All About The Buck

The primary goal of my oftentimes meandering morning market missive is to attempt to identify the key drivers of the stock market on a daily basis. The idea is to try and stay in tune with what “is” actually happening in the market and to avoid the trap of thinking about what “should” be happening. Trust me when I say that setting the ego aside and identifying what the actual drivers of the action is can be easier said than done!

Once you make the decision to leave your personal view of the world out of the equation, one of the tricks to achieving my daily goal is to recognize that the drivers of the markets often differ given the time frame being evaluated. For example, what is driving the market in the near-term (i.e. what traders and their computers are focused on today) may be completely different from the drivers of the action from a long-term perspective – such as the fundamental picture.

As such, let me start this morning’s missive by stating that we are focused on the near-term outlook here, which I define as a few days to a couple weeks.

Watching the Greenback

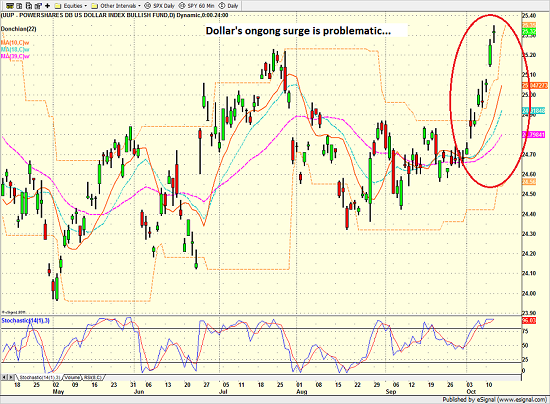

With the caveats out of the way, from my perch, there can be little argument that key driver to the stock right now is the recent surge in the U.S. dollar.

Powershares US Dollar ETF (UUP) – Daily

View Larger Image

While the daily correlation to the S&P 500 is not perfect on a minute-by-minute basis at this time, I can say that the intraday spikes in the stock market do appear to have been driven by the action in the dollar. It’s as if somebody somewhere suddenly looks at a screen and say, “Geez, look at the darn dollar!”

Cutting to the chase, I see four basic reasons for the dollar’s recent strength:

- Fed Expectations

- BREXIT

- China

- Europe

Changing Expectations

While it may sound silly, the increasing odds of the Fed hiking their target for the Fed Funds Rate by 0.25% in December is a primary factor here. The key is to recognize that there is a boatload of capital tied up in all kinds of fancy carry-type trades that are tied to various currencies around the world. And as long as the currency used in the trade is stable or heading in the right direction, everything is hunky dory.

However, if the currency you are carrying a trade with (e.g. borrowing in) starts to go the wrong direction, bad stuff starts to happen to the profitability of these trades, which tend to be very highly leveraged. Thus, when one of these trades starts to go bad, traders tend to sell the easiest, most liquid thing they own – the S&P 500.

In this case, the market has had to change its expectations about the Fed raising rates in December based on the recent economic data and all the talk coming from various members of the FOMC. And from a simplistic standpoint, if rates are expected to go up, your currency will follow suit.

The Race to Zero

In addition to traders being forced to adjust their expectations (and their prevailing trading positions) to the likelihood of the rates rising in December, there is also the reality that other major currencies are busy going down – which, in turn, causes the dollar to rise.

So, looking around the world at other currencies, we see the British Pound (aka the “loony”) diving on worries over the impact of the BREXIT, the Chinese yuan falling in response to weaker than expected economic data, and the Euro declining due to, well, all kinds of reasons – not the least of which is the trouble with the German banks.

Sure, some will argue that the tail could be wagging the dog here. However, the bottom line is that the rising dollar is causing all kinds of correlation trades to occur – including the selling in the stock market.

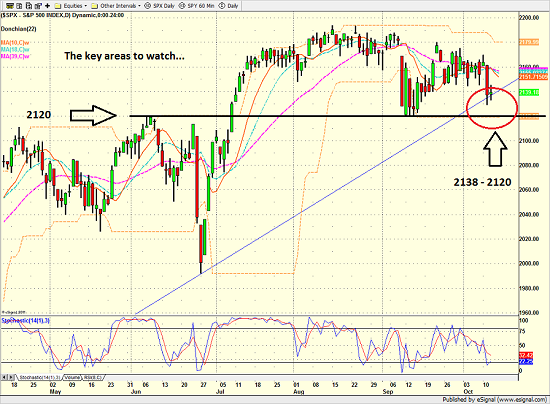

Speaking of stocks, the S&P is currently sitting at a fairly precarious position. Below is my quick and dirty take on the key lines in the sand for technical traders that you may need to be aware of.

S&P 500 – Daily

View Larger Image