Additional Signs Of Improvement

Good Monday morning and welcome back. Although the ECB and FOMC Meetings are over and rates have been increased in the U.S., the Fed remains a focal in the markets due to the fact that we have a full calendar of Fed-speak on tap for this week. For example, at 8:00 a.m this morning, Federal Reserve Bank of New York President, William Dudley will speak, with Chicago Fed President Charles Evans scheduled to speak at 7:00 p.m. Then tomorrow, Vice Chairman Stanley Fischer, Boston Fed chief Eric Rosengren, and Dallas Fed President Robert Kaplan will all speak. And Governor Jerome Powell and St. Louis Fed President James Bullard are on the calendar later in the week. The questions that investors want more information on include (a) what the “unwind” plans for the Fed’s balance sheet will look like and (b) if any FOMC members favor additional rate hikes in 2017.

Since it’s the start of a new week, let’s get right to our objective review the key market models and indicators. To review, the primary goal of this weekly exercise is to remove any subjective notions and ensure that we stay in line with what “is” happening in the markets. So, let’s get started…

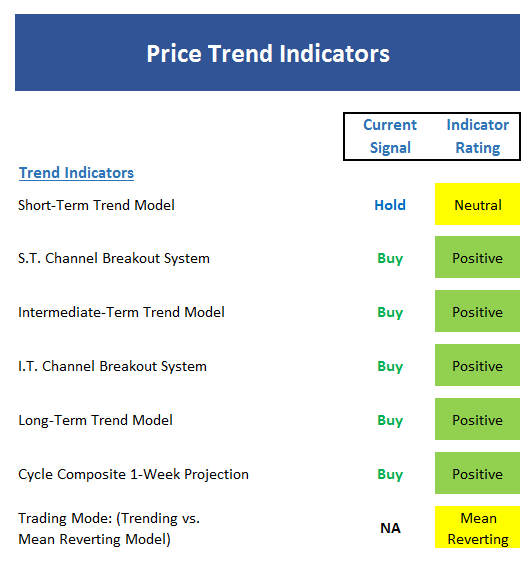

The State of the Trend

We start each week with a look at the “state of the trend.” These indicators are designed to give us a feel for the overall health of the current short- and intermediate-term trend models.

View Trend Indicator Board Online

Executive Summary:

- The short-term Trend Model is now neutral as price is hovering right at the current short-term smoothing, which itself is moving sideways.

- The short-term Channel Breakout System remains positive but a break below 2415 would cause the indicators to issue a sell signal

- The intermediate-term Trend Model remains solidly positive

- The intermediate-term Channel Breakout System is also positive and gives the bulls the edge above 2352.

- The long-term Trend Model is still bullish

- The Cycle Composite is higher this week, lower next, and then points to a summer rally into the middle of July. But from there the cycle composite suggests trouble.

- The Trading Mode models are still mixed but two out of three still call this a mean-reverting environment.

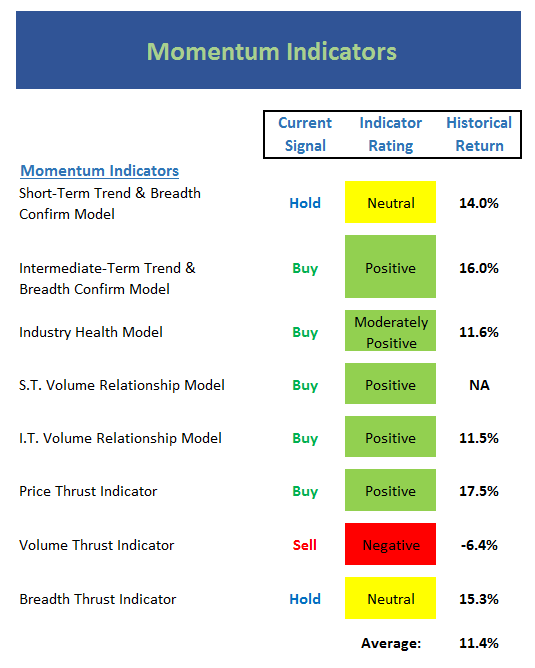

The State of Internal Momentum

Next up are the momentum indicators, which are designed to tell us whether there is any “oomph” behind the current trend…

View Momentum Indicator Board Online

Executive Summary:

- The short-term Trend and Breadth Confirm Model has slipped to neutral, which by itself is not a cause for alarm.

- Our intermediate-term Trend and Breadth Confirm Model remains positive with the all-equity A/D line at new highs. This is a big-picture positive.

- The Industry Health Model continues to improve – albeit ever-so slightly – within the moderately positive zone.

- The short-term Volume Relationship continues on a buy signal and is positive at this time – but only by a small margin.

- The intermediate-term Volume Relationship favors the bulls.

- The Price Thrust Indicator is in pretty good shape.

- The Volume Thrust Indicator has slipped to negative.

- The Breadth Thrust Indicator remains stuck in neutral.

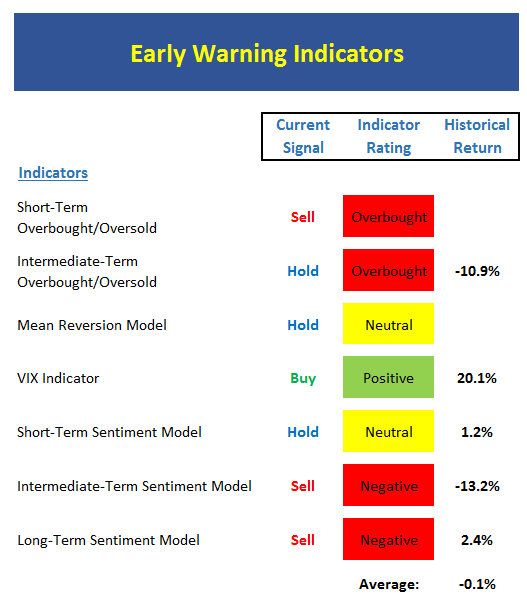

The State of the “Trade”

We also focus each week on the “early warning” board, which is designed to indicate when traders may start to “go the other way” — for a trade.

View Early Warning Indicator Board Online

Executive Summary:

- From a near-term perspective, stocks are coming off an overbought condition, which gives the bears an opening.

- From an intermediate-term view, stocks are also overbought and beginning to reverse. This also suggests the bears have an opportunity in the near-term.

- The Mean Reversion Model remains in neutral.

- The most recent signal from the VIX Indicator was a buy.

- From a short-term perspective, market sentiment is dead neutral.

- The intermediate-term Sentiment Model continues to favor the bears.

- Longer-term Sentiment readings also favor the bear camp at this time.

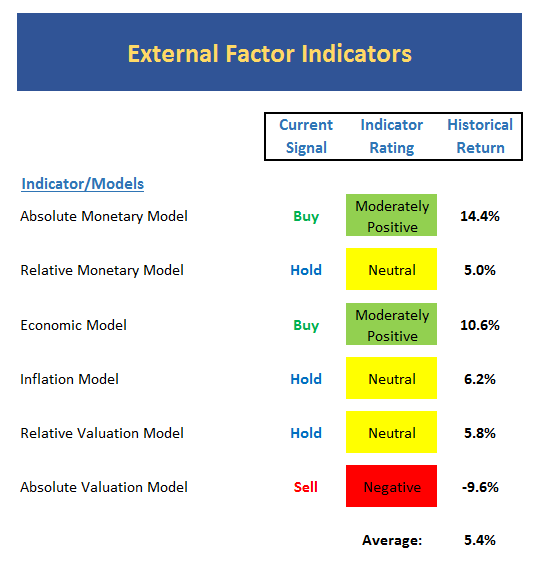

The State of the Macro Picture

Now let’s move on to the market’s “external factors” – the indicators designed to tell us the state of the big-picture market drivers including monetary conditions, the economy, inflation, and valuations.

View External Factors Indicator Board Online

Executive Summary:

- Monetary conditions continue to improve and our Absolute Monetary model has moved back up into positive zone.

- On a relative basis, our Monetary Model remains neutral – but is moving in the right direction.

- Our Economic Model (designed to call the stock market) continues to gain ground and appears to be getting back in sync with the market action.

- The Inflation Model continues to sport a neutral reading, which is a positive from a bigger picture standpoint.

- Our Relative Valuation Model has seen some improvement recently, but remains neutral overall.

- The Absolute Valuation Model has also improved slightly – a step in the right direction.

The State of the Big-Picture Market Models

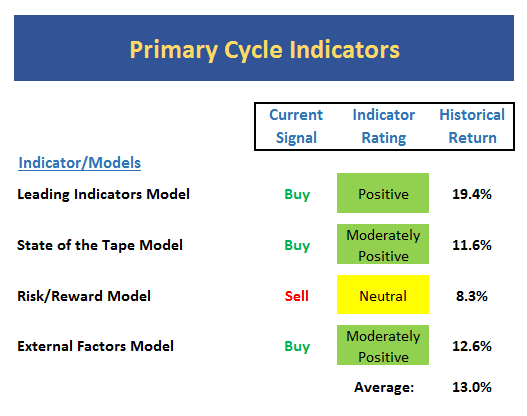

Finally, let’s review our favorite big-picture market models, which are designed to tell us which team is in control of the prevailing major trend.

Executive Summary:

- The Leading Indicators model, was our best performing timing model during the last cycle, moved back to positive last week.

- The Tape continues to muddle along in a moderately positive fashion.

- The Risk/Reward model reading remains neutral but the most recent signal was a sell.

- The External Factors model continues to improve and suggests stock returns will be slightly above their long-term averages.

The Takeaway…

The message from the indicators boards this week continues to be one of an improving environment. While there were several “issues” with the big-picture conditions recently, some of these concerns now appear to be waning – especially in the area of rates and monetary policy. This does not mean however, that the market risk factors are now low. No, my take is that risk factors have come down a smidge and while still elevated, are not quite the concern they were a month ago. However, with the cycle composite calling for a meaningful decline to begin in mid-July, I think it is wise to remain alert at this time.

Disclosure: At the time of publication, Mr. Moenning and/or Sowell Management Services held long positions in the following securities mentioned: none. Note that positions may change at any ...

more