Top 3 Biotech Takeover Targets To Buy

On to 2016! As my late father always said “Life is like a pendulum. It swings too far to the right. It swings too far to the left. It is rarely in the middle where it belongs.” I have always found this to be a good way to look at history, politics, and of course, the stock market.

I will bet that 2016 will bring a reversion to the mean and small cap equities will once again outperform their larger brethren. Below are several small cap selections that should do very well in 2016 should that indeed occur.

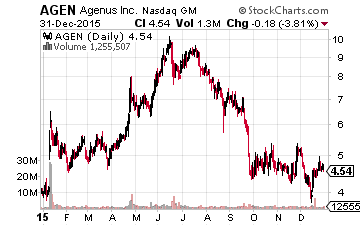

The small cap biotech concern Agenus (NASDAQ: AGEN) ended the year about where it began at just under $5.00 a share after spiking to $10.00 a share during summer, before the bear market in biotech wiped out that rally. The company made progress on a variety of fronts in 2015. Its adjuvant used in a variety of vaccines being developed was approved for malaria in Africa and Europe and a shingles vaccine is on its way to approval in 2016.

The company monetized the royalty stream from its vaccine adjuvant business for some $115 million to smartly fund development of its checkpoint inhibitor technology without diluting existing shareholders. It has nine compounds in mid-stage development using this platform in conjunction with development partners Merck (NYSE: MRK) and Incyte (NASDAQ: INCY). Agenus can earn up to $450 million in milestone payments through the development process on these compounds in addition to royalties from any commercialized products.

The company is flush with cash, has multiple “shots on goal”, major development partners, desired technology and a market capitalization of just $400 million. I like Agenus as a standalone entity but would not be surprised if someone purchases the company at a significant premium sometime in 2016.

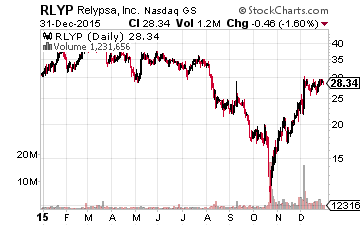

Speaking of buyout targets, it is hard to see how Relypsa (NASDAQ: RLYP) stays “single” through the New Year. The company’s first approved compound “Veltassa” just hit the market. This compound is aimed at the hyperkalima market which should have $2 billion in annual sales worldwide. Its primary competitor ZS Pharma (NASDAQ: ZSPH) has a product for the same condition that should be on the market in the next quarter or two.

Both treatments have certain advantages and I look for them to eventually split the hyperkalemia market space between themselves, but Veltassa does have first mover advantage. It is also better tolerated by individuals with high blood pressure which is a good portion of the hyperkalemia (too much potassium in the blood) population.

ZS Pharma was purchased by AstraZeneca (NYSE: AZN) in early November at a valuation that implies that Relypsa is 100% to 150% undervalued based on potential sales at its current price of under $30.00 a share. Rumors already have Merck, Sanofi (NYSE: SNY) and GlaxoSmithKline (NYSE: GSK) being interested suitors.

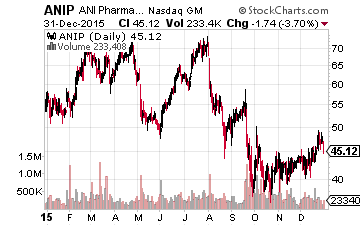

Finally, we end with a small branded and generic drug maker ANI Pharmaceuticals (NASDAQ: ANIP). Unlike Agenus and Relypsa, ANI has several compounds already on the market as well as consistent revenue and earnings growth. Like most pharma stocks ANI suffered during the late summer and fall with all the negative headlines surrounding Valeant Pharmaceuticals (NYSE: VRX) as it became the poster child for drug “price gouging,” always a popular topic for politicians in the lead-up to a presidential election.

The stock has started to recover over the past month but at approximately $47.00, the shares are still a far cry from the over $70.00 a share they went for before the recent bear market in the biotech/biopharma sectors and the nonsense around Valeant. As these events slide farther into the background, I believe ANI has will have even more upside.

Revenues grew over 35% year-over-year in 2015 and another 20% plus gain should occur in 2016. After earning $1.14 a share in FY2014, profits are tracking to $2.70 a share this fiscal year and the current consensus has ANI Pharmaceutical earning some $3.00 a share in FY2016. The stock is cheap given that growth at just over 15 times forward earnings and has net cash on its balance sheet as well.

The company also has a robust pipeline as well as development partnerships with two multibillion-dollar biotech giants: Aduro BioTech (NASDAQ: ADRO) and Teva Pharmaceutical Industries (NASDAQ: TEVA). With a market capitalization of just over $500 million, ANI would also make a bite-sized acquisition for a larger player.

I hold all three of these small cap biotech and biopharma plays and expect better things from them in 2016.

Positions: Long AGEN, ...

more