Top 6 Biotechs To Buy After The Recent Sell-off

The markets posted their worst weekly performance of the year of 2015 in the just completed week as concerns around China overwhelmed any positives within the environment for equities. The fact that the Middle Kingdom is not growing at anywhere close to the “official” 7% GDP growth target is something I have been harping on for months on these pages as well as on SeekingAlpha and Real Money Pro. For the first time in years, the performance of the S&P 500 is negative over the past six months. This year there has been no year-over-year growth in either revenues or earnings as the strong dollar, collapsed commodity prices, and weak global economic growth have taken their toll.

This feels like more than a “hiccup” as even the high beta/high momentum stocks selling at nosebleed valuations are starting to break down. The charts of high flyers Amazon (NASDAQ: AMZN), Netflix (NASDAQ: NFLX) and Tesla Motors (NASDAQ: TSLA) started to get ugly towards the end of a volatile trading week. This raises concern as these stocks have been responsible for most of the market’s tepid returns this year.

Not surprisingly, the high beta biotech sector has started to reverse after being one of the market leaders since its last sell-off at the end of the first quarter of 2014. Given the biotech indices were up better than 50% over the prior 12 months prior to this correction, some profit taking should be expected given the market has been relatively flat over that time frame. This “risk off” sector rotation could continue for a while until the overall market finds firmer footing. The biotech sector is already in official “correction” mode as the main biotech ETFs have dropped some 15% since July 20th.

It seems an appropriate time to chime in with some core concepts I have developed over two decades in investing in this very lucrative but very tumultuous space. First and foremost, it is important to emphasize that long-term biotech investors should have 50% to 75% of their biotech portfolios in large cap growth stocks within the sector that consistently churn out both revenue & earnings growth, have deep pipelines, great balance sheets, and are selling at reasonable or attractive valuations.

This will help take a great deal of volatility out of an investor’s biotech portfolio. Four times the small cap biotech sector has suffered 20% or worse declines since the end of the financial crisis in 2009. Their larger-cap brethren have not suffered one such sell-off over the same time frame.

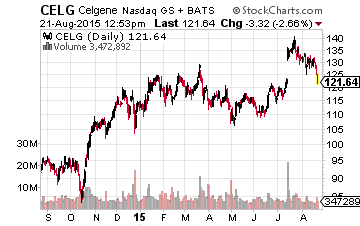

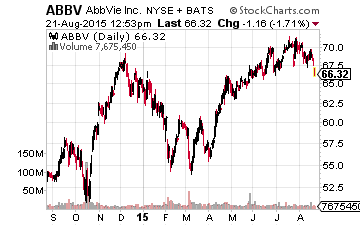

This is an ideal time to incrementally initiate or add to positions in what should be core stakes in any well-run biotech portfolios. These include such well-known names such as Celgene (NASDAQ: CELG), AbbVie (NYSE: ABBV), Mylan (NYSE: MYL) and Gilead Sciences (NASDAQ:GILD). All of these companies are seeing healthy revenue and earnings growth in a global environment that is seeing little of either right now. All are already attractively priced with Gilead just downright cheap at under 10 times this year’s likely earnings in a market priced at approximately 17 times forward earnings.

After not having much in a way of a dip to buy over the past year, myriad small cap biotech concerns have had significant sell-offs that are the result of a sudden shift in sentiment on the biotech sector and have not been triggered by company-specific news. Intrepid long-term investors should be slowly accumulating positions with the rest of their biotech portfolio in these promising but speculative names. Many are selling for 20%, 30% or even 40% less than recent highs and offering the best long-term entry points in quite some time.

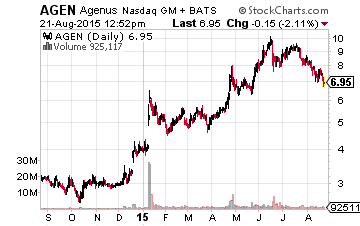

These would include Agenus (NASDAQ: AGEN), a position that went into the ***Small Cap Gems portfolio in October of last year at just under $3.00 a share. The stock surged past $10.00 a share late in the second quarter. However, with the recent sell-off in the biotech sector the shares can be had for around $7.00.

Nothing has changed around the company’s long term prospects. If anything, they have brightened even more as its adjuvant used in a variety of vaccines under development was part of the malaria vaccine that was approved for Europe & Africa. The vaccine was developed by GlaxoSmithKline (NYSE: GSK) who will be responsible for distribution and marketing. Agenus will soon start to receive a royalty stream off the sales of the vaccine. A very effective shingles vaccine using the same adjuvant should also be approved on the market in the next 12 months.

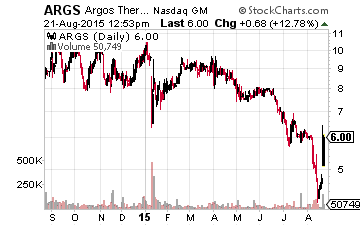

I would also take a look at Argus Therapeutics (NASDAQ: ARGS). This small cap immunotherapy play starting the year at $10.00 a share, got cut in half as the year rolled on but has actually behaved better even as the rest of the biotech has started to fall apart. The shares now go for around $6.00 a share. This concern has an evolving and diverse pipeline.

Phase III trial results for its treatment for metastatic renal cell carcinoma should come out in the second half of 2016 after showing solid results in previous trials. Analysts are high on the company’s prospects with the median analyst price target standing at $17.00 a share currently.

The Russell 2000 is already in an official correction territory as is the biotech sector. I expect the S&P 500 and the NASDAQ to join them with at least a 10% sell-off from peak to trough before the end of summer. Despite the challenging current environment, I am slowly doing some additional buying in the biotech sector as outlined above with some of the “dry powder” I have built up over the past few months waiting for this type of dip to put to work. When the market gives you lemons, it is time to make some lemonade.

Positions: more

why do you never mention AGN? no position?