A Choppy, Headline-Driven, Sideways Market

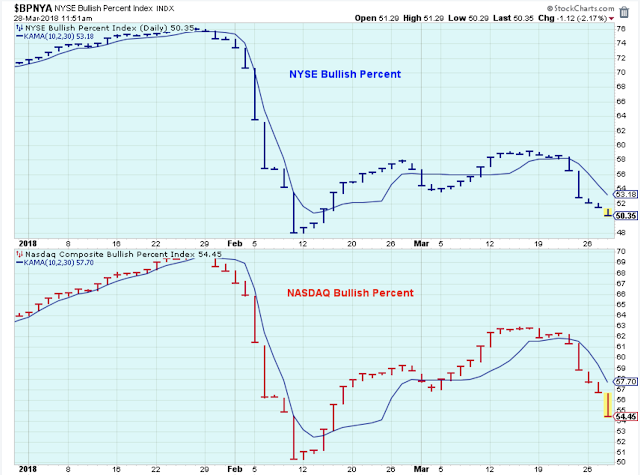

The bullish percents continue to point lower confirming the short-term downtrend.

(Click on image to enlarge)

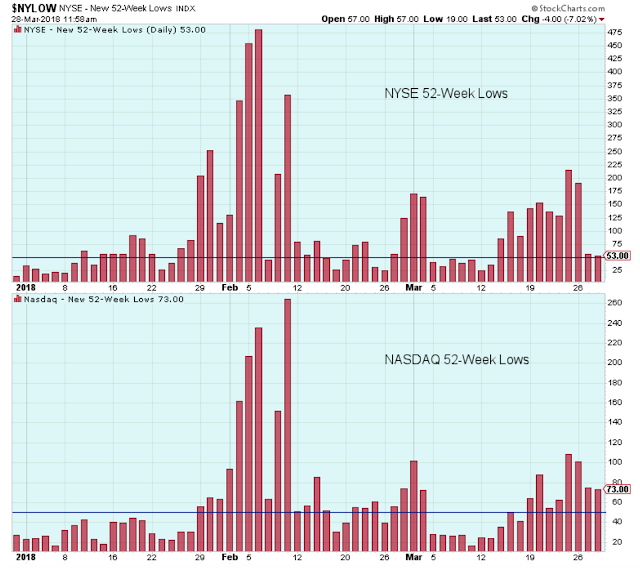

The number of 52-week lows is still a bit elevated which also confirms the short-term downtrend.

(Click on image to enlarge)

Bonds have found support and have started to rally.

(Click on image to enlarge)

The 10Y yield has dipped (prices higher, yields lower).

(Click on image to enlarge)

But the dip isn't enough yet to change the longer-term outlook.

(Click on image to enlarge)

German yields provided advance warning that US yields were likely to dip.

(Click on image to enlarge)

Interesting comments about corrections. This is via "VIX Squared" on Twitter.

(Click on image to enlarge)

Outlook Summary:

I am expecting a choppy, headline-driven, sideways market between now and the November elections. I still plan to buy the dips for short-term gain, but over time I plan to continue to reduce my overall exposure to stocks.

The expected US economic growth rate is back down to the 2% level.

Higher rates are now a headwind for US stocks. The recent tax cut, the 300 billion spending increase, and the already out-of-control federal deficit are a set up for a very dangerous spike in interest rates.

Once again, the problems in Europe related to debt and the banking system are serious issues.

Something else to consider is the Mueller investigation. I worry that the headlines generated by the investigation may rattle the markets more than people are currently anticipating.

Based on market seasonality, Mike Burk is projecting a medium-term stock market peak in May which sounds about right to me.

- The long-term outlook is increasingly cautious.

- The medium-term trend is down.

- The short-term trend is down.

- The medium-term trend for bonds is up.

Outlook from Bob Doll, Nuveen (Bob Doll)

- Stocks are in a sideways holding pattern

- Rising rates and protectionism are headwinds

- Low risk of recession or bear market this year

- White House and mid-term elections present political risks

- 2018 could be mirror image of 2016

Investing Themes:

- Technology

- Banks and Brokers

- Payment Processors

- Gamers

- Defense

- Emerging Markets

Strategy:

My accounts are now about 60% stocks. The remainder is cash and bond funds. New purchases are on hold at least until the short-term trend corrects down to the bottom of its range.

Buy large cap stocks and ETFs on pullbacks of the medium-term trend.

Buy small cap growth stocks on break outs to new highs during short-term up trends.

Stop buying when the short-term trend is at the top of the range.

Take partial profits when the uptrend starts to struggle at the highs.

Never invest based on personal politics.

Disclaimer: I am not a registered investment advisor. My comments above reflect my view of the market, and what I am doing with my accounts. The analysis is not a recommendation to buy, ...

more