5 Most Undervalued Stocks In The Dow – August 2016

There are a number of great companies in the market today. By using the ModernGraham Valuation Model, I’ve selected the five undervalued Dow Components reviewed by ModernGraham which are suitable for the Defensive Investor or the Enterprising Investor according to the ModernGraham approach.

This is a sample of the types of screens included in ModernGraham Stocks & Screens, which is available for premium subscribers. Defensive Investors are defined as investors who are not able or willing to do substantial research into individual investments, and therefore need to select only the companies that present the least amount of risk. Enterprising Investors, on the other hand, are able to do substantial research and can select companies that present a moderate (though still low) amount of risk. Each company suitable for the Defensive Investor is also suitable for Enterprising Investors.

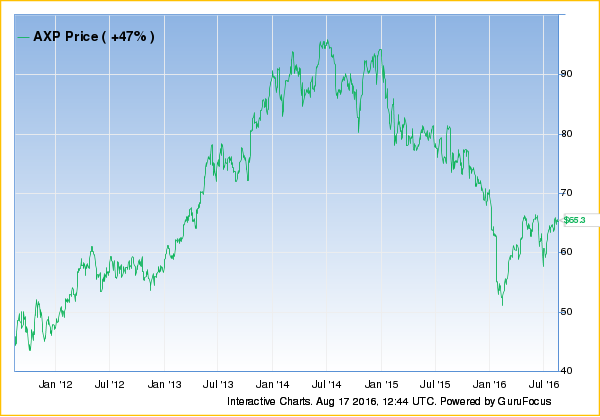

American Express Company (AXP)

American Express Company qualifies for both the Defensive Investor and the Enterprising Investor. In fact, the company meets all of the requirements of both investor types, a rare accomplishment indicative of the company’s strong financial position. The Enterprising Investor has no initial concerns. As a result, all value investors following the ModernGraham approach should feel comfortable proceeding with the analysis.

As for a valuation, the company appears to be Undervalued after growing its EPSmg (normalized earnings) from $3.43 in 2012 to an estimated $5.09 for 2016. This level of demonstrated earnings growth outpaces the market’s implied estimate of 1.95% annual earnings growth over the next 7-10 years. As a result, the ModernGraham valuation model, based on Benjamin Graham’s formula, returns an estimate of intrinsic value above the price.

American Express Company performs fairly well in the ModernGraham grading system, scoring a B. (See the full valuation)

Boeing Co (BA)

Boeing Co is suitable for the Enterprising Investor but not the more conservative Defensive Investor. The Defensive Investor is concerned with the low current ratio, high PB ratio. The Enterprising Investor is only concerned with the low current ratio. As a result, all Enterprising Investors following the ModernGraham approach should feel comfortable proceeding with the analysis.

As for a valuation, the company appears to be Undervalued after growing its EPSmg (normalized earnings) from $4.51 in 2012 to an estimated $7.35 for 2016. This level of demonstrated earnings growth outpaces the market’s implied estimate of 4.67% annual earnings growth over the next 7-10 years. As a result, the ModernGraham valuation model, based on Benjamin Graham’s formula, returns an estimate of intrinsic value above the price.

Boeing Co performs fairly well in the ModernGraham grading system, scoring a B-. (See the full valuation)

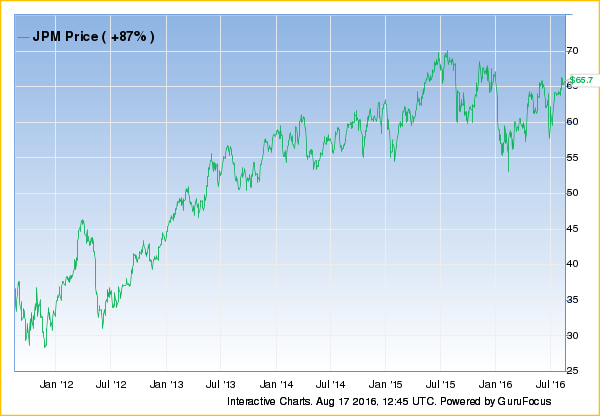

JPMorgan Chase & Co. (JPM)

JPMorgan Chase & Co. qualifies for both the Defensive Investor and the Enterprising Investor. In fact, the company meets all of the requirements of both investor types, a rare accomplishment indicative of the company’s strong financial position. The Enterprising Investor has no initial concerns. As a result, all value investors following the ModernGraham approach should feel comfortable proceeding with the analysis.

As for a valuation, the company appears to be Undervalued after growing its EPSmg (normalized earnings) from $4.11 in 2012 to an estimated $5.4 for 2016. This level of demonstrated earnings growth outpaces the market’s implied estimate of 1.68% annual earnings growth over the next 7-10 years. As a result, the ModernGraham valuation model, based on Benjamin Graham’s formula, returns an estimate of intrinsic value above the price.

JPMorgan Chase & Co. performs fairly well in the ModernGraham grading system, scoring a B+. (See the full valuation)

Travelers Companies Inc (TRV)

Travelers Companies Inc qualifies for both the Defensive Investor and the Enterprising Investor. As a result, all value investors following the ModernGraham approach should feel comfortable proceeding with the analysis.

As for a valuation, the company appears to be Undervalued after growing its EPSmg (normalized earnings) from $5.49 in 2012 to an estimated $9.6 for 2016. This level of demonstrated earnings growth outpaces the market’s implied estimate of 1.52% annual earnings growth over the next 7-10 years. As a result, the ModernGraham valuation model, based on Benjamin Graham’s formula, returns an estimate of intrinsic value above the price.

Travelers Companies Inc fares extremely well in the ModernGraham grading system, scoring an A. (See the full valuation)

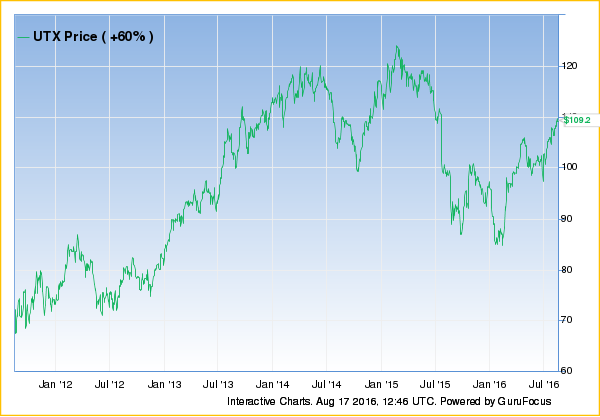

United Technologies Corporation (UTX)

United Technologies Corporation qualifies for both the Defensive Investor and the Enterprising Investor. The Defensive Investor is only initially concerned with the low current ratio. The Enterprising Investor has concerns regarding the level of debt relative to the current assets. As a result, all value investors following the ModernGraham approach should feel comfortable proceeding with the analysis.

As for a valuation, the company appears to be Undervalued after growing its EPSmg (normalized earnings) from $5.17 in 2012 to an estimated $7.65 for 2016. This level of demonstrated earnings growth outpaces the market’s implied estimate of 2.29% annual earnings growth over the next 7-10 years. As a result, the ModernGraham valuation model, based on Benjamin Graham’s formula, returns an estimate of intrinsic value above the price.

United Technologies Corporation fares extremely well in the ModernGraham grading system, scoring an A. (See the full valuation)