Akcea, A Wholly Owned Subsidiary Of Ionis Pharmaceutical, Set To IPO

Overview

Akcea Therapeutics Inc. (Nasdaq: AKCA) filed an S-1/A with the Securities and Exchange Commission for its upcoming initial public offering. The company intends to sell 9,620,000 shares of its stock at a marketed price range of $12 to $14. It has an additional 1,443,000 shares over-allotted as an option for its underwriters.

Company insiders are planning to purchase $25M worth of shares at the IPO price. Assuming the company prices at the mid-point of its price range it would have a fully diluted market cap of $657.3M.

Underwriters for the deal include: Cowen, Stifel, Wells Fargo Securities, and BMO Capital Markets.

The company is expected to IPO on Friday, June 30, 2017.

We first covered the deal on our IPO Insights Platform.

Business overview

Akcea Therapeutics is a biopharmaceutical company that is in the late clinical stages of developing drugs to treat metabolic diseases caused by lipid tissue disorders. The company founded operations in 2015 as a wholly owned subsidiary of Ionis Pharmaceuticals (IONS); its purpose was to develop and commercialize Ionis' drugs to treat lipid disorders. To date Ionis has funded expenses of Akcea and is expected to remain a principal stockholder after the IPO.

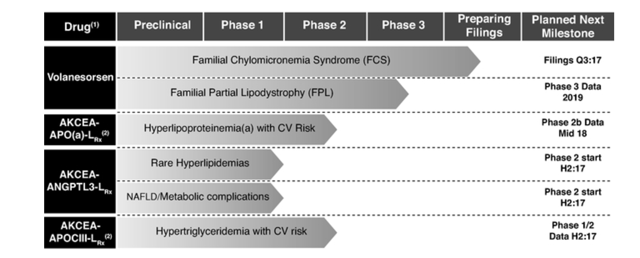

Akcea is developing four new drugs that are based on antisense technology. Its most advanced drug has completed a phase three clinical trial for treating familial chylomicronemia syndrome, or FCS, and it is beginning a phase three clinical trial for treating familial partial lipodystrophy, or FPL. Both diseases are rare genetic disorders that cause very high levels of triglycerides.

The company has a strategic partnership with Novartis Pharmaceuticals (NVS) to commercialize its drugs and received a payment of $75 million from the company upfront. Novartis paid $15 million to Ionis for its sublicensing fee. If Novartis exercises its right to commercialize the drugs, it will pay Akcea a $150 million licensing fee for each drug that it licenses and sells.

(S-1/A)

Executive management team overview

Paula Soteropoulos joined Akcea as its chief executive officer, president and a member of the board of directors in Jan. 2015. Previously, she served as a member of the executive team of Modernan Therapeutics Inc., as the general manager of its cardiometabolic business unit, and as a senior vice president of strategic alliances from July 2013 to Dec. 2014. Additionally, Soteropoulos has 21 years of experience working at Genzyme Corporation in a variety of leadership roles.

Jeffrey M. Goldberg joined Akcea as the chief operating officer in Jan. 2015. Previously, he served as a member of the executive team at Proteostasis Therapeutics Inc. (NYSE:PTI) as well as its vice president of business operations. Goldberg also spent eleven years in different positions at Genzyme and Sanofi S.A. (NYSE:SNY).

Financial highlights and risks

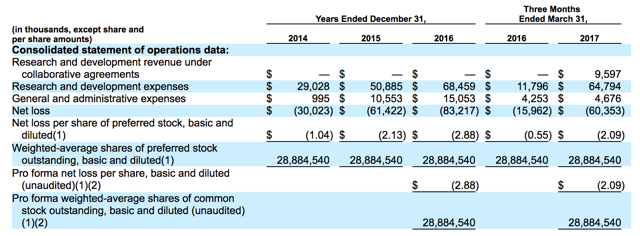

Currently all of its product candidates are pre-commercial sale. As noted previously in January 2017, Akcea initiated a strategic collaboration with Novartis and received $9.6 million in revenue during the first quarter of 2017.

Net losses were $30.0 million, $61.4 million and $83.2 million for the years ended December 31, 2014, 2015 and 2016, respectively, and $16.0 million and $60.4 million for the three months ended March 31, 2016 and 2017, respectively. The significant jump up in net losses during the most recent quarter was the result of a $48.4 million sublicensing expenses related to its collaboration with Novartis.

(S-1/A)

To date, the company has funded operations through a $100.0 million cash contribution from Ionis, $75.0 million from initiating its collaboration with Novartis, and $106.0 million from drawdowns under a line of credit with Ionis. As of its IPO, AKCO has cash and cash equivalents of $124.5 million and an accumulated deficit of $235.0 million.

The company intends to use its proceeds from its IPO and private placement primarily for research and development, as well as for the completion of its clinical phases; the remainder will be for the company's expenses.

Conclusion: Consider A Modest Investment

Akcea products have generated significant interest, and a strategic partnership with Novartis bodes well for its continued growth and development.

Additionally, the fact that company insiders are planning to purchase $25M worth of shares at the IPO shows their confidence and belief in its future success.

Despite the high risk associated with investing in early stage biopharma, we feel Akcea is a good pick for aggressive investors comfortable with risk and looking for exposure to the industry.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in AKCA over the next 72 hours.

Disclaimer: I wrote this article myself, and it ...

more