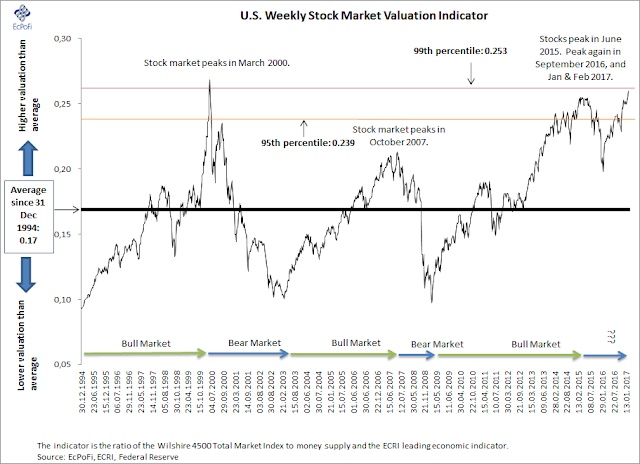

U.S. Weekly Stock Market Valuation Indicator - Back In 99th Percentile

This simple weekly stock market valuation indicator for the U.S. is now almost back to the 99th percentile.

As the indicator reflects stock market prices relative to the money supply and a leading economic indicator, the current reading indicates the stock market has only been valued higher on one occasion previously based on data since 1994; the period surrounding March 2000, the height of the dotcom bubble.

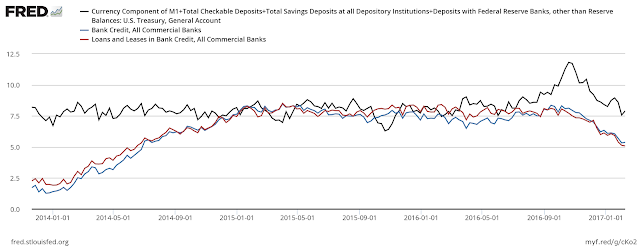

Note that the indicator correctly indicated the 2000 and 2007 bubbles, but that the correction following the June 2015 peak was relatively minor only short-lived. Rapid increases in bank credit was one factor acting to avert a larger correction in 2015 and 2016. This time around however bank credit growth is contracting while loan delinquencies have been on the rise for many quarters. Betting on bank credit expansion to be the savior again might therefore currently seem like a somewhat risky bet.

Disclosure: None