Your 2016 Playbook For Navigating The Markets

2015 has been a most challenging year for investors and thankfully it is coming to a close. Now, it is the time of year that every pundit and forecaster worth their salt offers up a view on what lies ahead in the New Year. Most of these prognostications will mainly be milquetoast projections as Wall Street seers have little incentive to wander far from the consensus. This means an investor will be inundated with projections that the market will gain 5% to 10% in the New Year; pretty much in line with the long term historical averages.

With that in mind, I will offer up some stronger opinions on the key drivers for the market and some picks to successfully profit should these themes play out as predicted in 2016.

Interest Rates:

The Federal Reserve lifted interest rates off of zero in December. It was the first interest rate hike from the central bank since 2006. The institution’s current forecast currently points to four more small hikes in 2016. I would take this forecast with a huge grain of salt. At this time last year, the Federal Reserve’s projections were calling for three interest rate hikes in 2015 and the central bank ended up delivering just the one in the last month of the year.

Given global demand is at the lowest levels since 2009 and both the Japanese and European Central banks are still in an easing mode; it is hard to see more than two interest rate increases in 2016. This is especially true as there is no reason to believe the domestic economy will grow much more than the two percent level it has been stuck in since the weakest post-war recovery on record started back in June of 2009.

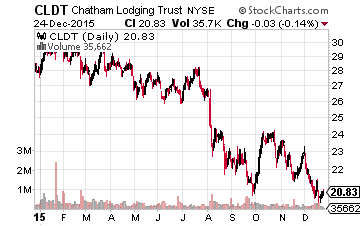

This means there should be some good value in the high yielding real estate investment trust space that has been hit hard leading up to the Fed’s December hike. I personally have added to hotel REIT Chatham Lodging Trust (NASDAQ: CLDT) recently after it staged a significant decline since summer. The company’s FFO (funds from operations) should report a 15% gain in 2016 after a 20% increase in 2015. The stock is cheap at under eight times forward FFO and yields nearly six percent in monthly dividends at current levels.

The Dollar:

The greenback is unlikely to repeat the double-digit returns against the Euro and Yen that it had this year in 2016. However, with the Fed tightening while these countries’ central banks continue to provide extraordinary liquidity to their markets, it is hard to see the dollar not going somewhat higher in the New Year. This is especially true given our economy should easily grow faster than Japan or Europe as a whole.

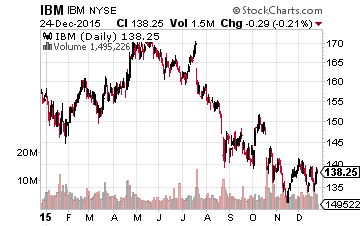

A strengthening dollar will continue to be a headwind to earnings growth at American multi-nationals. The strong greenback was a key component to earnings among the S&P 500 being down year-over-year in 2015 for the first time since 2009. I would be wary of some of the larger tech companies that get so much of their revenue from overseas like IBM Corp. (NYSE: IBM) and Oracle (NASDAQ: ORCL), who have consistently disappointed this year party due to these currency impacts.

Energy and Commodities:

The continued strength in the dollar is just one reason it is hard to see a significant and sustainable bounce in energy and commodities in 2016, at least through the first half of the year given the current tepid level of worldwide demand. The impacts from the collapse in the energy and commodities complexes are my number one concern going into the New Year.

The predicted default rate for the energy sector in the high yield credit markets is currently 11% in 2016. However, if crude stays under $50 a barrel until substantial forward hedges come off next summer, the default rates could be much, much higher. This has the potential to both roil the credit and stock markets.

In addition, recessions and debt ratings in commodity producing nations like Canada and Argentina should continue to head lower if commodities and energy stay at these levels. The latter country looks like it is heading to yet another default in 2016. More important is to keep an eye on Brazil which accounts for half of South America’s economic output and is seeing the worse economic conditions since the Great Depression while also in the midst of the biggest corruption scandal in its history.

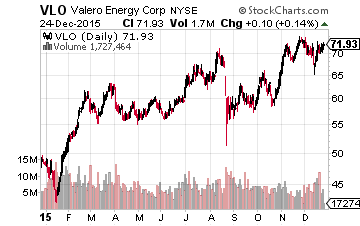

I am totally out of the both the energy and commodity sectors of the stock market with the one exception of a core position in Valero (NYSE: VLO), a refiner that is cheap, pays a nice dividend yield and is well positioned to navigate the glut of cheap crude.

Earnings:

Due to an anemic world economy, especially in the emerging markets, a strong dollar, and the implosion in commodity and energy prices, it is hard to be optimistic about earnings growth in 2016. The current consensus is calling for five to six percent earnings growth in the S&P 500 in the New Year. This is similar to where projections started out in 2015 only to disappoint. I think 2016 is another year of flat or slightly down profits.

I do think we will see a shift in market leadership. In 2015, what little market leadership equities have had came from the so-called FANG (Facebook (FB), Amazon (AMZN), Netflix (NFLX), Google (GOOGL)) stocks as investors bid up anything that could show substantial growth in a slowing global economy.

I think the value and growth at a reasonable price stocks that were on the sidelines this year will do well in 2016. These are large cap growth stocks that have reasonable valuations, rock-solid balance sheets, and pay a nice dividend yield. These companies should outperform the market easily if most of my overall outlook for the global economy and markets comes to fruition in the New Year. Another attractive feature of these sort of stocks is, given their valuations, they should hold up well even if we do get a significant decline in the market at some point in 2016.

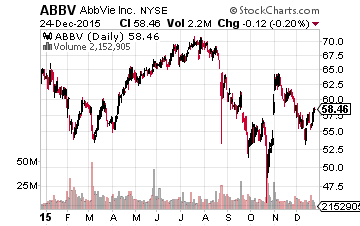

I am finding a preponderance of these sort of appealing large-cap growth stocks in the biotech sector, which is why my portfolio is more heavily weighted to biotech than any other sector. Stocks like Amgen (NASDAQ: AMGN), AbbVie (NASDAQ: ABBV) and Gilead Sciences (NASDAQ: GILD) are all solid values here. One also has to love Apple (NASDAQ: AAPL) here as well despite the stock not doing much over the past three quarters. The company has returned over $50 billion to its shareholders in both 2014 and 2015 via stock buybacks and dividend payments. Despite this, it has not even made a dent in its huge cash hoard. At current prices, the shares should provide a nine percent free cash flow yield in 2016, one of the highest such measures in the market.

This concludes my outlook for equities going into 2016. I wish I could be more sanguine on the prospects for overall appreciation in the market in the New Year. But, given the current state of the global economy, rising interest rates, a strengthening dollar, and collapsing energy and commodity prices, the most likely outcome in 2016 is a repeat of 2015 albeit with different market leadership. The selections outlined above should weather whatever storm comes our way in 2016 and also do quite well if my view turns out to be overly pessimistic.

Position: Long CLDT, RLYP, ...

more