$21 Trillion And Counting: Forget The Dot Plots - It's QT, Stupid! (Part 3)

<< Read Part 1: $21 Trillion And Counting: Why This Time The Fiscal Wolf Is Really At The Door

<< Read Part 2: $21 Trillion And Counting: Why Deficits Didn't Matter During The Age Of Monetization, 1987-2017

One of the worst ills of monetary central planning is that it has given rise to a laughable auxiliary of Wall Street economists who pontificate upon the entrails of the Fed's Dot Plots. Typical of these is Neil Dutta, head of economics at Renaissance Macro Research, who had this scintillating insight for today's Fed meeting pronouncements:

“The dots are likely to shift around, but we are skeptical that we will see four hikes penciled in for 2018. In order for this to happen, it would require four officials moving up to four hikes and for the new Richmond Fed President to also estimate four hikes this year,” Dutta said.

“Instead, what we are likely to see is a coalescing around three hikes this year. After all, there are six officials currently below three hikes for 2018,” he said.

“While some at the Fed appear to be enamored with the idea that the labor market is beyond full employment, the latest figures don’t really support this view,” he said.

“The continued rise in prime-age participation rates suggest that more workers can be drawn into the labor force provided the recovery continues,” Dutta said.

In other words, 105 months after the Great Recession ended, Dutta has read the Dot Plot entrails and finds a reason for even further prolongation of negative real interest rates.

That's because according to this Keynesian devotee of bathtub economics, the labor pool has not yet been fully drained. So why not indulge the Wall Street carry trade gamblers with still another round of essentially free funding?

Stated differently, in the eyes of Dutta and most Wall Street economists, money has no market price and labor force utilization can be measured to the second decimal point.

In fact, both propositions give the concept of pointy-headed intellectuals a bad name. Apparently, the only reason to even have an interest rate is to ward off consumer price inflation. Yet until the bathtub of potential labor supply is drained to the very bottom there is purportedly nothing to worry about.

Never mind, of course, that in today's globalized labor market, and under domestic arrangements where the marginal supply of labor is measured in gigs, hours and even 15-minute intervals on Wal-Mart's schedule boards, Dutta and his Fed counter-parts have no clue about how much "slack" actually exists; nor will they ever find out.

Indeed, the only thing that can really be said is that the potential US labor force of working-age adults (16-68 years) amounts to 420 billion annual hours ( 2,000 standard hours per year for 210 million persons), and that a vast share of those hours are not currently deployed in the measured GDP.

According to the BLS, in fact, currently, only 255 billion of these hours (or 61%) are actually "employed". But that random ratio has absolutely nothing to do with the Fed's policy maneuvers.

Instead, what might be termed the "implied comprehensive unemployment rate" of 39% is driven by everything from higher education enrollment rates, to disability rolls, un-monetized household labor, minimum wage rates, welfare disincentives to work and the millions of drifters and grifters who populate the underground economy or mom and dad's basement, as the case may be.

So the idea that we don't need an interest rate until the un-measurable labor pool is sufficiently drained is just risible nonsense---even if you recognize that the BLS headcount measures are not worth the paper they are confected on.

Under the monetary central planning regime, therefore, the money market interest rate, in particular, has become just a plaything of the FOMC. After years of ZIRP, it has been reduced to an administrative dial on the Fed's policy dashboard which exists for its own convenience alone as it blindly pretends to raise (or lower) the water level of aggregate demand in the $19.7 trillion US economy.

We use the two bolded words deliberately. By "blindly" we mean the sheer insanity of the Fed's failure to recognize that with three so-called rate increases by year-end, the administered price it puts on the money market scoreboard would still print at only 2.13% in a 2.20% inflation (Y/Y) context.

Needless to say, December 2018 will mark the 10th anniversary of ZIRP. So under what rational economic theory can it be held that investors in what amounts to a 10-year debt instrument (i.e. fed funds rolled-over every night for a decade) deserve a zero (or less) real rate of return?

The fact is, the Fed heads and their Wall Street acolytes are so focused on the short-term delta's in the in-coming data and keeping the gamblers bidding the dip that they do not even think about the absurdity of attempting to impose a regime of return-free risk on the money and capital markets.

Besides that, they are mainly "pretending" anyway. That's because their hideous experiment with quantitative easing and massive bond-buying has essentially wiped out the Federal funds market.

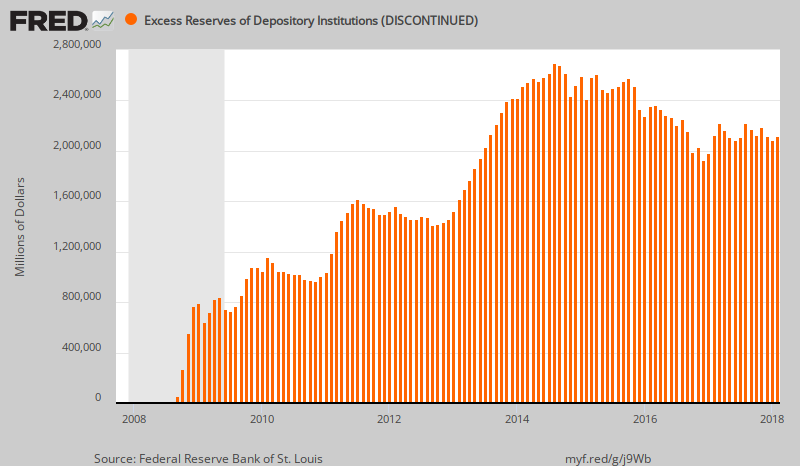

As shown below, QE generated such a massive surge of excess bank reserves that there was actually no need for banks to borrow from each other in order to even out daily reserve balances in the traditional manner.

In the fall of 2007, for example, excess bank reserves on deposit at the Fed amounted to a few billion dollars. But after Bernanke's 13 weeks of money printing madness in the fall of 2008, which more than doubled the Fed's $900 billion balance sheet, excess reserves soared to $800 billion, and then as the phases of QE unfolded eventually peaked at $2.68 trillion in September 2014.

Since then, this massive aberration in the banking system has been reduced to about $2.1 trillion, but the point remains. The traditional Federal funds market is deader than a doornail.

That's why, in fact, the Fed goes through the charade of setting a floor and sub-floor around it's "target" rate for non-existent federal funds. The so-called "floor" is administratively set as the IOER rate, which is the interest the Fed pays member banks on their excess reserves.

Given Dutta's assumption of three rate increases this year, the IOER, which stood at 1.5% before today's meeting, will average 1.88% in CY 2018. That means, in turn, that the Fed will pay the banks $40 billion to NOT lend their excess reserves at a lower rate, which they couldn't do anyway!

That's right. Honest-to-goodness member banks of the Federal Reserve system can only change their reserves balances by making new loans and taking corresponding deposits (more reserves); or by liquidating loans and deposits (less reserves).

The gigantic bloating of excess reserves shown below, by contrast, arose when the Fed deposited credits in their reserve accounts after purchasing bonds from them under QE.

On the margin, therefore, the Fed will collect $40 billion in interest payments from Uncle Sam on the bonds it bought with credits conjured from thin air, and then recycle these funds to America's always "needy" banks for no better reason than to essentially say: So there!

That is, the monetary politburo can set a "target rate" even if it leaves no more trace on the main street economy than the sound of a tree falling in an empty forest.

Worse still, in the event that some financial institution wishes to lend its excess reserves below the IOER "floor" the Fed then trots out the ON-RRP or overnight reverse repo rate, which was set a 1.25% before today's meeting.

Needless to say, that "sub-floor" is sure to succeed even if the IOER "floor" somehow starts to leak. That's because the Fed essentially offers to borrow unlimited amounts from Wall Street at the ON-RRP rate (all financial institution are eligible, not just member banks) and provide the lender with top tier collateral (Treasury securities), to boot.

A Martian who came upon these arrangements would undoubtedly smirk about a central bank in the monetary belts-and-suspenders business, but not Neil Dutta and his ilk. They take this rate setting charade seriously because they get paid (unaccountably) the big bucks to count dots on a Fed press release.

Unfortunately, the dots they are counting get programmed into the algorithms of the robo-traders, and all have a swell time attempting to arb the post-meeting announcement. But the fun only lasts a few hours or days at best---until its time for the Dutta's of the world to start counting the dots again.

You could call this sheer madness and be done with it because whole ordeal amounts to Fake Monetary Policy.

In truth, the portentous debate about three versus four rate hikes over the course of the next year forward essentially amounts to this: Do the banks get paid $40 billion or $45 billion not to lend the massive trove of excess reserves shown in the chart at rates below the Fed decreed IOER.

The larger point here is that in a post-QE world, the federal funds rate is not only a meaningless vestigial financial organ; it is actually an exercise in what magicians call misdirection.

In fact, we'd call it sleight-of-hand which is so tricky that even the magician fails to recognize what he is doing.

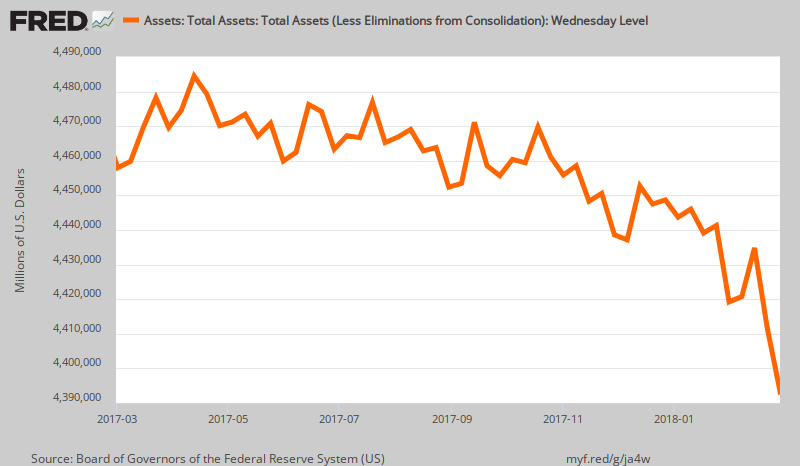

To wit, the real Fed action in what is now a QT (quantitative tightening) world is entirely a function of the rate at which it is shrinking its balance sheet. Unlike the make pretend floor of IOER, every bond the Fed dumps from its balance sheet will drain a like amount of cash out of Wall Street.

That has already begun to happen under the auto-pilot schedule announced by the Fed last fall. Aside from short-run technical leads and lags mainly related to the Fed's $1.8 trillion holdings of GSEs, it is now draining cash at a rate of $240 billion per year, and that will hit a $600 billion rate after October 1.

Thus, at the end of February, the Fed's balance sheet footings had already been reduced from $4.5 trillion to just $4.39 trillion, and the fun was just getting started.

Stated differently, forget your high priced entrails readers like Neil Dutta. Just watch the yellow line because it will be plunging like never before in the history of central banking.

Nor is the Fed shouting at the world's sea of central bank created liquidity alone. As it presses forward with QT and massive scale bond-dumping, the ECB will be right behind----ending its QE program in December 2018 and fixing to pivot to QT as soon as a German replaces Draghi the following fall.

There is nothing more important than this sequence because the madness under Draghi at the ECB is the main reason the end of QE at the Fed in October 2014 has had such a muted and delayed impact on the US bond market.

In short, during the interim, the ECB took up all the slack. Indeed, as it drained euro markets to the tune of $90 billion per month at last year's peak, it created a massive incentive for euro bond investors to sell their holdings to the ECB, book their front-runners gain, and then reinvest in far higher yielding UST's.

Overall, it increased it has expanded it balance sheet by EUR $2.5 trillion during the last three years alone. But, alas, that was a one-trick pony.

As we address in part 3, with the ECB soon out of the QE business entirely, the Fed's cash drain will soon begin to bite and hard.