The Year In VIX And Volatility

The consensus called for a big uptick in volatility in 2016 and while there was a lot of drama, the VIX spikes were relatively manageable and short-lived. The VIX opened the year at 22.48 and ended the year at just 14.04. For the full year, the median VIX was 14.31, while SPX historical volatility for the full year ended up at a mere 13.12.

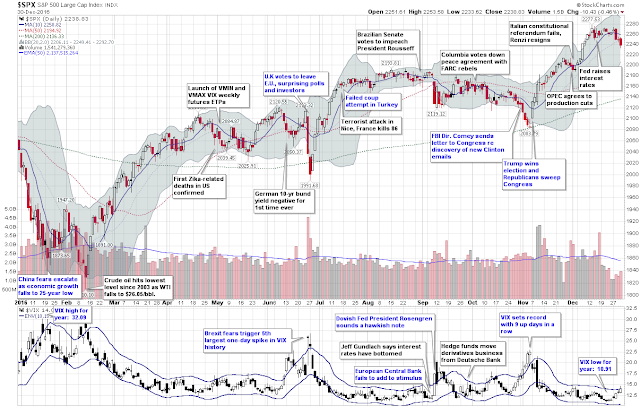

That being said, there were five distinct VIX spikes in the graphic below, listed according to chronology:

- Fears related to slowing growth in China (January)

- A plunge in crude oil prices to $26.05/bbl. for WTIC, as investors grappled with the possibility that Cushing storage facilities would be exhausted (February)

- The surprise Brexit vote result in favor of the U.K. leaving the E.U. (June)

- A cocktail of nearly simultaneous shocks from Fed President Rosengren (suddenly sounding hawkish), Jeff Gundlach (interest rates have bottomed) and the European Central Bank (no additional stimulus) puts pressure on stocks (September)

- Increasing uncertainty leading up to the U.S. election (November)

In all five instances, the VIX moved up sharply, but in defiance of historical precedent, the volatility index moved down almost as sharply as it moved up. In fact, some of the biggest extremes for the year came in the form of volatility crushes, where the VIX had an unprecedented series of sharp downward one-day moves. Checking the record books, the only previous year that the VIX posted three top 20 one-day declines was 2007 – and clearly investors were in denial that year. This year the Trump election caused the sixth largest one-day drop in the history of the VIX, whereas the Thursday before and Tuesday after the Brexit vote triggered the eighteenth and tenth largest one-day VIX declines.

On the other side of the ledger, some of the upward moves in the VIX made the record books as well. The day following the Brexit vote saw a 49.3% VIX spike – the fifth highest one-day spike on record. What was even more surprising was the Rosengren/Gundlach/ECB cocktail noted above triggered a 39.9% spike (eleventh highest in history) in what seemed to be a relatively calm market environment in September. It turns out the VIX was just getting warmed up for greater things, including a record nine consecutive up days leading up to the November election.

Even with these extremes, the highs and lows in the VIX were rather middling, with the VIX peaking at 32.09 on January 20 and hitting an annual low of 10.93 on December 21.

The graphic below captures these and other highlights from 2016:

[source(s): StockCharts.com, VIX and More]

Included in the non-VIX highlights are a 5000+ year low in interest rates in Europe and Japan (where negative interest rates prevailed) as well as a thirteen-year low in the price of crude oil. On the geopolitical front, political craziness of one kind or another abounded in Brazil, South Korea, Turkey, Italy, Colombia and South Africa, among other locations. Terrorism also left its footprint again in 2016 and Zika also created considerable political and social turmoil. In the financial realm, European banks had a very difficult year and begin 2017 on shaky footing.

While the year ended on a relatively quiet note, I suspect 2017 will have much more in the way of new surprises, including swans of many dark hues. Next week I will resume the VIX and More fear poll and find out what the consensus is for volatility and its causes in the coming year.

Finally, since 2011, I have been maintaining a proprietary Macro Risk Index that measures volatility and risk across a broad range of asset classes, including U.S. equities, foreign equities, commodities, currencies and bonds. In 2016, the Macro Risk Index was trending down most of the year, punctuated by significant spikes in February (crude oil) and again in June (European currencies).

How did 2016 measure up to expectations? I sum up the year in My Low Volatility Prediction for 2016: Both Idiocy and Genius. Also worth investigating are a pair of Barron’s articles from one year ago laying out two opposing perspectives on volatility in 2016. For the case for rising volatility and what to do about it, try Jared Woodard’s Prepare for Rising Volatility in 2016. I provide the contrarian point of view in The Case Against High Stock-Market Volatility in 2016.

Have a happy, healthy and profitable 2017!

Disclosure(s): the CBOE is an advertiser on VIX and More

Disclaimer: "VIX®" is a trademark of Chicago ...

more

Thanks for sharing. Merry Christmas and Happy New Year