer useful policy guidance in the crisis. But is this really the story?

No, it isn’t. It’s true that few economists predicted the crisis. The clean little secret of economics since then, however, is that basic textbook models, reflecting an approach to recessions and recoveries that would have seemed familiar to students half a century ago, have performed very well. The trouble is that policy makers in Europe decided to reject those basic models in favor of alternative approaches that were innovative, exciting and completely wrong.

Slow down Professor Krugman.

Using GDP as the metric, the USA is doing better than Europe. However, there is very little in common economically between the USA and Europe. It is far from proof that what the USA is doing to solve the its economic doldrums is turning out better than the path Europe has taken. One major headwind facing Europe is a poor monetary union where the weaker members cannot gain traction without control of their currency. If Europe did what the USA did - what "proof" is there that Europe would be in a better position today? My OPINION is that there are no good monetary options which can overcome a poor monetary union.

In Professor Krugman's post, he asserts that the reason Europe is not doing well is because of austerity, and claims Keynesian huge budget deficits would have been the correct way for Europe to go. There is no empirical long term data on the effects of large budget deficits, low inflation and quantitative easing - unless one wants to use Japan.

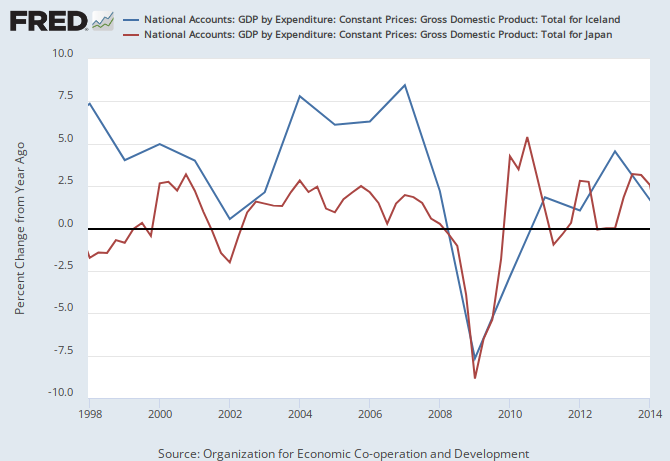

Japan continues to be dogged with deflation or low inflation as well as poor GDP growth. On the other hand, one can look at the opposite approach taken by Iceland (renunciation of debt combined with austerity) which appears to achieve nearly the same result. Neither Japan or Iceland has economic dynamics which are similar to the USA or Europe.

I have never understood the general concept that if a little deficit spending is good, a ton of it is better. One cannot assume doing more of something will give you a better result. It could be the optimum deficit spending was less than the USA did - or even if the long term effect of austerity would have been even better. My opinion is that austerity was not the way for the USA to go based on the dynamics in play - but this is an opinion without empirical evidence. On the other hand, I think that much of the deficit spending the USA did at the peak of the Great Recession recovery was misdirected and therefore did not have the necessary punch.

The biggest economic growth headwinds for the USA (and Europe and Japan and to a lesser degree China) is debt. This past week Van R. Hoisington and Lacy H. Hunt of Hoisington Asset Management stated in part:

In our review of historical and present cases of over-indebtedness, we noticed some overlapping tendencies with less regularity that are important to mention.

First, when all major economies face severe debt overhangs, no one country is able to serve as the world’s engine of growth. This condition is just as much present today as it was in the 1920-30s.

Second, currency depreciations result as countries try to boost economic growth at the expense of others. Countries are forced to do this because monetary policy is ineffectual.

Third, devaluations do provide a lift to economic activity, but the benefit is only transitory because other countries that are on the losing end of the initial action retaliate. In the end every party is in worse condition, and the process destabilizes global markets.

Fourth, historically advanced economies have only cured over-indebtedness by a significant multi-year rise in the saving rate or austerity. Historically, austerity arose from one of the following: self-imposition, external demands or fortuitous circumstances.

Here Messieur Hoisington and Dr. Hunt have partially argued for austerity. Professor Krugman believes austerity is a "new" and unproven idea - but austerity has been an economic tool used since the beginning of time. But here again, the problem is that detailed empirical data is lacking to prove scientifically how much deficit spending or austerity should occur - and under what circumstances or dynamics.

If you have only a sledge hammer in your economic tool box, every economic crisis will be sledge hammered. Every situation has different dynamics, and requires different tools of different sizes. Economists appear not to understand the limitations caused by lack of scientific methods used to "prove" or explain their theories.

Seems there is a lot of sledge hammering going on.

Other Economic News this Week:

The Econintersect Economic Index for April 2015 is indicating growth will be sluggish. Most tracked sectors of the economy are expanding - but now there is contraction in some data sets. The negative effects of the recently solved West Coast Port slowdown (a labor dispute which had been going on for months) and bad weather continues to be seen in much of the raw data - and it will be an economic drag on 1Q2015 GDP and into 2Q2015. It is difficult to differentiate these transient issues (weather and labor) from cyclic economic conditions - but one could argue that transient issues are a cause of economic cycles.

The ECRI WLI growth index remains slightly in negative territory which implies the economy will have little growth 6 months from today.

Current ECRI WLI Growth Index

The market was expecting the weekly initial unemployment claims at 280,000 to 305,000 (consensus 286,000) vs the 295,000 reported. The more important (because of the volatility in the weekly reported claims and seasonality errors in adjusting the data) 4 week moving average moved from 282,750 (reported last week as 282,750) to 284,500. The rolling averages have been equal to or under 300,000 for most of the last 7 months.

Weekly Initial Unemployment Claims - 4 Week Average - Seasonally Adjusted - 2011 (red line), 2012 (green line), 2013 (blue line), 2014 (orange line), 2015 (violet line)

Bankruptcies this Week: Fredericks of Hollywood

Disclosure: None

The answer is energy. There is an energy economy that underpins the fiscal economy. Howard T. Odum figured out this energy economy in the 1970s and applied it to both ecology and economics. He invented the discipline of biophysical economics. The difference between the US and Europe is that Americans have been benefiting from a massive inflow of cheap energy from PBR long-wall coal and more recently from fracked gas and oil that is compensating for equally profligate deficit spending and a swelling money supply. This is due mainly to the fact that land and mineral rights are still privately owned in the USA, and our oil and gas and coal companies are still privately held as well. All the innovation resulting in massive, new, truly economical energy production is coming from the 10% of the major energy companies that have not yet been nationalized.

When the fiscal economy turns over faster than the energy economy, you have inflation. When the energy economy and the manufacturing and value-adding elements it powers cycle faster than the fiscal economy, you have deflation. We saw deflation and pressure to expand the money supply more frequently in the days of the gold and silver standards. If economists understood and applied Odum, they would have their grand unification theory and make a true science out of a dismal one.