AMD Stock - 2016 Stock Forecast

Overview of The Semiconductor Sector

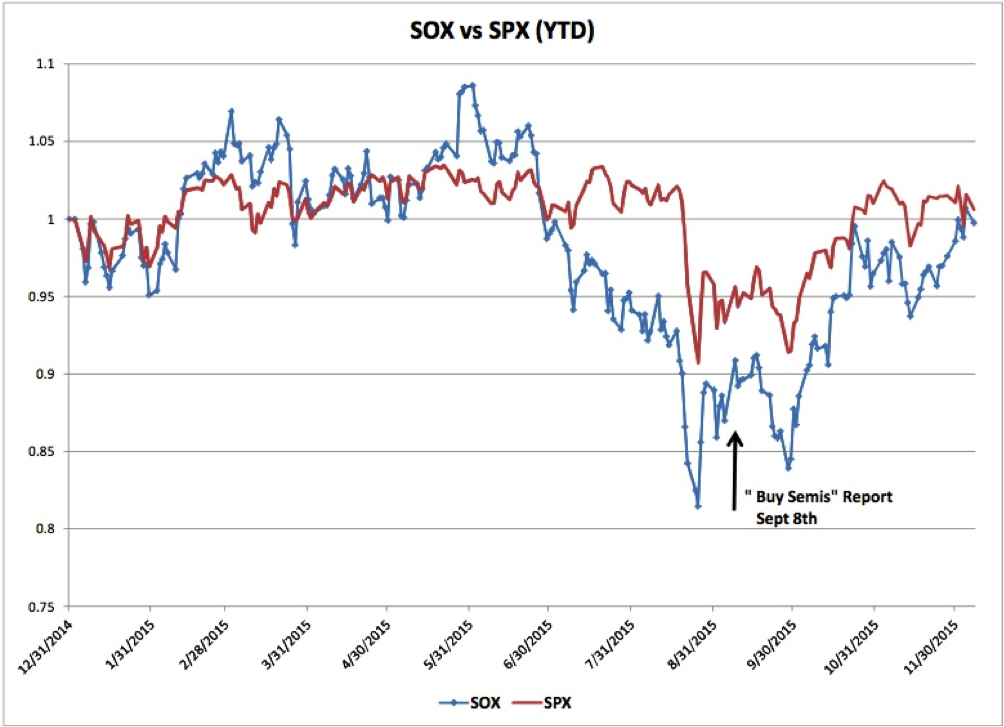

2015 semiconductor revenues came in relatively flat Y/Y and the SOX semiconductor index was flat in 2015 as well (versus +28% return in 2014). Looking ahead, we expect the semiconductor industry to return to growth and expect the SOX to outperform the broader markets with average upside within our coverage universe of 10-15%. The industry is pulling out of a mild cyclical downturn, characterized by value chain inventories normalizing with demand trends, and the next phase should be semi companies shipping to consumption/seasonal trends and a growth outlook for 2016, in line with our view for an increase in global GDP next year. Semi stocks have started to positively discount an improved fundamental dynamic (similar to prior cycles), and we see further upside driven by continued diversification and operating and free cash flow margin expansion.

If we look at the graph presented below, taken from Bloomberg we can see how the SOX index performed vs. the S&P in 2015. We notice on the graph that Bloomberg also released a buy recommendation for the index in the beginning of September. This recommendation was a long-term buy of the index inviting investors to hold on to the index through 2016.

Source: Bloomberg

The “Gemini”: Most Advanced GPU

Although AMD faces stiff competition in their market from heavyweights such as Intel Corporation, they operate in a niche for graphic chips, where they boast a very good reputation. AMD is known globally for the production of their GPUs (Graphics Processing Units), and CPUs (Central Processing Units). For the upcoming year we see potential upside on the GPU side; over the last year, AMD’s “Radeon” (GPU) chips have been a game changer for the company, constantly being improved and updated with new features, they were a success and definitely helped boost the company’s profits.

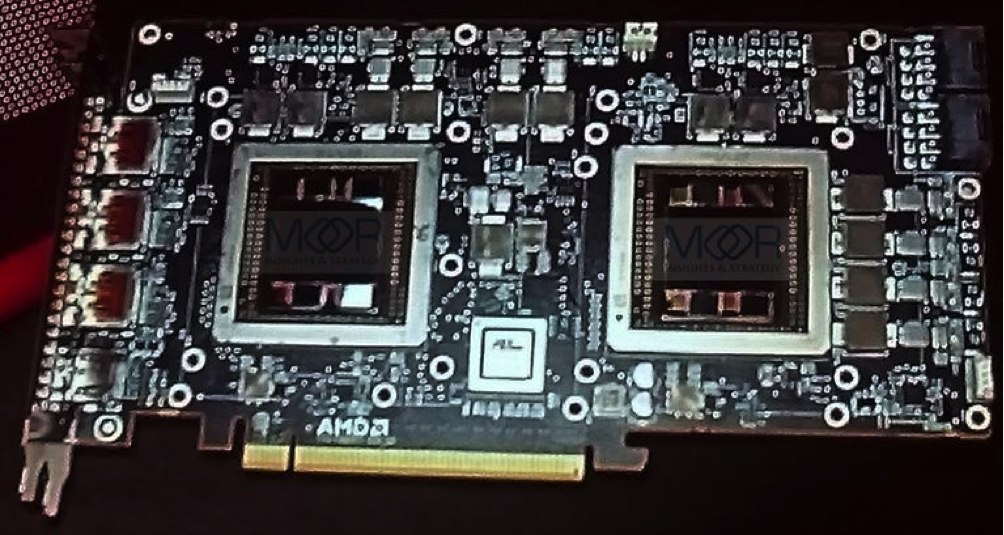

This year AMD announced the latest and most advanced GPU chip yet, known as the “Gemini”. The Gemini is focused on Virtual and Augmented Realities, the biggest revolution yet. AMD’s GPU chips have always been focused on the gaming industry, and they were always updated with the latest technologies. With the market for Augmented and Virtual realities booming at the moment, this chip could potentially change the company’s history as no others are in production of similar products yet.

Being the first to release this new technology on the market boasts endless opportunities. We know that the biggest tech giants on the market are betting heavily on Augmented and Virtual Realities, companies such as Google (Alphabet) with “Google Glass” and “Google Cardboard”, Microsoft Corporation with “Holo Lens”, Facebook with “Oculus Rift”, and many others including Sony with “Project Morpheus”, already one of AMD’s biggest clients through the PlayStation 4. AMD’s Gemini will receive strong demand if the project goes through and the release of the chip satisfies the needs of these companies.

Below we can see and image of one of the first samples of the “Gemini”, sent to India for testing

Source: Google Images

Investment Thesis

AMD has benefited from strong demand for next generation gaming consoles (PlayStation 4 and XBOX One). We expect the demand to be stable for the upcoming year. In addition, AMD appears to be benefiting from the ongoing corporate PC refresh cycle as the company is linked to the corporate PC business. The company has seen a stable demand for its GPU chips over 2015, largely due to a glut of used graphic cards in the market. We believe the demand will significantly increase in 2016 with the release of the “Gemini” chip, as it boasts a completely new and innovative technology. We believe AMD’s cost cutting efforts have also helped the company and are starting prove fruitful. We maintain an Overweight view of AMD’s stock coming into 2016.

Valuation

AMD’s stock is relatively inexpensive when compared to the other Semiconductor giants in the industry. The stock trades at 0.4x 2K16 expected sales, the low end of it’s historical range, 0.3x-0.4x. We believe there is upside due to the fact that the stock is trading at historical lows, and with the help of it’s new product and increasingly high sales the stock could jump.

Risks

AMD typically derives over 50% of its revenue from the core PC end market, which is highly correlated with macroeconomic conditions. If the PC end market is weaker/stronger than expected, this could lead to a decrease/increase in microprocessor and GPU shipments, which could result in a downward/upward revision of our revenue and EPS estimates for AMD.

AMD competes with Intel and NVIDIA in the microprocessor and graphics markets, respectively. Therefore, any material share gains/losses could result in upside/ downside to our revenue and EPS estimates, which could cause us to reassess our Overweight rating on AMD.

Forecast

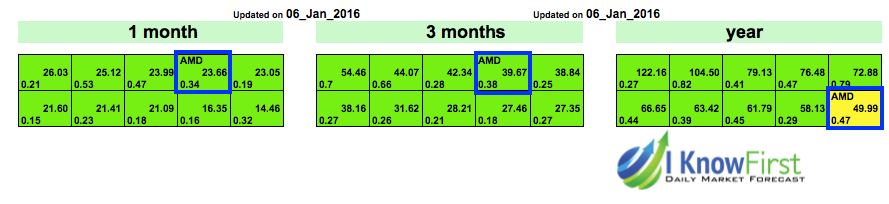

We released a bullish forecast on Advanced Micro Devices. The one-month, three-month and one-year forecast for AMD is shown below. We can see that over the three-time horizons, predictabilities and signals are high. On the 1-year period, AMD has a signal of 49.99 and high predictability of 0.47.

I Know First has proven itself to be accurate on AMD predictions. Indeed, I Know First wrote a Talk Markets Article about Advanced Micro Devices on July 28th, 2015. The article argued that the company’s stock was Bullish in the long term even though they experienced turbulent times recently losing much of its market share to rivals Intel (INTC) amongst challenging times in the PC market. Since that time, the stock price has increased 43%.

Conclusion

We expect the SOX index to rise in 2016 therefore; we expect a good year for the semiconductor industry and its companies in general. We believe AMD is well placed to grow extensively in 2016 thanks to it’s new “Gemini” chip, on top of the cost-cutting efforts it has produced over 2015. Our algorithmic forecast for AMD is a bullish one, and due to the latter combined with the analysis provided above, I Know First maintains an overweight view for AMD.

Disclosure: I Know First is a financial services firm that utilizes an advanced ...

more