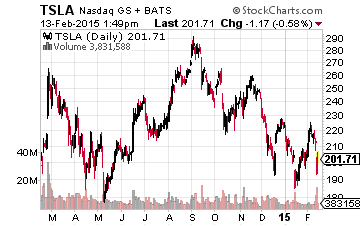

Why Tesla Might Be The Market’s Biggest Mistake Of The Year

Tesla is one of the most talked about stocks in the market. But it is also one of the most misunderstood, with a sky-high valuation based only off of fanciful words from its CEO. Read here to find out what makes the valuation so out of whack, and learn of a handful of better investments in the auto industry.

Tesla (NASDAQ: TSLA) has become the ultimate fanboy stock.

Earnings for the fourth quarter came in at a loss of 13 cents a share, where the company was expected to earn a 32 cent per share profit. Losses continue to grow. Last quarter it lost over $70 million, in the third quarter it lost $60 million, in the second quarter it lost $50 million, and…well, you get the picture.

Tesla shipped just around 9,800 cars during the fourth quarter, versus the expected 12,000. Ultimately, it missed its goal of shipping 33,000 cars in 2014.

The company made a slight profit during 1Q 2013, but it has now posted a loss for seven straight quarters. That’s a trend that’s expected to continue for the foreseeable future.

But the stock is holding strong at $200. Wall Street analysts are defending the stock and investors are cherry-picking which news they want to hear.

Of which, there’s the likes of Tesla launching its first SUV (the Model X) later this year, the much anticipated gigafactory being set to start battery production in 2016, and there’s the promise of the Model 3 — which is expected to hit the market within the next three years and will cost less than $50,000.

To top it all off, the media is focusing on one particular quote from the fourth quarter earnings call:

“If you take this year’s revenue, around $6 billion or thereabouts, and if we are able to maintain a 50% growth rate for 10 years, add to your 10% profitability number, and have a 20 P/E, our market cap would basically be the same as Apple’s is today.”

Never mind the fact that Apple (NASDAQ: AAPL) is the first company ever to top a $700 billion market cap, or that a $700 billion market cap would be a return of 28x, but what stands out to me is the $350 billion in revenue number.

That’s $350 billion in revenue by 2025, compared to its current $3 billion. Consider the fact that Apple’s revenue growth rate over the last ten years has been an annualized 12%. Selling $500 iPhones and iPads is also a business that’s easier to scale than a business selling $50,000 electric vehicles (EVs).

By saying that Tesla will be successful enough to generate $350 billion in annual revenues, you’re saying somebody is going to lose, and lose big. Where do those revenue gains come from? And from who?

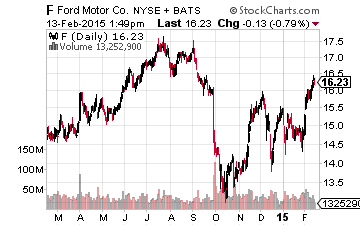

For perspective, if Tesla is generating $350 billion in sales, that’s enough to put Ford (NYSE: F), BMW and Nissan (NSANY) out of business based on today’s sales numbers.

Yet, the market is also forgetting that there’s a lot that can go wrong between now and 2025.

Tesla has noted that it can produce upwards of 200,000 vehicles a year with its sole assembly plant in California. With the addition of its gigafactory, which will be fully functional by 2020, Tesla thinks that production could go up to 500,000 EVs.

But to get to $350 billion in revenues you’re going to need to sell more than 500,000 cars. We still have a long way to go and you’re looking at billions of dollars to build out more assembly plants.

When you’re trying to build out a massive production facility, it takes time and capital, with a large learning curve. It has taken Ford over a century to grow revenues to $140 billion.

The biggest problem with Tesla is that there’s big expectations already built into the stock.

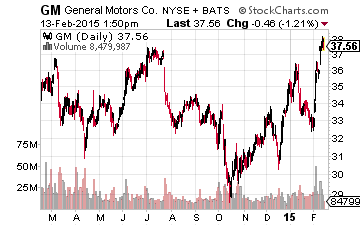

Tesla’s market cap is roughly $25 billion, which is about 40% of the market caps for Ford and General Motors (NYSE: GM). But the really interesting part of the story is that Tesla only generates about $3 billion in annual revenues, while Ford and GM generate between $140 billion and $160 billion a year.

So GM’s market cap is about 2.5x that of Tesla, but it generates 50x as much revenue? This is true. Let’s look at it another way. GM’s current market cap is roughly 0.4x of its annual sales and Tesla’s market cap is 8x its sales.

At the current price, Tesla will need near perfect execution. But there are a lot of things that are out of its and CEO Elon Musk’s control.

EVs have remained a small niche market for years. Changing that will be hard, and high price tags and the lack of charging stations are acting as overhangs as well.

Then there’s China. My colleague, Bret Jensen, put out a piece last month entitled 3 stocks to avoid in 2015, and as you might imagine, Tesla made that list. Bret notes, “China is a country that is critical to Tesla achieving its production goals over time.”

Piggybacking off Bret, I’d add that while the Chinese love their iPhones, the EV market is a bit different over there. Most of their EV business involves renting EVs. And the EVs that do sell well are much smaller than the Tesla models. Yet, in Tesla’s quest to a $700 billion market cap, it assumes that China will generate 30% of its sales.

Low gas prices will also be an interim headwind, where there will be less incentive to turn to EVs when gas is at $2 a gallon. But there’s also increased competition to deal with, where BMW and GM won’t idly stand by, assuming the EV market does gain traction.

The more you dig into the Tesla story, the more you realize the genius of Elon Musk, but also the relative idiocy of the market.

Back in September, Tesla CEO Elon Musk noted that Tesla’s stock was a bit overvalued based on the short-term uncertainty. The multi-year story for investors has still been pretty great. Over the last two years, shares are up 420%.

But just the fact that GM can sell more cars in a week than Tesla can sell in an entire year is very telling. Now, to the Tesla bulls, this means there’s a ton of growth opportunities ahead, which includes stealing market share from GM. Even if that’s true, paying $200 a share for just $26 a share in revenue seems wildly excessive.

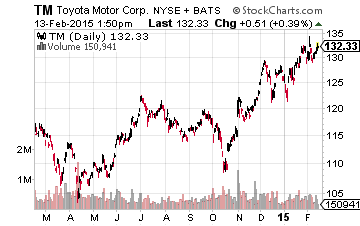

Why not just invest in dividend paying automakers and wait until things are a little less uncertain for Tesla?

General Motors and Ford both trade at less than 10x next year’s earnings (actual earnings, not the promise of earnings) and pay dividend yields above 3%. And with Toyota (NYSE: TM), you have one of the largest automakers on the planet. Its pays a 2.4% dividend yield, a dividend that it paid steadily throughout the financial crisis.

There’s a number of ways to play the EV and high-end market as well.

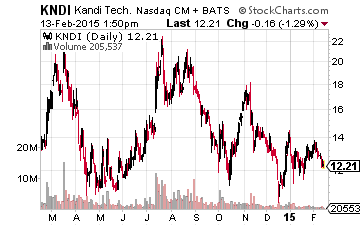

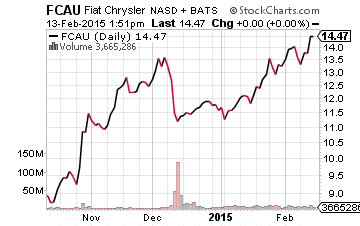

For playing the EV market in China there is Kandi Technologies (NASDAQ: KNDI), which is slowly gaining traction. Fiat Chrysler (NYSE: FCAU) is an underrated play on the higher-end market. It owns the Ferrari brand, which it plans to spin off to shareholders later this year. And while it’s still in turnaround mode, shares trade at less than 0.2x sales — recall Tesla is at 8x.

In the end, there’s something for everyone out there. More importantly, there are companies that aren’t built on fairy tale expectations. If you’re investing in Tesla to be the next Apple, that’s the ultimate fool’s game. And if you’re investing in Tesla because it will revolutionize the auto industry, that too is a fool’s game in my opinion.

Something that’s not a fool’s game is buying large, stable companies with solid growth prospects and realistic goals. It’s nice, maybe quaint, that Elon Musk says he can turn Tesla into the next Apple in terms of capitalization. But that’s just not realistic.

Disclosure: None

Isn't the issue of Tesla's potential also to do with developing batteries as power sources, not just for cars? You seem to be stuck on the car issue... or am I missing something?

Don't forget power trains, they might provide them to Daimler to build a range of electric cars as well.