AUD/USD Continues To Decline Following The News About US-China Trade Relations

The Australian Dollar declined heavily last week by a combination of negative news about US-China trade relations, low demand for risky assets and Australian economic data (weaker than expected).

The Reserve Bank of Australia continues to hold the official cash rate at 1.5 percent for a 28th consecutive month ahead. The RBA maintained a positive position in the labor market, citing a speed-up in wages growth last month. However, there were some signs of deceleration and declines in commodity prices.

Australian Retail Sales came in at 0.3% as expected. The Aussie dropped after GDP turned out to be way below expectations. This reduced the odds of a rate hike by the RBA. Quarterly GDP came in at 0.3%, vs 0.9% expected.

(Click on image to enlarge)

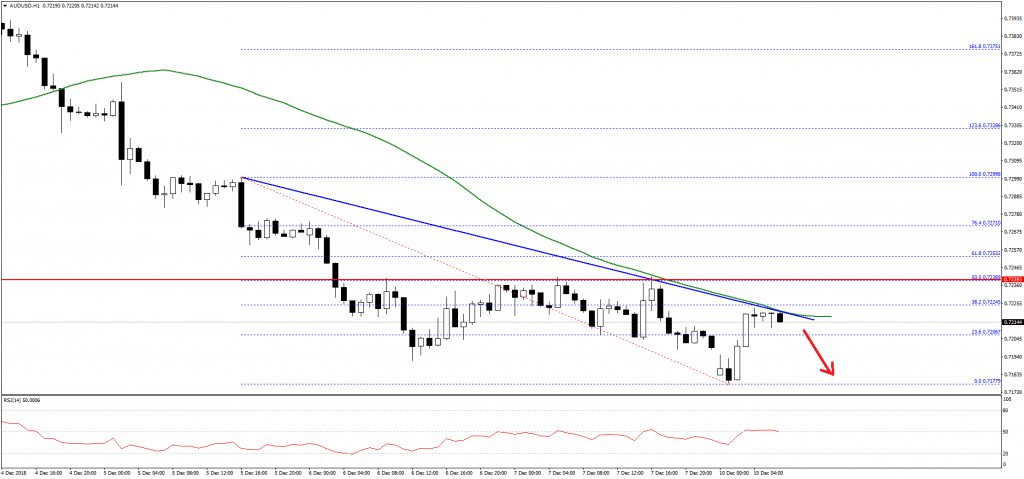

The Aussie dollar declined recently and broke the 0.7320 and 0.7300 support levels against the US Dollar. The AUD/USD even traded below the 0.7240 support level to move into a short-term bearish zone.

The pair traded close to the 0.7175 level and settled below the 50 hourly simple moving average. Later, the pair corrected higher above the 0.7200 level and the 23.6% Fib retracement level of the recent decline from the 0.7299 high to 0.7177 low.

However, the pair is currently facing a major resistance near 0.7220, 38.2% Fib retracement level of the recent decline, and a bearish trend line on the hourly chart. Therefore, the pair is likely to resume its decline below 0.7180 and 0.7170 in the near term.

On the other hand, a break above the 0.7220 and 0.7240 resistance levels is needed for a trend change.