Valuation Uncertainty—Illustrated

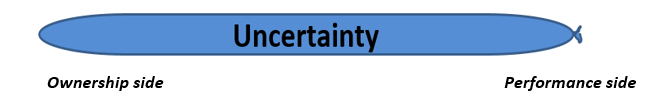

One can use a balloon to visualize the valuation uncertainty inherent in a venture capital investment. Imagine one that looks like a hot dog and can be twisted into animal shapes. But instead of air, this balloon is full of uncertainty. The left end of this balloon represents ownership interests in a venture-stage company, while right end represents certainty about its future performance.

And just what is a venture-stage company? One that has the following risk factors for investors:

- Market for its products/services is new/uncertain

- Unproven business model

- Uncertain timeline to profitable operations

- Negative cash flow from operations; it requires new money from investors to sustain itself.

- Little or no sustainable competitive advantage

- Execution risk; team may not build value for investors

Technology and biotech companies routinely raise venture capital via initial public offerings. Given the Jumpstart Our Business Startups (JOBS) Act reforms, the number doing so will increase, so it is instructive to consider models for addressing uncertainty.

Investors face two related risks when they invest in such a company—valuation and failure. The first is the risk that they buy-in at an excessive valuation. The second is the risk that the business will fail to perform as anticipated.

Here, certainty is symbolized by a weight. Placement of the weight at one end of the balloon creates certainty there and causes uncertainty to bulge on the other end. The principle is that uncertainty can be moved but not eliminated.

Let’s considers where uncertainty resides in a conventional capital structure, in the Fairshare Model and in the capital structure favored by venture capital firms.

------------------------------------------

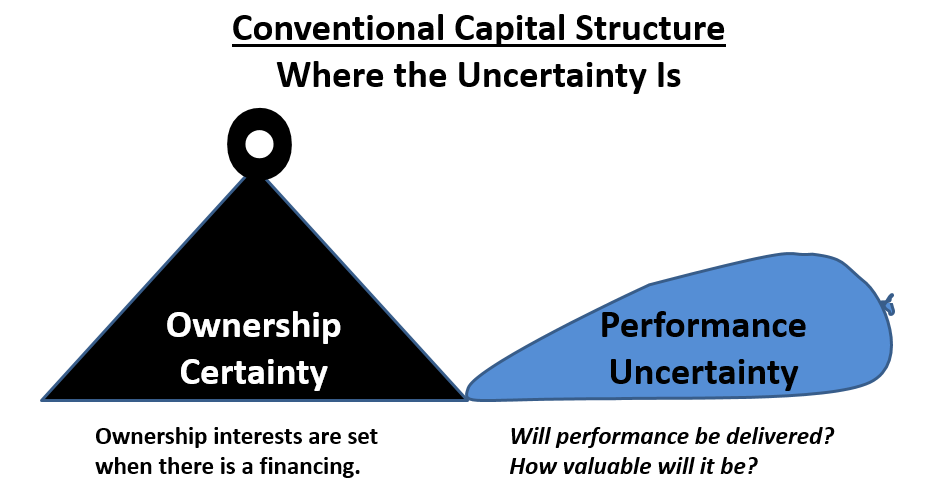

Conventional capital structures share a characteristic—a value for future performance must be set when a company sells new stock. This is difficult to reliably do, hence the risk.

The following balloon illustrates what happens. The ownership split between employees (the entrepreneurial team) and investors is set by the valuation; the certainty at the ownership end of the balloon pushes the uncertainty to the performance end.

Will the company deliver its product as expected? What will the market response be? If the answers to these and similar questions were known when the investment deal was set, it would affect the ownership split. If its performance exceeds expectations, employees may feel they sold too cheap. If it is less, investors may feel they should have gotten greater ownership.

This is the inherent nature of a conventional deal. The ownership split is based on the unknown—the value of future performance.

------------------------------------------

The Fairshare Model is a performance-based capital structure for companies that raise venture capital via a public offering. Its the subject of a book I’m writing (more on this below). No company has used it but some surely will, once enough investors express interest in seeing IPOs based on it.

A company that uses the Fairshare Model will have two classes of stock—one trades, one doesn’t, both vote. Pre-IPO and IPO investors will get the tradable stock, known as Investor Stock. For value already delivered, employees also get it. For their future performance, employees get the non-tradable stock, called Performance Stock.

Based on criteria set by the company and described in its offering document, Performance Stock converts to Investor Stock. The conversion rules can change so long as both classes of stock agree to the change.

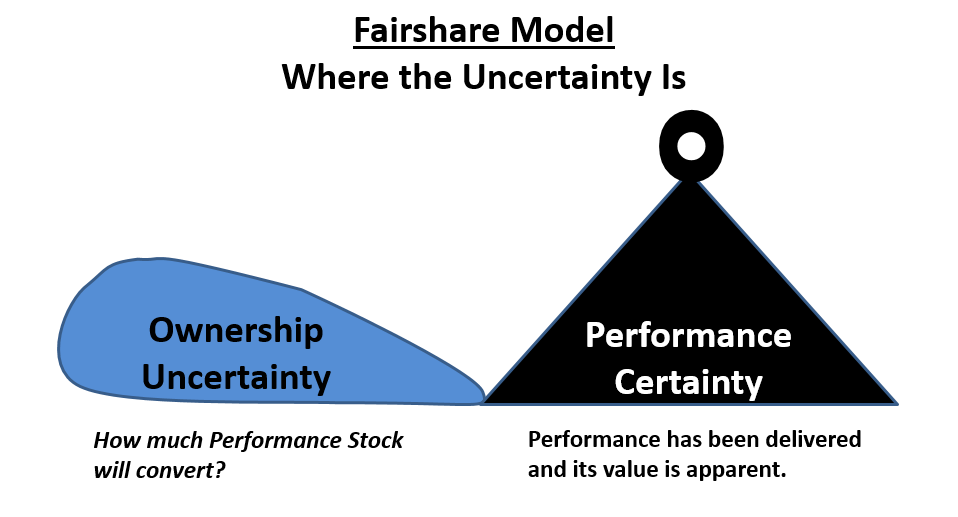

The next balloon illustrates how the Fairshare Model addresses uncertainty. The weight of certainty is on the performance side of the balloon—it has been delivered so the uncertainty moves to the ownership side. A question emerges…how much Performance Stock will convert?

The answer will be in the conversion rules and these will vary by company. They will reflect its industry, stage of development and the personalities of the entrepreneurial team.

Companies that adopt the Fairshare Model will be human behavior laboratories as it will require investors and employees to collaborate in new ways. The measurements could be the market price of Investor Stock, financial performance (e.g., sales, profit), operating milestones (e.g., product release, clinical trial results) and/or social impact.

The Fairshare Model provides a different way to deal with valuation risk—it creates incentive to offer IPO investors a low valuation. Why? If a rise in the price of Investor Stock drives conversions, Performance Stockholders will want to set the IPO valuation low. It can also reduce failure risk because it can help companies attract and manage human capital. In addition to pay, benefits and stock options on its Investor Stock, a company can offer employees an interest in its Performance Stock. It pays off when they, as a team, meet the conversion criteria.

------------------------------------------

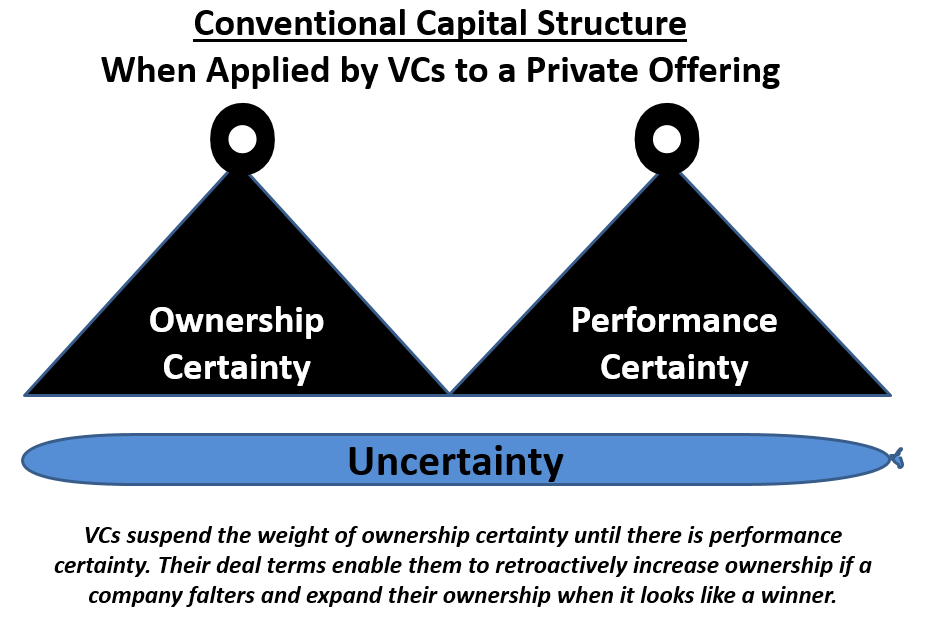

When they invest, venture capital firms require a private company to incorporate performance-based elements in its conventional capital structure. As the final balloon illustrates, VC deal terms suspend certainty about ownership until there is certainty about performance.

For angel investors and employees, a VC’s anti-dilution clauses, liquidation preferences and accrued dividends reduce their ownership payoff, potentially dramatically. Furthermore, a VC will require employees to vest their stock or enter into buyback agreements. Collectively, these deal terms suspend certainty about ownership or its rewards.

Thus, VCs have price protection. Ultimate ownership positions are settled once ultimate performance is certain (i.e., the company is acquired or its value in the public market is established).

It is utterly sensible as venture-stage companies are difficult to reliably value and mitigating valuation risk encourages VCs to take on investments where there is high risk of business failure.

But it leads to a question, Shouldn’t Public Investors Get Price Protection Too?

The Fairshare Model will be published about five months after 750 people pre-order a copy from Inkshares, a new styl

more

e publisher that decides what projects to back based on reader support.

e publisher that decides what projects to back based on reader support.