2 Stocks To Pick Up In The Wake Of Fallout From Valeant

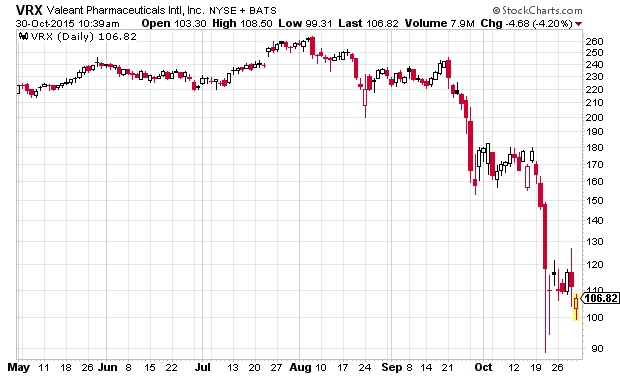

We will see how the overall pharma and biotech sectors hold up today on news that hit after the bell around recent sector pariah Valeant Pharmaceuticals (NYSE:VRX). Optum, the health services platform of UnitedHealth (NYSE:UNH), as well as CVS Health (NYSE:CVS)and Express Scripts (NASDAQ:ESRX) announced they are cutting ties to Philidor, the specialty pharmacy linked to Valeant Pharmaceuticals. Valeant also just announced it would drop ties to Philidor as well. This is the latest piece of bad news for what was a hedge fund darling until a month or so ago.

Biotech has had a good month after stepping a toe in official bear market territory towards the end of September. This week the space has been helped by better than expected earnings reports from some of the large cap stocks in the sector such as Gilead Sciences (NASDAQ:GILD) and Amgen (NASDAQ:AMGN). Both of these companies easily beat on the top and the bottom lines as well as raised guidance. These companies continued ability to deliver solid results even in a globally challenged environment are why they are two of the “core” holdings within my Biotech Gems portfolio and paired with a dozen promising and less heavily weighted small and mid-cap positions.

The Pharma & Biotech sectors have also been helped this week by good earnings reports from Bristol Meyers Squibb (NYSE:BMY), Merck (NYSE:MRK) and Pfizer (NYSE:PFE). A possible merger between the latter and Allergan (NYSE:AGN) that hit the wires early Thursday also has been a positive for the sector late this week.

The news around Valeant could put these sectors under pressure once again into early next week at the least. Here is what I am watching for today from the continuing fallout from the ongoing saga at Valeant Pharmaceuticals.

- Expect to see Bill Ackman, the billionaire hedge fund manager that has a large long position in Valeant; to be on the air frequently over the next 72 hours defending the company and his stake. After appearing constantly to pound the airwaves on why he had a major short on Herbalife (NYSE:HLF) last year, the fund manager gets to find out what it is like to be on other side of the table. Who says there is no cosmic justice?

- Expect at least one politician facing an election in 2016 to make political hay by using Valeant yet again as a lead into the election theme of drug price “gouging”. Little if any of the content of these rants will see the light of legislation in 2017, but it will again be a headwind for this sector. Look for the media to also pile on this current story du jour.

- Obviously Valeant has done what on the surface and quite probably in reality constitutes being a “bad actor” and is getting some just desserts right now. However, the vast majority of the industry should not be tagged by its actions. The average script price of hepatitis C blockbusters Sovaldi & Harvoni continues to fall quarter over quarter as but one example. In addition, drug prices constitute approximately 10% of overall healthcare spending. Instituting tort reform, allowing insurance to cross state borders or cracking down on the some ~$90 billion annually in Medicare & Medicaid fraud would be more effective ways to control healthcare costs. None of these items will be actioned in 2017 either.

- Watch the credit markets. The widening spreads in the credit markets over the past few months are my major concern for the market heading into 2016 which I covered in a recent blog post. Most of the recent challenges in the high yield sectors have been caused by the aftermath of the collapse of the commodity and energy markets. This should get worse if commodity and energy prices stay at current levels as producers’ forward hedges made when prices were much, much higher continue to fall off the books. Valeant has financed its bevy of recent acquisitions with some $30 billion in debt. As of late last week that debt had gone from over par to 88 cents on the dollar according to a piece in Barron’s last weekend. This could be yet another stress for those markets.

- I have been getting a lot of questions on whether Valeant is a buy after the shares have been cut in half over the past month or so. I believe there are too many unknowns at this point to take a stake in the current bad boy of pharma. When there is one cockroach, there is likely to be more. If I was going to take a small directional bet it would be through call option spreads where I could define the risk/reward more easily.

- Big biotech companies should be fine as they are focused on developing new drugs, not putting big price hikes on old compounds. Finally, the fallout on Valeant could very well knock other names down in the pharma sector as well as “high beta” small & mid cap biotech concerns. If the blowback from Valeant hits stocks like Mylan (NASDAQ:MYL), I would use the opportunity to add a little to my core position.

That is my take on the likely fallout from Valeant today as we close out trading for October.

In the meantime other biotech and pharmaceutical firms are looking to merge for reasons varying from technology, marketing, product development, even back to the tax inversion theme from last year. Lately talk has centered around a tie up between pharma giants Pfizer and Allergan. And while this could be a boon to investors in those stocks the biggest opportunities for massive gains are when big pharma gobbles up the little guys.

Disclosure: more

You might be right about a knock on effect from the Valeant fallout story, although these companies are focusing on different areas of the market and not considered direct competitors. I expect we will continue to see volatility in the biopharm/healthcare sector going forwards. Amgen is only up 0.7% YTD. To avoid the pitfalls of volatile stocks, try to buy on the dip rather than the upswing, and hold for the longer term. Maybe after being hit so hard maybe Valeant is now a buy?