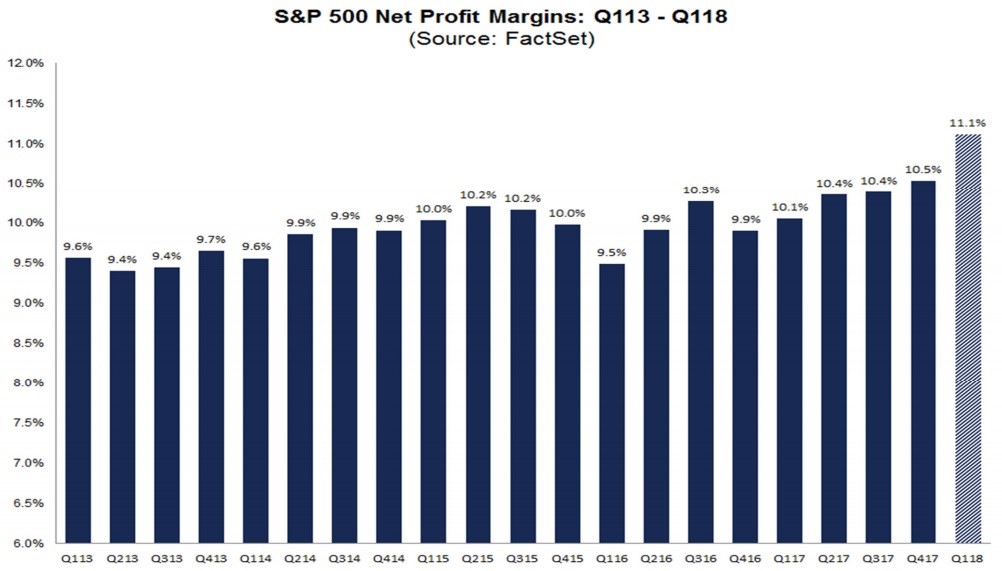

11.1% S&P 500 Profit Margins: The Highest Since At Least Q3 2008

International Earnings Boost Margins

Earnings growth is now on pace to be 18.3% as 17% of S&P 500 firms have reported by April 20th. The data in this article is all from FactSet because S&P Dow Jones took a one week hiatus. Keep in mind, the quarter started as expecting 17.1% growth which implied 20.1% growth based on the average beat rate. The goal is to get to at least 20.1% by the end of the quarter. Clearly, the earnings growth is at a good pace, but a sector missing results can bring it down. You can’t assume the pace will continue. While I didn’t think earnings season would cause the market to make a new high, it’s disconcerting to see the market remain in the bottom half of the recent range with such solid results being reported.

Profit Margins Spike Due To Tax Cuts

The chart below shows the historical net profit margins since 2013. As you can see, the 11.1% blended net margins in Q1 2018 are the highest in this graph. They are the highest since FactSet began calculating margins in Q3 2008. This margin calculation seems impossible, which is why it needs further explanation. Margins including international sales are at a record high, but domestic profits margins aren’t near their record high. This gives you the implication that current margins are sustainable until the end of the cycle. Margins were creeping up sequentially last year. Based on that trend, it’s fair to say Q1 2018 would have been a record without the tax cuts. The tax cuts boosted the numbers.

(Click on image to enlarge)

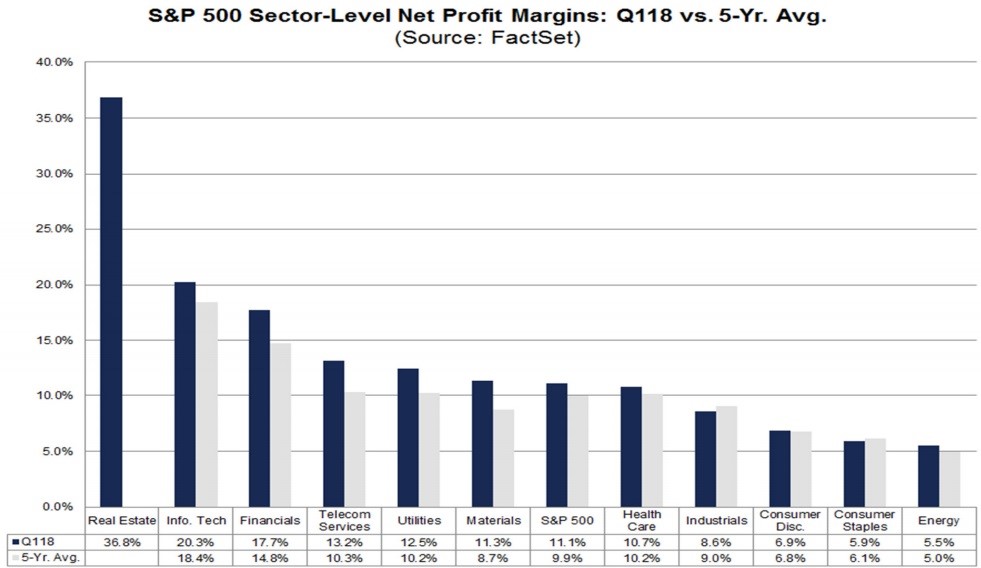

Sector Margin Breakdown

The chart below shows the sector breakdown of net profit margins compared to the 5 year average. Most sectors are above their average as expected. The consumer staples are below their 5 year average, but only by 0.2%. It seems harsh based on this metric to see them at their 52 week low, but rising yields are pushing them lower. The big question if firms in this sector such as General Mills and Phillip Morris are bond like instruments or stocks. If they are bonds, their stocks will fall to increase their yield. Their earnings multiples will be crushed to the single digits in that scenario especially if yields continue rise. If these firms are stocks, then their PE multiple matters. In that case, they are cheaper than the market, have lower growth, and supposedly have consistent earnings. The reason I say supposedly is because the improvements to private label products have hurt the consumer packed goods industry which is a key part of the consumer staples business.

(Click on image to enlarge)

Kraft-Heinz Case Study

I believe in firms like Kraft-Heinz because I think they have ability to innovate on the product front. These big consumer packed goods brands have the capital to make small acquisitions and form partnerships to make up for the lagging brands. Specifically, Kraft-Heinz has partnered with Momofuku to create three flavors of spicy sauces. The firm also released a new product called Mayochup which combines mayonnaise and ketchup. Heinz should have released this product years ago, but the firm just started feeling the pressure of a crashing stock, so the management decided to focus more on innovation. The stock is down 40% since February 2017. Finally, the firm created a startup incubator for brands called Springboard which will invest in natural and organic brands; specialty and craft items; health and performance brands; and experiential brands.

Looking at the firm as a stock, in the second half of 2016, you were getting a firm with declining brands that didn’t appeal to millennials at about 27 times forward earnings. Now you’re getting a firm with a 15 forward PE that sees the problems with its portfolio and is actively launching initiatives to fix the problem. It would be great to see the stock fall further to get a higher margin of safety. Clearly, the stock is closer to a bottom than a top. At 27 times earnings, I don’t believe in the new brands and partnerships, but at 13 times earnings I would.

(Click on image to enlarge)

If you look at the firm as a bond, the 4.3% dividend yield is about 1.3% higher than the 10 year bond. That’s not too exciting for bond investors who likely fear the execution risk of Kraft-Heinz’s management. Obviously, the 10 year yield has much less risk. The stock only had a high PE in 2016 and 2017 because of the dividend. These holders are panicking out of the name as yields rise. I think interest rates will fall again which means the current Kraft-Heinz dividend yield isn’t a problem. The real problem is other firms in the sector offer higher yields, meaning the stock needs to fall further. Personally, I would never buy a stock just for the dividend because that’s a recipe for disaster. I’d rather buy for buybacks than the dividend, but more importantly I’d look at the fundamentals of the business.

Tech Has An International Presence

A few of the sectors have net profit margins above their 5 year averages, but tech is the most important because it is 1.9% higher than its average and provides the highest percentage of earnings in the S&P 500 until the sectors are re-positioned later this year. Tech is the best example of a sector that is having its margins boosted from international earnings. The ability to maintain margins has been the big story surrounding the recent selloff in tech because Europe is looking to regulate firms like Alphabet and Facebook. That regulation makes the sector’s profit margins vulnerable. It could bring total S&P 500 margins back down to earth.

Conclusion

The financials, healthcare, and materials have the highest margins since FactSet began tracking the data. Furthermore, margins are expected to increase throughout the year like last year. Margins are expected to be 11.5%, 11.8%, and 11.7% in the next three quarters. I have recently changed my understanding of margins. Margins usually fall during recessions and rise during expansions, making them cyclical. I had previously considered them to be mean reverting. This is a key distinction because expecting a mean reversion means you are very bearish on margins. If you think margins are cyclical, you’re only bearish if you think the cycle will end. The tax cut implies margins can be elevated longer than those who believe in mean reversion think.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial ...

more