This Emerald Shines Bright Ahead Of IPO

Overview

Emerald Expositions Events (Pending:EEX) filed for its IPO on March 31, 2017. The company expects to raise $295M through the offer of 15.5 million shares at an expected price range of $18 to $20 and to make its debut on Thursday, April 27. If the underwriters price the IPO at the midpoint of that range, Emerald Expositions will have a market capitalization of $1.4 billion and trade at a price/sales multiple of 4.37x.

Lead Underwriters: Barclays Capital, BofA Merrill Lynch, and Goldman Sachs

Underwriters: Citigroup Global Markets, Credit Suisse Securities, Deutsche Bank Securities, RBC Capital Markets, and Robert W. Baird, Inc.

We previewed this deal on our IPO Insights platform.

Business Summary

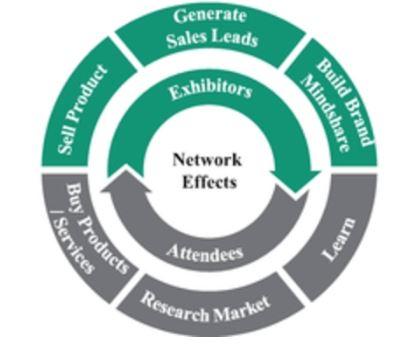

Based in San Juan Capistrano, California, Emerald Expositions Events is the largest operator of business to business trade show events throughout the US. It currently operates more than 50 trade shows, connecting over 500,000 attendees in 2016. It trade shows are used to connect buyers and sellers across a range of markets, including: general merchandise, sports, hospitality and retail design, jewelry, photography, decorated apparel, building, healthcare, and military.

Emerald Expositions, Inc. was originally part of Nielsen Business Media, Inc. and was acquired by PE firm, Onex in 2013. It was rebranded as Emerald Expositions, Inc. and operated as a standalone platform. In 2014, it acquired George Little Management and has completed twelve additional acquisitions to broaden its portfolio since being acquired by Onex.

(S-1/A)

Market

According to IBIS, the US trade Show and Conference Planning market was estimated at $14B in 2016. The overall industry is expected to grow at a CAGR of 5% between 2016 - 2020. Revivied corporate profit is likely to spur demand for trade shows, however online events may take away some growth. The industry is highly sensitive to any changes in economic conditions and a slowdown in the economy could significantly impact business.

Executive Management Highlights

David Loechner serves as CEO, president, and board member. Prior to this, he served as Senior Vice President (2006 - 2010). Loechner has over 33 years of industry experience and holds a B.A. in Business Administration from Principia College.

Phillip Evans serves as CFO and Treasurer, positions he has held since joining the company in October, 2013. Previously, he was CFO of ProQuest LLC (2009 - 2013) and also held senior financial positions at: R.R. Bowker, Marquis Who's Who, and Ernst and Young. Evans is an Associate of the Institute of Chartered Accountants in England and Wales and holds a B.A. (Honors) in Accounting & Finance from the University of Lancaster.

Financial Overview

Revenue generated was $273.5M, $306.4M, and $323.7M in 2014, 2015, and 2016, respectively. Gross margins have also increased steadily from 23%, 26%, and 31% in 2014, 2015, and 2016. In 2016, 92% of revenue was generated through live events, with the remaining 8% from other marketing services, including digital media and print publications. Net income was: $19.6M and $22.1M in 2015 and 2016, respectively. The company has racked up significant debt through acquisitions required in the industry. As of December 31, 2016, the company had cash and cash equivalents of $14.9M and total debt of $702M.

Valuation

The trade show industry is highly fragmented, with nearly 9,400 B2B trade shows held per year in the US. The four largest, for-profit organizers (Emerald Expositions, Reed Exhibitions, UBM (NYSEARCA:UBM), and Informa Exhibitions) account for 9% of the market. Reed Exhibitions and Informa Exhibitions are both private companies, and UBM trades on the London Stock Exchange.

These companies have a competitive advantage over thier smaller peers as they are better positioned to negotiate deals with vendors.

Compared to its peers, Emerald Expositions reports having a greater number of shows in the Top 250 US Trade Shows in 2016 and in the Fastest Growing Shows in 2016. It also reports a higher net square feed sold for trade shows than its peers.

(Click on image to enlarge)

(S-1/A)

Assuming Emerald Expositions prices at the mid-point of its price range, it would trade at price/sales ratio of 4.37x. This is slightly above its closest competitor, UBM. At the same time, UBM is growing revenue at a fast pace, but shows lower gross margins.

|

Ticker |

Market Cap |

Revenue |

Revenue Growth |

Price/Sales |

Gross margin |

|

EEX |

$1.4B |

$324M |

5.6% |

4.37x |

31.0% |

|

UBM |

$2.86 |

$863M |

12.0% |

3.27x |

17.69% |

(GoogleFinance)

Conclusion: Consider Buying In

Emerald Expositions is well diversified and is positioned strongly in a growing industry.

The company has been growing revenue, touts gross margins well above that of its peer UBM, and is profitable. Its large debt does raise some concern, but is expected given its acquisition by Onex in 2013.

At its current valuation, we are optimistic about this IPO, but given the risk posed by high debt, the potential to lose business to online channels, and just average growth rate, we recommend no more than a modest allocation.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in EEX over the next 72 hours.

Disclaimer: I wrote this article myself, and it expresses ...

more