Analysts Continue To Be Positive On Apple’s International Sales

Analysts weighed in on technology giant Apple (NASDAQ: AAPL) in light of international iPhone sales. In the beginning of April, Cantor Fitzgerald analyst Brian White affirmed that iPhone sales in China were still coming in hot after he took a trip to China in which he observed that Apple stores were "jam-packed" with 1 to 2 hour long lines despite increased competition from local smartphone brands.

Canaccord Genuity analyst Michael Walkley went further to say that Apple is currently the clear leader in the high-end global smart phone market and is continuing to grow. On May 11, Walkley reiterated a Buy rating with a price target increase to $160 stating, "We believe these trends should grow the iPhone installed base to over 500M users exiting C2015, and this bodes well for future strong iPhone replacement sales, earnings, as well as cash flow generation to fund strong long-term capital returns programs similar to the $200B program announced on April 27th."

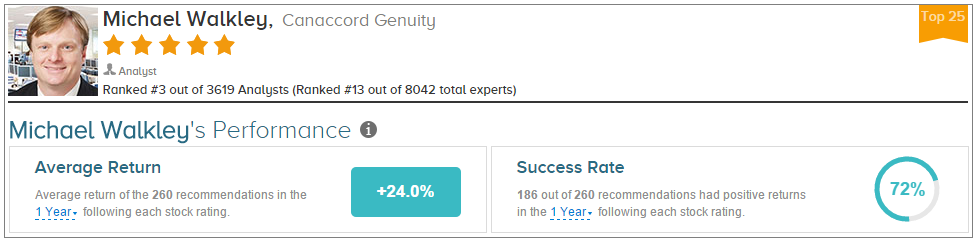

Michael Walkley has rated Apple 75 times since September 2010, earning a 77% success rate recommending the company and a +30.1% average return per AAPL recommendation. Overall, the analyst has a 72% success rate recommending stocks and a +24.0% average return per recommendation.

Separately on May 11, UBS analyst Steven Milunovich maintained a Buy rating on Apple with a price target of $150. The analyst focused more on sales of the Apple Watch, cutting his 2016 estimate from 40 million units to 31 million units. Despite this, Milunovich believes the Apple Watch could eventually become a "must-have" product such as the iPhone.

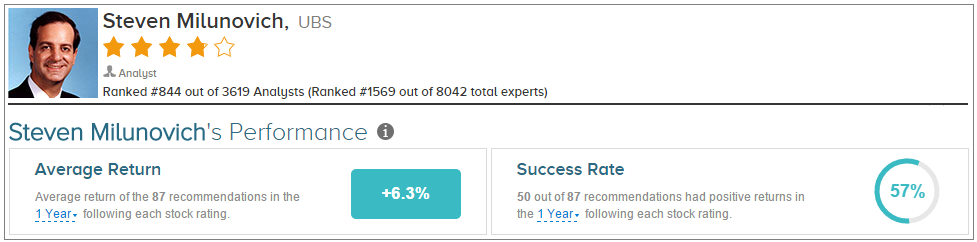

Steven Milunovich has rated Apple 55 times since July 2012, earning a 67% success rate recommending the company and a +13.4% average return per Apple recommendation. Overall, he has a 57% success rate recommending stocks and a +6.3% average return per recommendation.

Apple released its second quarter 2015 earnings results on April 27. The company’s profit increased 40% from the same quarter a year prior at $2.33 earnings per share. Apple’s revenue also increased 26% year-over-year for a total of $58 billion.

On average, the top analyst consensus for Apple on TipRanks is Moderate Buy.

Disclosure:None.