3 Dividend Growth Stocks To Buy When The Market Correction Comes

The last market correction was forty months ago in October of 2011. With the average time between corrections sitting at twenty months and looming bad news ahead, we are long overdue. That is why Tim Plaehn has compiled his top dividend growth stocks for you to pick up when the market goes on sale.

On Wall Street, the fears are rising that stocks are overdue for a “correction” which is generally defined as an overall decline of more than 10% but less than the bear market bogey of a 20% market drop. I am in agreement with those analysts who think a correction is possible in the near future for three reasons:

- S&P 500 large-cap corporate profits are expected to be lower when first quarter earnings come out. The large companies with significant international sales will be hit hard by the stronger dollar. The market, as indicated by the major index levels, is so far ignoring this fact.

- It is still possible the Fed will bump up short-term rates in the Summer or early Fall. Since the Fed last increased the Fed funds rate in June 2006, it is difficult to predict how the market will react, but my odds are greater for a short term decline.

- The stock market averages have not experienced a correction since the Fall of 2011. Historically, a correction comes around every 18 months or so. Corrections serve the vital purpose of washing out the stupid money and allowing smart investors to pick up shares of quality companies on the cheap.

While I would be perfectly happy if the stock market went up forever, I know that corrections and bear markets will happen. I plan to use the next correction to buy into a few of the high growth, low yield MLPs that I follow. My income stock investment strategy is always a balance of current yield vs distribution growth rates. In the MLP world, the top growing partnerships will increase their LP unit distributions by more than 20% per year, that’s 5% increases every quarter! Of course I want to make sure that my target MLPs can sustain those growth rates. For sustainable growth, focus on those MLPs with deep pocket sponsors. The growth business model works something like this:

A large energy company spins off an MLP to own midstream energy assets such as pipelines, storage facilities, and terminals. The MLP initially receives assets to generate enough free cash flow to cover the minimum quarterly distribution rate specified in the partnership agreement. The sponsor then makes regular sales of more midstream assets (called drop downs in MLP jargon) that are priced to allow the MLP to grow distributions at a target rate. The large energy company sponsors own large amounts of midstream assets, enough to provide drop downs for years to grow the MLP’s distributions. Also, since the sponsor receives cash for the dropped assets and the partnership is structured so that a large portion of the distribution growth (up to 50% or more) goes right back to the sponsor, the system is rigged to produce almost automatic growth.

I only have one issue with the secure high-growth MLP model: low yields! The cash flow growth of these MLPs is so predictable, the market has been putting below 2% yields on the MLP unit values. I worry that the market may decide that 3% is a better yield, which in a 30% price decline, which would take a couple of years to regain with 25% distribution growth. What I want to do is buy these high-growth MLPs after a general market correction has pushed the yields into the upper 2% range or better. So I keep an eye on the growth and wait for that next market correction. Here are three of these high growth MLPs to put on your watch list:

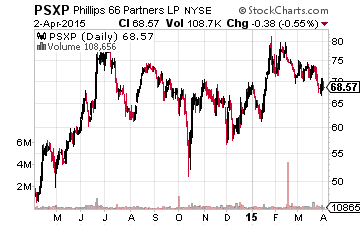

Phillips 66 Partners LP (NYSE: PSXP) was spun off by refining giant Phillips 66 (NYSE: PSX) with a July 2013 IPO. The PSXP quarterly distribution has increased by 51% over the last four quarters, and 25% annual growth is expected for at least the next three years. Its share price has moved up a nice 130% since the IPO less than two years ago. PSXP currently yields 1.98%.

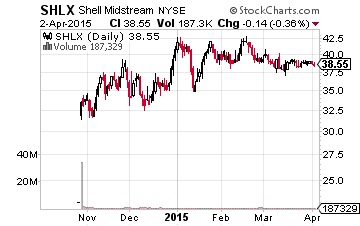

Shell Midstream Partners LP (NYSE: SHLX) was spun off by Royal Dutch Shell (NYSE: RDS-A and RDS-B) in October 2014 and has not yet been in business enough quarters to show distribution growth. SHLX yields 1.68% on its minimum distribution rate and Wall Street analysts are predicting 28% annual distribution growth. SHLX is up 15% since IPO.

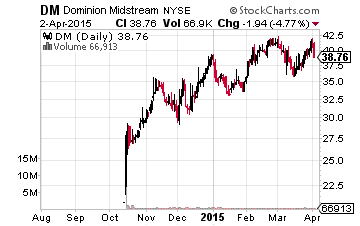

Dominion Midstream Partners LP (NYSE: DM) comes from another October IPO by $41 billion market cap utility company Dominion Resources (NYSE: D). The exciting part of the Dominion story is the company’s project to build the country’s only East coast LNG export facility. The Cove Point Liquefaction Project was approved in 2014 and will take several years to come online. Dominion Resources will build the facility and it will someday be dropped to the MLP. DM currently yields 1.75% with a projected 22% annual distribution growth rate. DM is up 46% since IPO.

An alternate investment strategy would be to take smaller than usual positions in these high-growth MLPs and be ready to increase your unit holdings if and when the market goes into a correction.

These types of MLPs aren’t going to make you rich just from the dividends, however as you can see by the share price increases investors are reaping the benefits from new investors driving up the share prices of companies with a stated objective to raise dividends and coming through on that commitment.

Disclosure: Long DM.

REITs that raise their dividends, like the ones above, have been an integral part of ...

more