A Review Of Commodities And Currencies - Thursday, Mar. 9

Inflation-sensitive areas of the market were hit hard but then stabilized near the close.

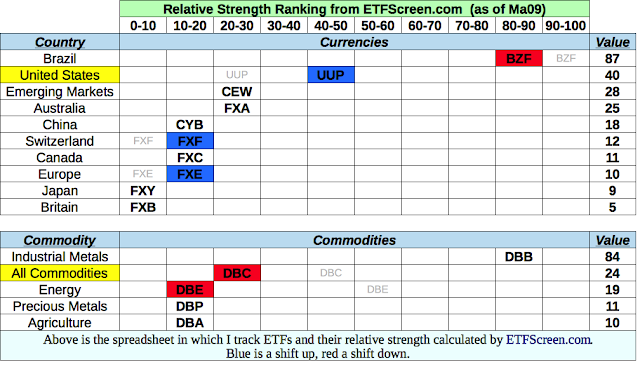

What is this spreadsheet telling us?

The US Dollar is stronger relative to the Emerging Market currencies and the Euro. This means avoid commodities and the commodity-related stocks, and focus investments on US stocks over foreign.

(Click on image to enlarge)

This chart below doesn't look too bad, but with every other inflation-sensitive ETF pointing lower, the chances are that this one is headed lower too.

(Click on image to enlarge)

The Medium-Term Trend

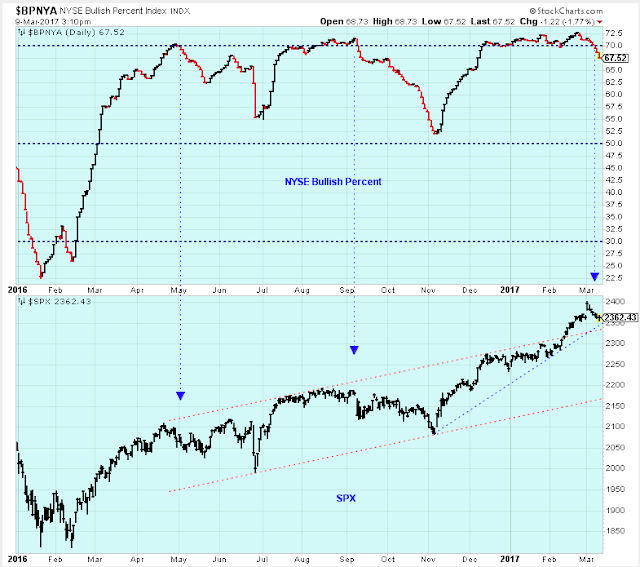

So far the selling isn't too bad. The SPX has pulled back to the trend line giving back the February excess caused by a bit too much stock market optimism.

To be honest, though, I don't really have a good sense of how far down the market will go, or how long the selling will last.

(Click on image to enlarge)

The chart below is an indication that the selling is broad based, although the bullish percents in the three lower panels are still above their February levels.

(Click on image to enlarge)

Sectors

There haven't been any changes in leadership. The XLV looks very strong. I think it does well when the dollar is strong, and maybe it is the only area that offers any value at the moment.

(Click on image to enlarge)

This chart doesn't look bad, but the relative strength is starting to slip.

(Click on image to enlarge)

This group just keeps pressing higher.

(Click on image to enlarge)

Disclaimer: I am not a registered investment advisor. My comments above reflect my view of the market, ...

more