Apple Inc. Never Fails To Impress; Analysts Cheer

Apple Inc. (NASDAQ: AAPL) released another record-breaking earnings report. The hegemonic technology company posted record second quarter results on April 27, beating all estimates. Despite inevitable sequential declines due to last quarter’s release of the iPhone 6/6 Plus, Apple posted year-over-year increases in nearly all other metrics.

Analysts estimated that Apple would post revenue of $56 billion, but the tech giant posted revenue of $58 billion, marking a 26% year-over-year increase. Despite the strong U.S. dollar, 69% of the quarterly revenue came from international sales. Revenue from China, Hong Kong, and Taiwan increased 71% from the same quarter last year, which many analysts attribute to the Lunar New Year. Apple said that had it not been for the strong U.S. dollar, revenue would have increased an additional 6%.

Apple beat the earnings per share estimate of $2.16, posting $2.33 per diluted share, marking a 40% year-over-year increase. As for iPhones, analysts estimated that Apple would sell between 55 million and 60 million iPhones in the quarter. Apple sold over 61 million iPhones in the second quarter, a 40% year-over-year increase. The only Apple product that decreased in sales was the iPad, as many analysts anticipated. iPad sales decreased 23% year-over-year, but Mac sales increased 10% year-over-year. As expected, Apple did not provide any figures on the Apple Watch. The new product just began shipping over the weekend but CEO Tim Cook commented that there are already more than 3,500 apps available for the product.

On the earnings call, Apple CFO Luca Maestri announced that Apple will be increasing its dividend for the third time in fewer than three years. Apple’s dividend will increase from $0.47 per share to $0.52 per share; an 11% increase. In addition, Apple will be increasing its capital return program to $200 billion through March of 2017.

Looking forward, Apple is expecting third quarter revenue to be between $46 billion and $48 billion.

Top analysts were eager to weigh in on Apple following earnings.

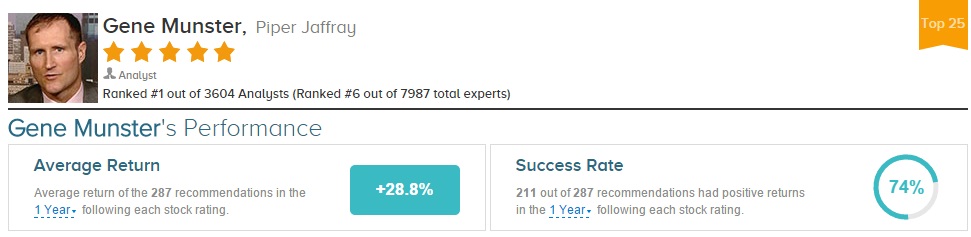

On April 27, analyst Gene Munster of Piper Jaffray maintained an Overweight rating on Apple and increased his price target from $160 to $162 driven by an increase in earnings per share. Munster, who has long been bullish on Apple, commented that “the story is largely unchanged.” The analyst pointed out that the iPhone’s market share increased to 18%, versus 16% a year ago. He added that China brought in record revenue for Apple and he believes “the China growth story will continue, despite recent changes from the Chinese government that added Apple to its do not purchase list.” Though Apple did not provide any figures for the Apple Watch, Munster remains confident that “the Watch will be a hit and account for more than 10% of revenue in 2017, but it will take time for the product to ramp.” He estimates that 8.7 million Apple Watches will be solid in 2015.

Gene Munster has rated Apple 139 times since January 2009, earning an 81% success rate recommending the stock with a +31.8% average return per AAPL rating. Overall, Munster has a 74% success rate recommending stocks with a +28.8% average return per recommendation.

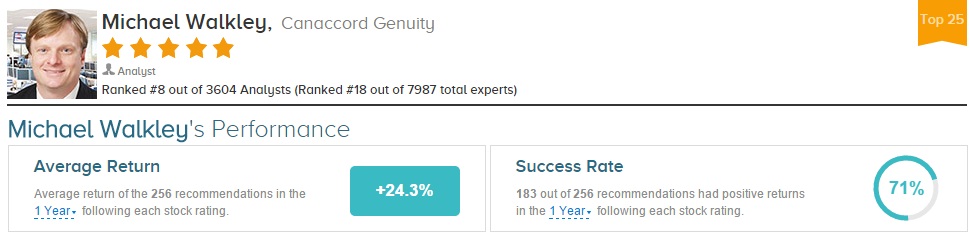

Separately, analyst Michael Walkley of Canaccord Genuity reiterated a Buy rating on Apple following the quarterly report and increased his price target to $155 from $150. Walkley noted Apple’s strong earnings and commented, “iPhone 6 and 6 Plus smartphones are generating very strong replacement sales from existing iPhone consumers.” Walkley continues to anticipate strong iPhone sales due to consumers upgrading or replacing their phones through the end of 2015. In addition, Walkley expects Apple to continue to gain smart phone market share due to “surveys indicating a greater mix of Android smartphone consumers switching to the new iPhones than the iPhone 5 series launches.”

Michael Walkley has rated Apple 73 times since September 2011, earning a 78% success rate recommending the stock with a +31% average return per AAPL rating. Overall, Walkley has a 71% success rate recommending stocks with a +24.3% average return per rating.

Brian White of Cantor Fitzgerald maintained a Buy rating on Apple and raised his price target from $180 to $195. White commented on the strong momentum of the iPhone 6/6 Plus, which he attributes to the large screens and the “growing attraction of Apple’s robust digital ecosystem.” White boldly believes that the Apple Watch will “prove to be the best selling new product in Apple’s history (within first 12 months).” Despite the decrease in iPad sales, White believes Apple’s partnership with IBM will “open up new opportunities for the iPad in the enterprise market” and White ultimately expects Apple to launch a larger iPad.

Brian White has rated Apple 108 times since October 2011, earning an 84% success rate recommending the stock and a +30.6% average return per AAPL rating. Overall, White has a 76% success rate recommending stocks with a +19.7% average return per recommendation.

Disclosure: To see more visit TipRanks today.

more