Updating Gold Ratio Chart Messages

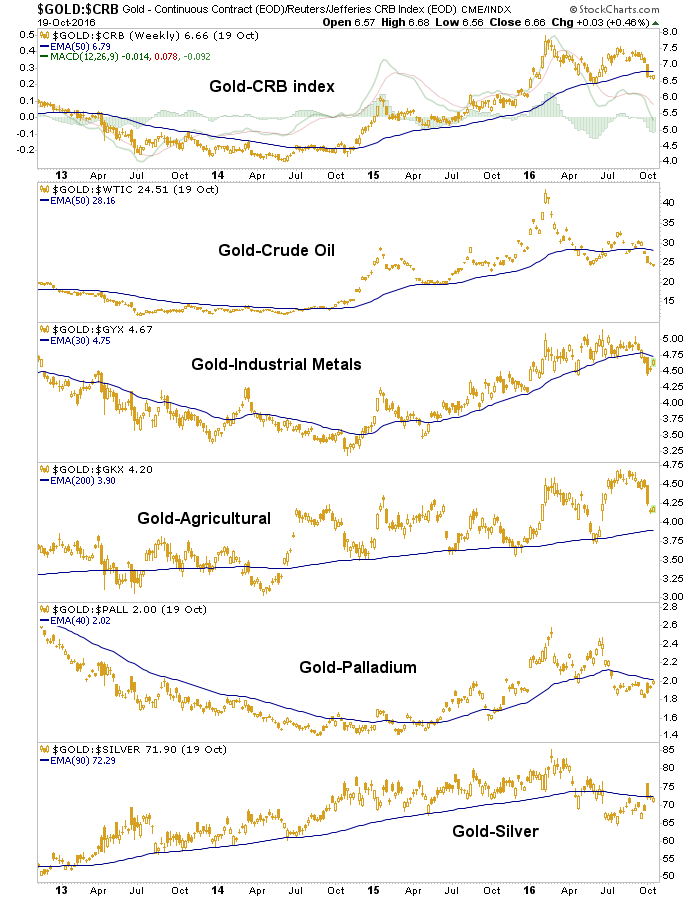

Gold has more counter-cyclical qualities than commodities. Hence, when it outperforms commodities the indication can be counter-cyclical and deflationary. When commodities outperform, obviously the opposite is indicated. As you can see, gold is threatening to break down vs. commodities in general, and did break down vs. two precious metals with more commodity-like characteristics (Silver and Palladium). Conclusion: We remain open to a view of inflationary economic growth.

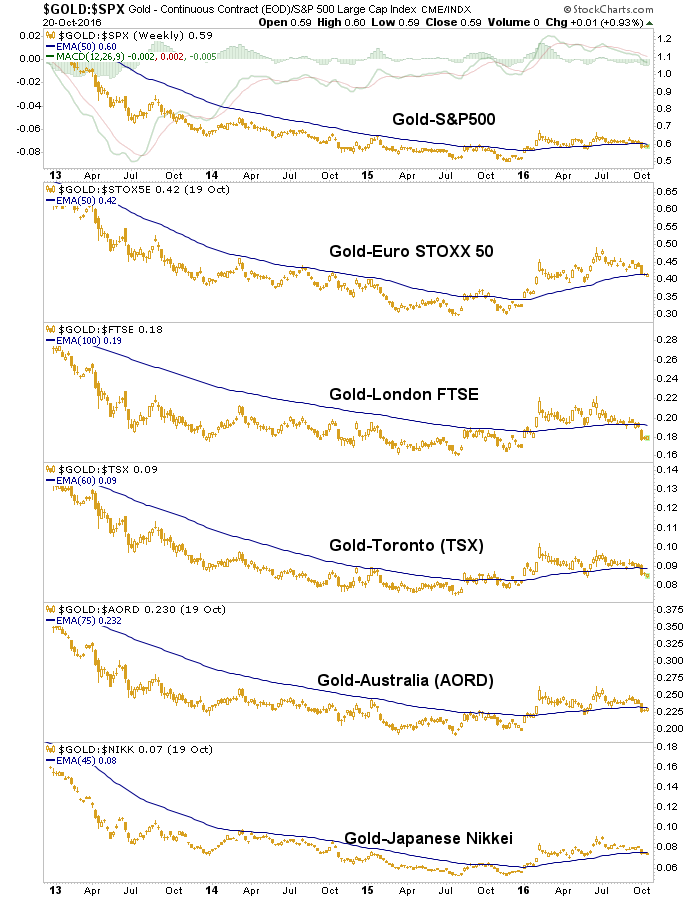

Gold vs. Stock Markets is very key in determining the macro and sector fundamentals necessary for a healthy gold stock sector. After all, when the stock market is outperforming gold why buy gold stocks? This is also an indicator of confidence or lack thereof in policy makers. Gold has at least temporarily broken down or is threatening breakdown vs. most major stock markets. This must be reversed for a positive long-term view of the gold stock sector to return.

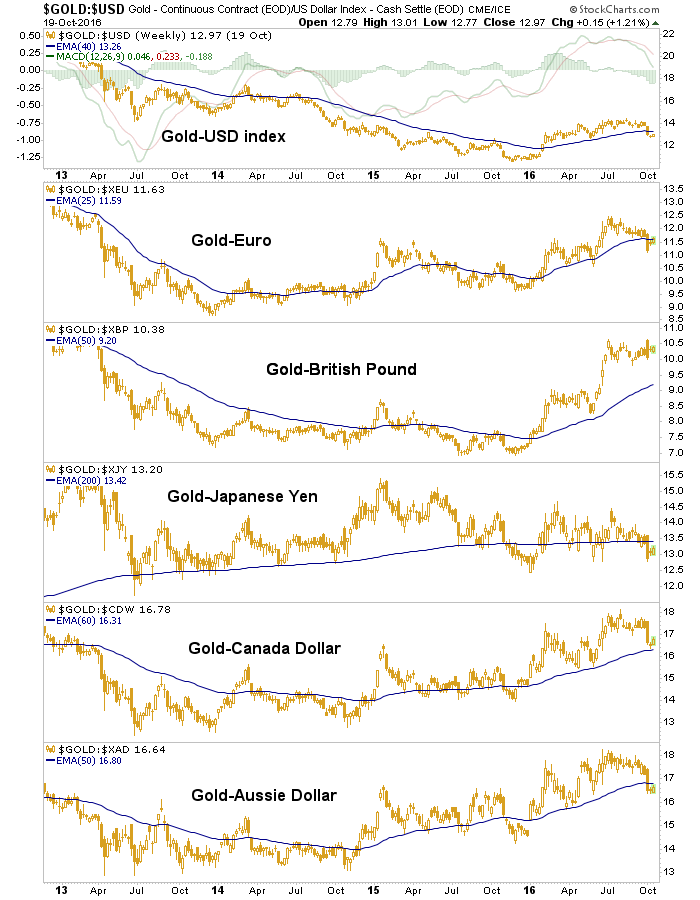

Gold vs. Currencies speaks for itself. It is confidence in a monetary asset vs. confidence in actual paper money (AKA funny munny). This is a mixed bag right now but gold generally remains up trending vs. major currencies and so, confidence in the printers and manipulators of these currencies continues to be in a downtrend.

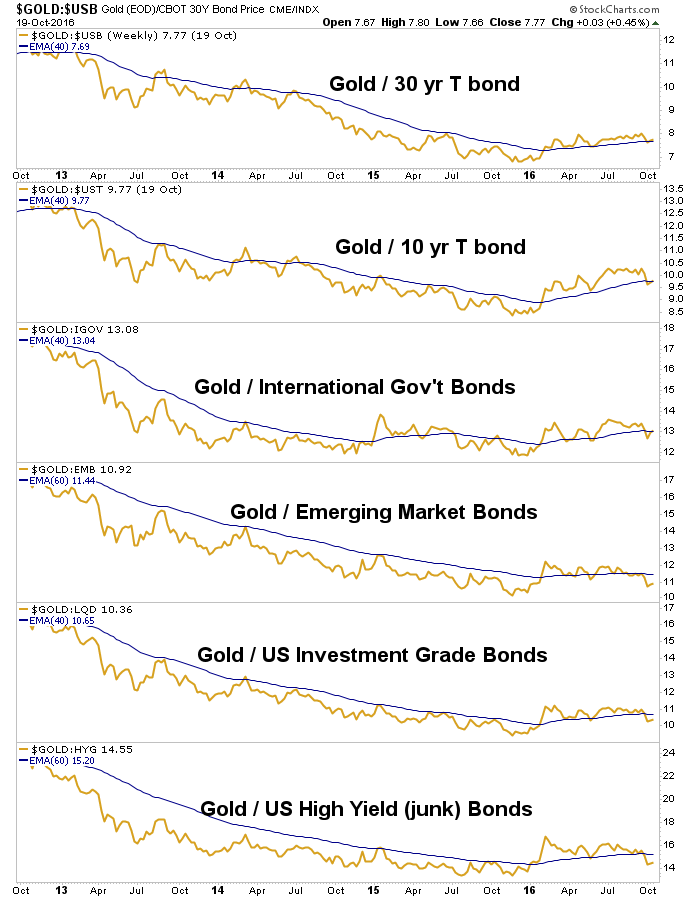

Gold vs. Bonds works much the same way but has more of a component of risk 'on' or 'off' to it. Gold continues to be in a slight uptrend vs. what is commonly thought of as the world's safest, US Treasury bonds. Yet the breakdowns vs. Emerging, Corporate and Junk imply that a risk 'on' backdrop remains in force. This would also go well with the inflationary outlook.

Just a quick update on some of the more hidden indicators for your consideration.

Disclosure: Subscribe to more