Union And Private Sector Workers See Accelerated Compensation Growth

Income & Spending Growth

Income and spending growth is also included in the PCE report. It implies continued steady economic growth as the personal income growth was 0.4% month over month which met estimates and was the same as last month. Real personal income growth was 2.6% year over year which is up from 2.3% growth in May. That growth rate is near the middle of where it has been this cycle. The weakest point was -3.2% in December 2013 and the strongest growth was 6.6% in December 2012. This June reading is solid when you consider growth was 2.8% in June 2017. There’s nothing in the headline reading that suggests we’re about to see an economic slowdown, like the ECRI is predicting.

Q2 real consumer spending growth was 4% which suggested the June PCE report would be strong. The June report essentially unbundles the quarterly results. Consumption growth was 0.4% month over month which met estimates. The May reading was revised higher from 0.2% growth to 0.5% growth. Spending on services was up 0.6% and there was no growth in spending on durables.

On a year over year basis, real consumption growth was 2.6% in May and 2.8% in June. That’s also in between the weakest and strongest growth rates this cycle. That led the savings rate to be unchanged from last month at 6.8%. It’s still weird to see such a high savings rate as there was recently a massive shift in the rate because new income from proprietors was added to the data. The PCE report suggests the Fed shouldn’t raise rates at a quicker pace than 2017. If I was in control of policy, I would raise rates one more time in 2018 and once in 2019.

Q2 Employment Cost Index

The Q2 employment cost index is a late report because the data in April and May is very old news. However, it’s still worth reviewing because it tells us about benefit growth instead of just pay growth. This tells us about total compensation which is more important than just wages. Quarter over quarter growth was 0.6% which missed estimates for 0.7% growth and was below Q1’s growth of 0.8%. Year over year growth was 2.8% which was above Q1’s growth of 2.7%. Year over year benefits growth was up 3 tenths to 2.9% and wages and salaries growth was up one tenth to 2.8%.

The increase in total compensation was the highest since Q2 2008, but it’s still below the rate at the end of last cycle. The ECI first started being calculated in 2002, so we don’t have a complete look at the previous cycle, but from what we do know, this increase is still low. The ECI peaked at 3.9% growth and troughed at 2.8% growth last cycle. This puts total improvement this cycle way below last cycle as growth has mostly below 2% until 2016.

If you break down the data, you can see that the growth rate is being limited by non-union workers and government workers. Union workers saw growth of 3.5% in June and non-union workers had growth of only 2.8%. You can tell by this data that there are many more non-union workers than union workers. Looking at this cycle holistically, union compensation growth has been mostly higher than non-union growth with an exception for the period between September 2015 and June 2017. As you can see from the chart below, private sector compensation growth has recently accelerated above government compensation growth. In June, private sector compensation growth was 2.9% and government compensation growth was 2.3%. As you can tell by the numbers, the private sector employs many more workers than the government. In this case, the bigger employer is the winner.

Strong Consumer Confidence, But Worries About The Future Remain

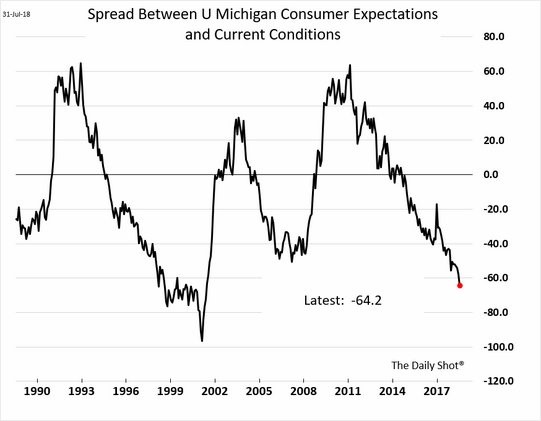

Consumer confidence was strong in July as the headline figure was 127.4 which beat estimates for 127 and last month’s report of 127.1. Those who said jobs are hard to get was flat at 15% and those saying jobs are plentiful was up almost 3% to 43.1%. Those readings on the labor market explain why the present situation index increased from 161.7 to 165.9. The expectations index fell over 2 points to 101.7 because of less optimism on future job prospects and income prospects. Once this leads to a decline in the quits rate, there will be noticeable weakness in the labor market. So far, the moderate weakness in this survey is meaningless. The overall difference between the expectations and the present situating index has been a telling sign for where we are in the business cycle.

As you can see from the chart below, when the difference is positive, it signals economic growth is set to improve and when it’s negative, it means a recession might be coming. The negativity is already lower than the trough in 2008. This is probably because the tax cuts and roaring bull market have improved the present situations index. It seems to suggest there will be a recession in the intermediate term just like the yield curve suggests.

Inflation expectations were up 0.2% to 5.1%. It’s up from 4.7% in April. To be clear, this reading is usually above the PCE and CPI estimates of inflation. The rate of change is pointing to slightly rising inflation. There has been a string of weak reports on the housing market. The percentage of people planning to buy a home dropped 1% to 5.1%, adding to the negative news.

The percentage of bullish investors fell over 6% to 36.5% and the percentage of bears increased almost 7% to 29.4%. This is great news for the stock market because there are reasonable fears that the market has too much euphoria. It’s amazing to see the consumer only has a net bullish reading of 7.1% because the market is near its all time high and it has been in a bull market for over 9 years. The fact that the market hasn’t surpassed its January high is probably weighing on optimism.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial ...

more