All About Deutsche

On this final trading day of the third quarter, the focus has shifted entirely to state of Germany’s biggest banks, namely Commerzbank and Deutsche Bank. While the soundness of the European banking system has been an issue on and off since the credit crisis ended in 2009, specific concerns about a couple of Deutschland’s biggest names are giving traders around the globe a reason to take a step back at this time.

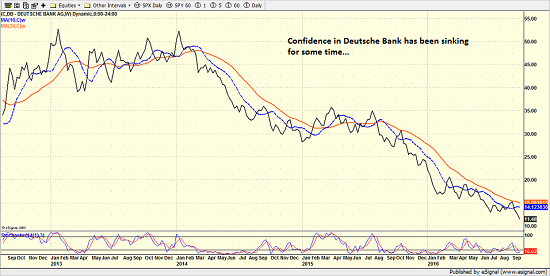

To be sure, Deutsche Bank (NYSE: DB) is not having a good year as the company’s stock is down more than 52% year-to-date as of Thursday’s close. However, the decline has become especially steep since during the month of September with DB off by 24.7% since September 9.

There appears to be a handful of reasons for the recent dance to the downside. First, the U.S. Justice Department issued a fine of $14 Billion for the bank’s role in the mortgage crisis, which was roughly triple what Deutsche officials had set aside. As you might suspect, this has called the bank’s liquidity into question.

Next came the comment from Angela Merkel, who apparently is just saying “Nein!” to the idea of a government bailout of Deutsche during an election year.

Finally, there was word this week that 10 hedge funds have decided to pull their cash out of Deutsche Bank. Yes, it is true that Deutsche does business with nearly 200 hedge funds. However, we all know how this game works. If a few players start to express concerns about the safety of their money in a bank, it become like a bat signal to the hedgie community. And the assumption is that the withdrawals will likely swell.

Lest we forget, Deutsche actually failed the Federal Reserve’s so-called “stress test” of the biggest banks this year. This suggests that in a crisis, Deutsche isn’t likely to have the capital needed to survive. And then in June, the IMF said that Deutsche Bank, “appears to be the most important net contributor to systemic risks in the global banking system.” Super.

Deutsche Bank (NYSE: DB) – Weekly

Why should we care, you ask? In short, banking is all about confidence. And a crisis of confidence appears to be developing at one of the world’s biggest banks. The bank’s capital levels are being called into question. Survival is suddenly an issue. And as such, the comparisons to Bear Sterns, Lehmann Brothers, and the potential for contagion is front and center here.

The bottom line is that traders have learned it only takes the failure of one big bank to trigger a financial crisis. So, the action in Deutsche Bank is currently the focal point of the market.

The Good News

Before you run out and start loading up on those leveraged, inverse ETFs and selling everything in your portfolio, we should keep in mind that the insanity of 2008 had more to do with derivative securities that the banks owned (and then couldn’t sell) than the failure of a single brokerage firm. Remember, it was the “mark to market” accounting rule that was one of the key problems. And once that rule was changed, the crisis came to a screeching halt.

So, the good news is that the global banking system in general and the U.S. banking system in particular is in much, MUCH better shape than it was in 2008. Therefore, even if Angela continues to refuse to help Deutsche and/or Commerzbank, and even if these banks can’t find a white knight partner, it is my humble opinion that the situation isn’t likely to become a replay of 2008.

Sure, banks could get hit across the board if DB goes belly up. And yes, this could easily trigger a meaningful correction in the overall stock market.

However, since the global banking system is in much better shape today than it was then, I’m of the mind that the chances of another global market debacle appear to be slim at this time. As such, investors may want to be at the ready to “buy the dip” again if things start to get nasty.