2 Stocks That Will Crash After Bad Earnings

An earnings miss that will send share prices tumbling seems imminent for both of these stocks. These are two stocks investors must avoid if they don’t own them and sell if they do.

You think stock prices have been volatile of late? Well, that is nothing compared to how this due reacts to their earnings announcements.

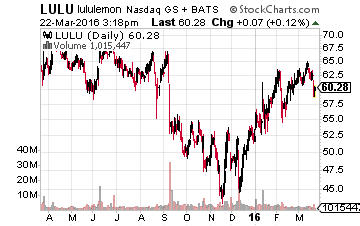

Lululemon Athletica inc.’s History of Undressing Investors

Wall Street says Lululemon Athletica inc, (NASDAQ: LULU) will earn $0.80 per share when they report results on Wednesday, March 30th. Expect actual numbers to be a penny or two less than analysts’ forecasts.

In case you don’t know, Lululemon manufactures and distributes athletic apparel and accessories for women, men, and youth. Primarily, they are known for yoga clothing, particularly pants (sometimes see-through – Google it).

For the last nine months, the consumer goods company struggled to make Wall Street’s grade, including falling short of the mark last quarter. Underwhelming results are a departure from years of smashing estimates.

Despite the record of making a joke of Wall Street’s quarterly projections, LULU shares sank more often than not in the three days before and after release. Investors wore a black-eye seven of the last 12 quarterly checkups.

On average, Lululemon Athletica’s price dropped 10.87% for the unlucky seven quarters and popped a nearly symmetrical 10.54% for the remaining five. Last quarter’s disappointment saw shares slide more than 12%, an improvement from a 15% nosedive the previous quarter.

Don’t be shocked by another unwelcome earnings miss or lowered guidance as Google Trends suggest sales growth might not be as robust as predicted. Revenue is slated to rise 14.80% year-over-year (YoY), but Google searches say not so fast.

Web searches for the keyword “Lululemon Athletica” are up only 6.7%. While not perfect, Google Trends has often served as a reliable indicator of consumer interest. In this case, requests fall well short of LULU’s top-line prognostications.

Reduced margins will also make it harder for money to flow from LULU’s top-line to its bottom-line. Cost of Goods Sold (CoGS) is on the upswing compared to 2015, climbing from 49.7% to 53.1%. At the same time, Selling/General/Administrative Expenses (SG&A) rose to 32.7% from 31%.

Ballooning inventory makes rising CoGS and SG&A expenses seem reasonable. The apparel maker’s inventory spiked, whizzed, and rocketed into orbit; up 144% YoY. Eww, that’s U-G-L-Y. Stale merchandise, especially in the fickle apparel industry, usually finds its way to clearance bins – talk about bad for margins.

Investors would be wise to avoid or even short Lululemon Athletica’s earnings announcement based on the evidence above.

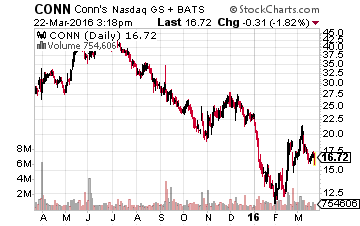

CONN’S, Inc. (NASDAQ: CONN): A Dangerous Place to Shop Pre-Earnings

On Tuesday, March 29th, CONN’S senior management will host a conference call to discuss their 4th quarter and full-year financial results. The consensus estimate of $0.28 is considerably lower than last year’s profit of $0.48 per share.

The Texas-based, broad-based retailer sells appliances, home furniture, mattresses, computers, tablets, printers, accessories, and other consumer electronics, such as LCD, LED, 3-D, ultra HD, and plasma televisions. They also provide credit.

According to our math, it looks as if CONN’S register receipts won’t match Wall Street’s predictions. Anticipate the company to announce earnings of two-to-three cents below expectations.

Not measuring up can be especially painful for CONN shareholders. Previous shortfalls chopped the stock price by as much as half in the three days surrounding the announcement, with an average slide of 28.5% – ouch.

Pricing pressure could be the reason CONN gets whacked if shares tank following the quarterly call. Inventory swelled more than 40% compared to the same timeframe last year.

Once again, a ton of unsold merchandise can mean heavy discounts are needed to bring in buyers. That’s never good for profit margins. It is an even bigger problem when revenue growth is underwhelming, as it the case with CONN, and is forecast to rise 6% YoY. However, the past two quarters flat-lined.

All is not awful for the retailer as option investors appear to be making a bullish bet on the stock. Call option contracts outnumber put options by three to one. That being said, there is a pig in the bullish-bet python. Seven out of 10 call options are stacked in a single exercise price – $18.

Experience says the outsized position is actually a bet against the stock rising. It’s more likely an investor sold the contracts to collect money from buyers, believing CONN is not going to make $18 before April 15th.

Another potentially positive sign is that web users Googled the keyword “CONN’S” more in the last three months than compared to last year. Searches are up 11% YoY which could mean the retailer surpasses revenue goals for the quarter and full-year. Ahh, but it is hard to get those swollen inventory levels out of mind. They could squash any benefit from better than expected sales.

The line-item is a hugely important metric for retailers; the fatter the percentage the smaller the profit, keep that in mind.

Overall, CONN’S history of cliff-diving in the day’s surrounding its earnings announcements makes the company OFF-LIMITS for traders and investors – AVOID if you don’t own it and SELL if you already do.

Disclosure: You could collect an average of $3,268 in extra monthly cash with ...

more