Why ArcelorMittal's ROE Of 12% Doesn't Tell The Whole Story

ArcelorMittal SA (ADR)'s (NYSE: MT) most recent return on equity was an above average 12.5% in comparison to the Materials sector which returned 6.1%. Though ArcelorMittal's performance over the past twelve months is impressive, it's useful to understand how the company achieved its healthy ROE. Was it a result of profit margins, operating efficiency or maybe even leverage? Knowing these components may change your views on ArcelorMittal and its future prospects.

ROE Trends Of ArcelorMittal

Return on equity (ROE) is the amount of net income returned as a percentage of shareholders equity. It is calculated as follows:

ROE = Net Income To Common / Average Total Common Equity

ROE is a helpful metric that illustrates how effective the company is at turning the cash put into the business into gains or returns for investors. But it is important to note that ROE can be impacted by management's financing decisions such as the deployment of leverage.

The return on equity of ArcelorMittal is shown below.

(Click on image to enlarge)

source: finbox.io data explorer - ROE

It appears that the return on equity of ArcelorMittal has generally been increasing over the last few years. ROE increased from -21.9% to 5.9% in fiscal year 2016 and increased to 12.5% in 2017. So what's causing the general improvement?

ArcelorMittal's Improving ROE Trends

In addition to the formula previously discussed, there's actually another way to calculate ROE. It's often called the DuPont formula and is as follows:

Return on Equity = Net Profit Margin * Asset Turnover * Equity Multiplier

Analyzing changes in these three items over time allows investors to figure out if operating efficiency, asset use efficiency or the use of leverage is what's causing changes in ROE. Strong companies should have ROE that is increasing because its net profit margin and/or asset turnover is increasing. On the other hand, a company may not be as strong as investors would otherwise think if ROE is increasing from the use of leverage or debt.

So let's take a closer look at the drivers behind ArcelorMittal's returns.

Net Profit Margin

It appears that the net profit margin of ArcelorMittal has generally been increasing over the last few years. Margins increased from -12.5% to 3.1% in fiscal year 2016 and increased to 6.7% in 2017.

(Click on image to enlarge)

source: data explorer - net profit margin

Therefore, the company's increasing margins help explain, at least partially, why ROE is also increasing. Now let's take a look at ArcelorMittal's efficiency performance to see if that is also boosting ROE.

Asset Turnover

It appears that asset turnover of ArcelorMittal has generally been increasing over the last few years. Turnover increased from 0.72x to 0.75x in fiscal year 2016 and increased again to 0.86x in 2017.

(Click on image to enlarge)

source: data explorer - asset turnover

Therefore, the company's increasing asset turnover ratio helps explain, at least in part, why ROE is also increasing.

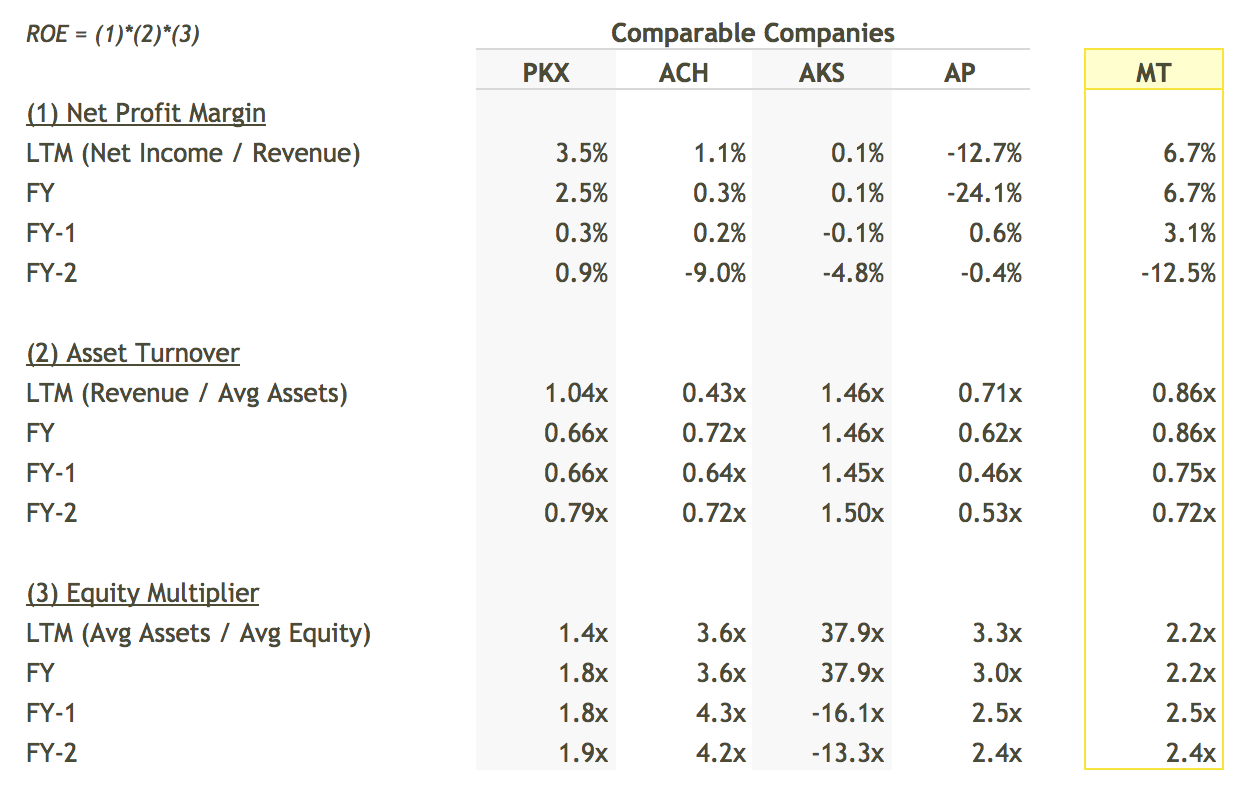

Finally, the DuPont constituents that make up ArcelorMittal's ROE are shown in the table below. Note that the table also compares ArcelorMittal to a peer group that includes POSCO(NYSE: PKX), Aluminum Corporation of China Limited (NYSE: ACH), AK Steel Holding Corporation (NYSE: AKS) and Ampco-Pittsburgh Corporation (NYSE: AP).

(Click on image to enlarge)

source: finbox.io's DuPont model

In conclusion, the DuPont analysis has helped us better understand that ArcelorMittal's general improvement in return on equity is the result of an improving net profit margin, an improving asset turnover ratio and declining leverage. Therefore when looking at the core operations of the business, ArcelorMittal shareholders have reason to be excited due to the company's general improvement in profitability along with a general improvement in operational efficiency.

Disclaimer: As of this writing, I did not hold a position in any of the aforementioned securities and this is not a buy or sell recommendation on any security mentioned. I also have no ...

more