5,000-Point Friday – This Nasdaq Bubble Will Never Burst!

Up up and away!

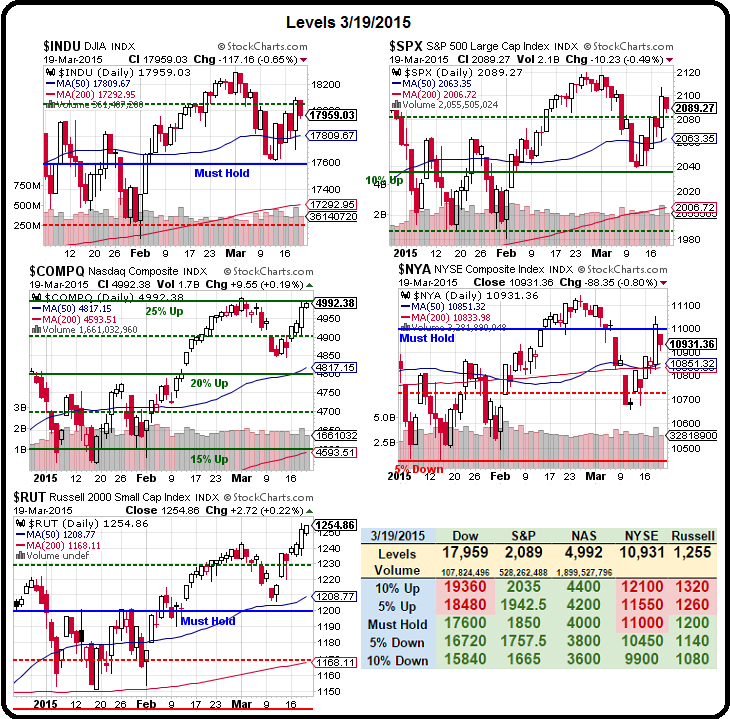

Not only is the Nasdaq popping back over 5,000 today but the Dow is back over 18,000 in the Futures and the Russell is already flying over 1,250 – well past the previous all-time high of 1,243 that was set on the first day of March.

As we've noted earlier in the week, a rising market tide has NOT lifted all ships with 30% of the Dow and 1/4 of the Nasdaq at 52-week LOWS (mostly materials), which is why they had to stuff AAPL into the Dow – so it could at least keep pace with the Nasdaq going forward.

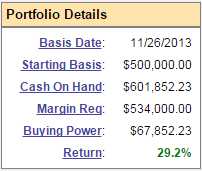

Hey, who are we to complain? This week's rally gave us a nice $4,300 gain on Wednesday's Top Trade Alert and a 5% comeback on our Long-Term Portfolio, which is closing back in on a 30% gain, albeit at the expense of our more bearish Short-Term Portfolio, which has fallen back to up just 77.6% but it's 1/5th the size of the LTP, so GO BULLS – I guess…

Despite our success, I'm not happy with this rally but I wasn't happy in 1999 or 2007 either and that made me miss out on some nice gains so we're keeping our LTP open (though, as you can see, over 50% in cash) so we don't "miss out" on the madness.

And it is madness – there's no connection between valuations and earnings and, as you can see from this chart, the Macro Outlook is deteriorating rapidly, even in the US. In fact – THE FED JUST SAID SO!!! Unfortunately (for us "rational" investors) bad news is still good news to the markets as it only brings wave after wave of MORE FREE MONEY – so much free money that we are drowning in it.

What does "drowning in money" mean? Here's some jokes for you -

- Money doesn't get no respect. Why, there's so much money in the World these days that you've gotta pay the banks to hold it for you!

- There's so much money in the World, that you have to pay interest on the bonds you buy!

- There's so much money in the World that Corporations are using it to buy back THEIR OWN stock!

- No respect, I tell ya'

Oh, ha ha ha, that is so funny! Imagine a World where there was so much money floating around that you had to PAY people to hold it for you? That there is no way for corporations to spend all the money they have so they buy themselves? It sounds ridiculous but that's what's happening right now as the Central Banks print near-infinite amounts of it to paper over a Global Recession.

Even better than no respect, there are NO CONSEQENCES for all this money-printing, are there. Not for the people that matter, anyway, those of us in the top 10% who have access to all that easy money. Sure we're not getting much in the bank but, for the last 6 years, we've had pretty-much guaranteed gains on our stock holdings.

700 points to 2,100 is 1,400 points – a nice 200% gain in 6 years for those of us rich enough to have owned stocks in 2009. I happened to be on TV while the market was collapsing in March of 2009 and we made 13 picks for our Members that returned (since they were leveraged option plays), 496% just 6 months later but we also had some stock picks too (using $1,000 allocation blocks for our $25KP):

- Long FAS: 71 shares of stock at $14 (adjusted = $994), now $126 ($8,946) - up $7,952 (800%)

- Long GE: 142 shares at $7 ($994), now $25.33 ($3,597) – up $2,603 (261%)

- Long BAC: 318 shares at $3.14 ($998), now $15.61 ($4,964) – up $3,966 ($397%)

- Long DIS: 62 shares at $16 ($992), now $107.37 ($6,657) – up $5,565 (560%)

- Long XLF: 166 shares at $6 ($996), now $24.37 ($4,045) – up $3,049 (306%)

- Long AMZN: 16 shares at $62.50 ($1,000), now $373.24 ($5,972) - up $4,972 (497%)

- Long HOV: 1,538 shares at .65 ($1,000), now $3.37 ($5,183) – up $4,183 – (418%)

- Long RKH: 110 shares at $9 ($992), fund closed at $54.67 ($6,013) – up $5,021 (506%)

So there's 8 boring old stock positions that turned $7,966 into $45,377 in 6 years for an average return of 469% – and we're not even including the dividends! This is how wealth is being transferred to the investor class by the Fed and this is why you see the incomes of the top 10% (Us) rising over 120% in the past 6 years while the bottom 90% (Them) LOST 10% of their incomes.

I occasionally TRY to help the bottom 90% but, more and more, I think it's a lost cause so I'm doing my best at the moment to try to help the top 10% not fall below that line – because it really sucks down there and it's getting worse every election. These disparities are very, very real and, if you don't feel it or you don't see it, then you are very lucky and what I don't want you to do is get complacent about it.

That's why we are cautious despite the exuberance that is being shown by the equity markets. We'll do fine with our conservative portfolio and our various hedges but the real money – as you can see, is made when the market sells off and you are fortunate enough to have CASH!!! on the sidelines.

I just want to make sure you stay one of Us, because being one of Them is no fun at all:

Have a great weekend!

- Phil

more