At 24,329 Price Of DJIA At 44 % Discount To Value Of 43,533

Summary

- Re-balancing is slowing the price rise of DJIA while simultaneously boosting the bond market and the value of the DJIA.

- Despite this the DJIA price should continue to rise and accelerate with the seasonal Santa Claus rally.

- Flattening of the yield curve is more from falling long rates so it should not be interpreted as the portend of a recession.

- Selling equities and buying bonds still seen as abject madness.

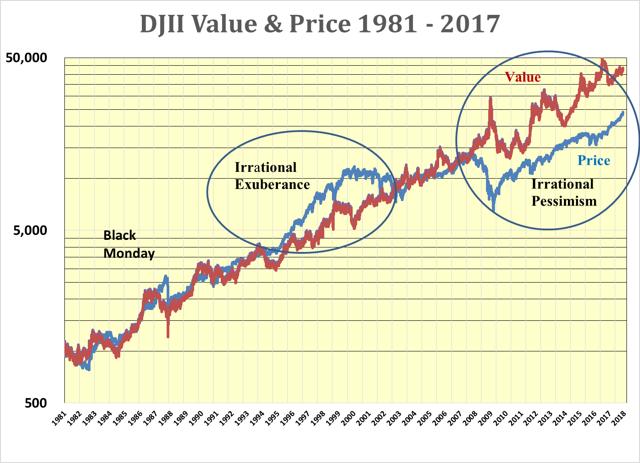

Since the early 1970s the price of the DJIA has declined by a whopping 50% in response to exogenous variables only twice when the value of the DJIA was in line with its price first 1973 and then in 2008.

Both declines were caused by events that had been a long time fermenting. The first was OPEC 1 and the second the Community Reinvestment Act.

The CRA was started by President Carter, expanded by President Clinton and Mr. Obama when he was a community organizer and was compounded by Barney Frank and Christopher Dodd. The chickens came home to roost with Freddie and Fannie collapsing during the Obama Administration with the help of ACORN whose tutor had been Barrack Obama. This took place despite all the efforts of President G.W. Bush to get to grips with the shenanigans at Freddie and Fannie.

The excellent performance of equities this year has made them victims of their own success in so far as many pension portfolios among others are being re-balanced ahead of the year end. Whether by design, through trust indentures, or by desire, as seems to be the case with CALPERS’ announced intention to consider moving from a 50% equity weighting to 34%, the result is to push longer rates down.

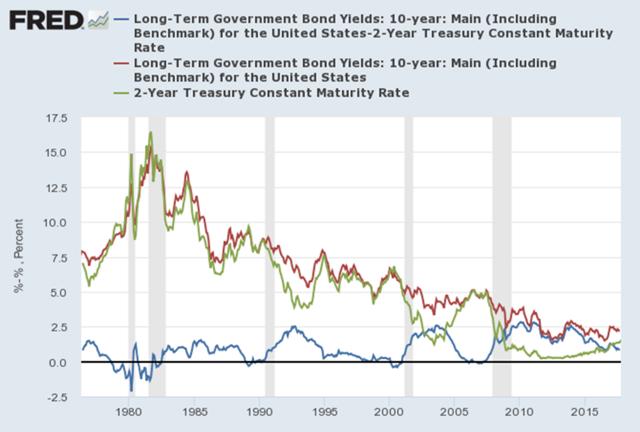

The shift from equities into the highest-duration Treasuries is flattening the yield curve by forcing down the yields on long bonds. This, in conjunction with a continuing rise in dividends, are pushing up the dividend discount value of the DJIA to 43,533 which is spurring on the continuing price rise.

So where does Santa fit in?

This continuing virtuous upward spiral should enhance the seasonal Santa Claus rally which is usually the result of:

- an end of any tax-loss selling;

- the passing of a major tax-payment date on December 15 making the U.S. Treasury flush with cash and out of the market through year end;

- the payment of many annual and semi-annual bond coupons and equity dividends;

- the reluctance of many portfolio managers to disrupt their portfolios ahead of year end;

- very thin trading over the holiday period.

The flattening yield curve is much more the result of falling long rates rather than the Fed pushing up short rates. While a flattening or an inverted yield curve has in the past often been considered a portend of a recession, more so, it must be stressed, than the reality of one. The flattening has usually come about as a result of continuing increases in the Fed funds rate and not declining long rates, which is the case this time.

As the last thing the Fed wants is to cause a recession anytime soon the Fed will probably continue to act cautiously. This should keep long rates low for longer well into the New Year as more rebalancing takes place even though I still consider buying bonds and selling equities to be the abject madness that I did in June 2016.

Interest rates and dividends are the key to market value

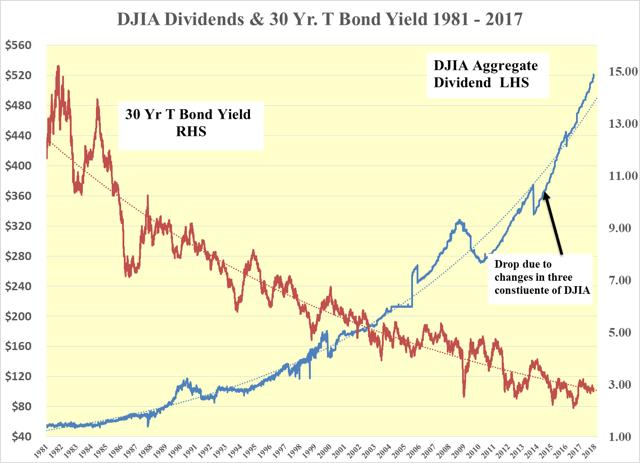

The two main vectors of the dividend discount model are the yield of the 30 year U.S. Treasury bond and the dividend of the DJIA. The former should remain low for longer while the latter should continue to rise from its record level of $522.01.

Comparing the price of the DJIA with its dividend discount value the following chart shows that, until Lehman and then subsequently, the PRICE of the DJIA has not fallen significantly when its VALUE has been at a premium to its price.

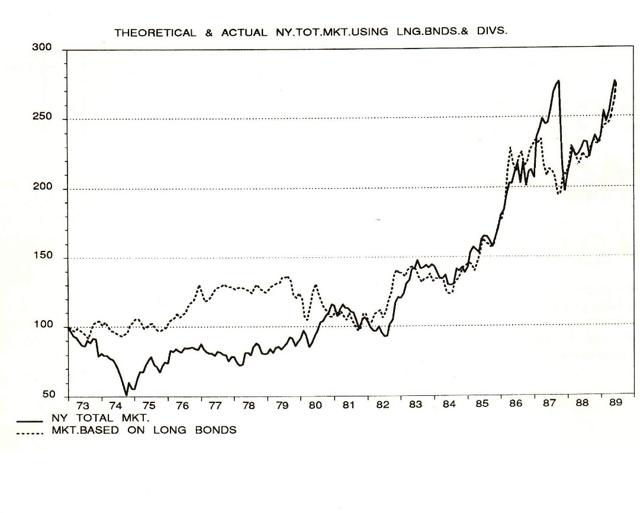

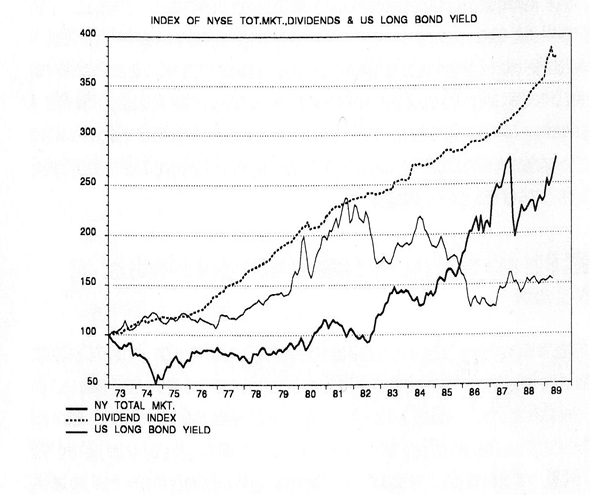

The next chart is from an article that I published on June 6, 1989. It shows how the price and the dividend discount value of the total New York market fared from 1973 through 1989. Again the price of the market fell below its value following OPEC 1 and remained there for the rest of the decade. It is surmised that the shock of the 1974 crash and the losses incurred, instilled a great deal of fear in the minds of market participants. This appears very similar what has happened to the DJIA price and value post Lehman.

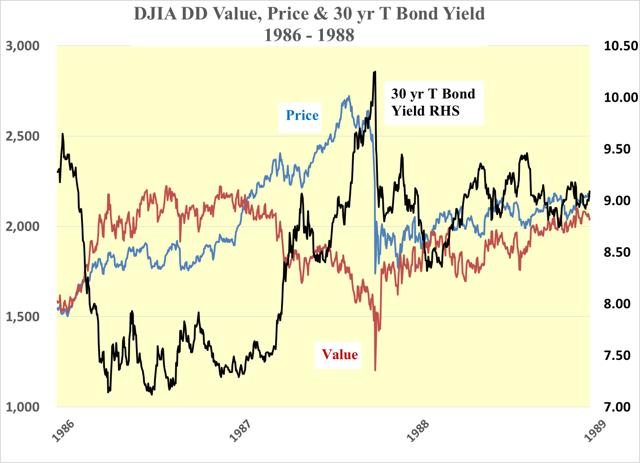

This together with rising inflation causing the doubling of the long bond yield kept the price below its value despite the doubling of dividends over the period between 1973 and 1981. Equilibrium was finally achieved in early 1981 and remained so until the latter part of the 1990's. The crash of 1987 came about as result of the dividend discount value falling well below its price as long rates rose.

The problem was not “Black Monday” but the summer of 1987 when the price charged upwards and over the cliff rather like a scene from the Looney Tunes and Merrie Melodies series of cartoons about Road Runner and Wile E. Coyote.

Driven by falling interest rates in the first part of 1986, Road Runner charged up the red value hill in the chart below. Wile E Coyote chased Road Runner up the blue price glide path. As interest rates started to rise from the 7.25% low of 1986 to the 10.25% high of 1987, Road Runner become cautious and followed the red value line down.

Like the majority of market participants, who have an amazing propensity for projecting the most recent trend ad infinitum, Wile E Coyote charged upward with abandon into the wild blue yonder. Only then did he realize that he was running on thin air. The inevitable happened on “Black Monday”.

The bailout for both the DJIA and Wile E. Coyote was the quick action by Fed and a broad flight to safety with the consequent sharp reduction of the 30 year T Bond Yield.

The same fear that held the market back in the 1970's would appear to be present today. Back then it took eight years for value and price to reach equilibrium. Today it has been ten years so far since the two have been in equilibrium. However, the gap appears to have started to close over the past two years with a 50% rise in the DJIA price since early 2016. This can be seen in the following logarithmic chart with the price moving up relative to the exponential trend line.

The pressure on price is up and the more re-balancing that takes place, the more balanced portfolio managers sell equities, the more the yield curve flattens and the greater the pundits will cry “wolf” about the coming recession.

In turn the fear of a recession provides justification for even more re-balancing, forcing the yield curve to further flatten and push the 30 year T bond yield ever lower, which pushes up the dividend discount value of the DJIA and it pulls up the price which in turn leads to even more re-balancing in an ever virtuous upward spiral of the DJIA value and price.

It is now thirty years since I first started to use the dividend discount model to determine the value of the DJIA and compare that against its price. Apart from the financial meltdown the work has morphed into an extremely useful guide to assist true long term investor in equities.

Continue to BUY the DJIA and take no prisoners.

I wrote this article myself. I do not hold any positions in the securities mentioned in this article and do do intend to take any positions in the next 72 hours.

Dear Readers,

This was published at 2.38 pm this afternoon. It is now 6.05 pm and no one has commented one way or another on the contents. I am looking for positive and negative criticism. Surely some one out there has questions.

Since May 5 2014 I have published 29 articles and had only 4 comments, which is most disheartening. TalkMarkets should be a sounding board for the exchange of ideas but this seems to me to be just a one way street of good research which I have made available free to all. It would be nice to here from you in return.

Should you think that my efforts are just BS then let me know but I would like to hear supporting arguments if that is your opinion.

Kind regards