Tocagen IPO Could Garner Significant Investor Attention

Tocagen Inc. (Pending:TOCA) expects to raise $70 million in its upcoming IPO ($81.5 million, if the underwriters exercise their option to purchase additional shares).

Based in San Diego, California, Tocagen is a clinical-stage company that is developing gene therapies to activate a patient's immune system against cancer.

The company will offer 7.25 million shares at an expected price range of $10-12. If the underwriters price the IPO at the midpoint of that range, TOCA will have a market capitalization of $200 million.

TOCA filed for the IPO on March 9, 2017. The lead underwriters are Evercore Group, Leerink Partners and Stifel Nicolaus & Company. The IPO has no selling group.

Business Summary: Clinical-Stage Company Developing Gene Therapies Targeting Cancer

(Source: Tocagen S-1 filing, April 3, 2017)

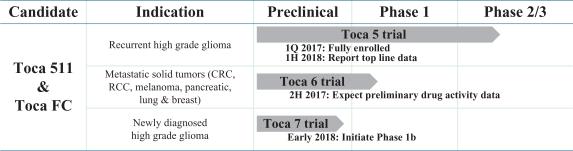

Tocagen Inc. focuses on developing gene therapy candidates to activate a patient's immune system against cancer. The company is developing Toca 511 and Toca FC, currently in Phase II/III clinical trial for patients with recurrent high grade glioma (HGG) and in Phase Ib clinical trial for the intravenous treatment of renal, melanoma, lung, breast, pancreatic and metastatic colorectal cancers. Tocagen is also developing other retroviral replicating vectors to deliver genes to cancer cells.

The company develops the cancer-selective gene therapies on a platform built on retroviral replicating vectors (RRVs), which selectively deliver the therapeutic genes directly into the DNA of cancer cells. Tocagen has retained worldwide rights to the development and commercialization of its product candidates, and the company has intellectual property protection in major markets worldwide, including 58 issued and granted patents and 75 patent applications (foreign and domestic) on its technology and product candidates.

Use of Proceeds And Risk Factors

Tocagen acknowledges that it has no products currently approved for sale, and it has generated no revenue from any product sales. Its operations have been funded primarily through private placement of convertible preferred stock, the issuance of notes payable, issuance of convertible promissory notes payable and private and federal grants.

The company intends to use the net proceeds of this IPO for further clinical trials and as general working capital.

Potential Competition: AstraZeneca, Bristol-Myers Squibb and Others

Tocagen faces competition from a wide variety of companies that have or are developing cancer treatments. These include AstraZeneca (NYSE:AZN), Bristol-Myers Squibb (NYSE:BMY), Celgene (Nasdaq:CELG), Hoffman-La Roche (OTCQX:RHHBY), GlaxoSmithKline (NYSE:GSK), Merck (NYSE:MRK), Novartis (NYSE:NVS), Pfizer (NYSE:PFE), Argos Therapeutics (Nasdaq:ARGS), Idera Pharmaceuticals (Nasdaq:IDRA), Adaptimmune Therapeutics (Nasdaq:ADAP), Kite Pharma (Nasdaq::KITE) and others.

Executive Management Highlights

CEO Martin Duvall has been in his position since November 2016. His previous experience comes from Ariad Pharmaceuticals, Merck, Abraxis BioScience, MGI Pharma, Morphotek, Taxotere and Aventis Pharmaceuticals. Mr. Duvall received his BA degree in chemistry from Muhlenberg College, his MA degree in chemistry from Johns Hopkins University and his MBA from the University of Kansas.

Co-founder and President of Research and Development, Dr. Harry Gruber, M.D., has been in his position since November 2016. He co-founded Tocagen in 2007. His previous experience comes from positions at Kintera, Viagene, Gensia and Intervu Inc. Dr. Gruber holds a BA and an MD from the University of Pennsylvania and trained in Internal Medicine, Biochemical Genetics and Rheumatology/Immunology at the University of California, San Diego, where he subsequently joined the medical school faculty until founding Gensia Inc.

Conclusion: Consider An IPO Allocation

Despite being pre-revenue, Tocagen has a license and collaboration agreement with Siemens Healthcare Diagnostics, which we view as promising.

We have also observed that companies targeting cancer are often high-profile and tend to do well in their IPOs.

The syndicate, while small, boasts strong sector expertise.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in TOCA over the next 72 hours.

Disclaimer: I wrote this article myself, and it expresses my own ...

more